FedEx reinstates 2022 profit target, shares soar

FedEx shares were up more than 4% in premarket trading

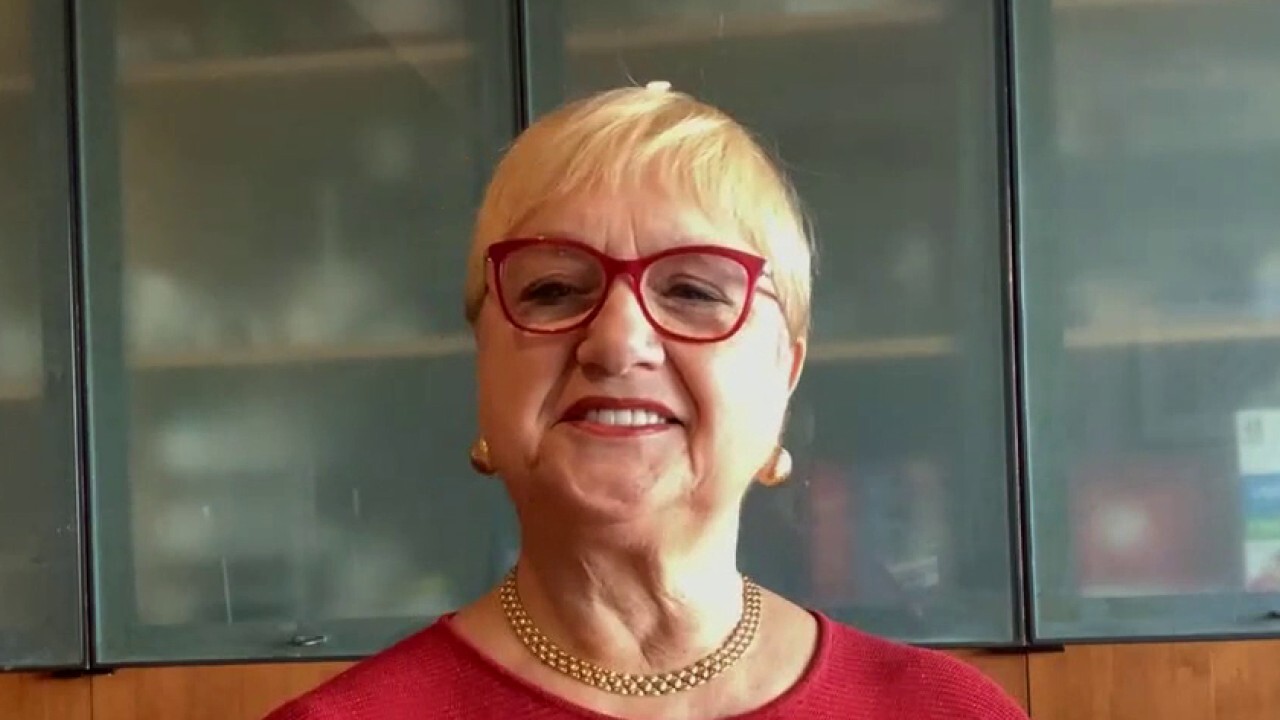

Famous chef Lidia Bastianich talks food prices, PBS special

Restauranteur Lidia Bastianich on the impact of inflation and her new PBS special 'Overcoming the Odds' that brings American's from all-walks of life together with food.

U.S. delivery firm FedEx Corp reinstated its original fiscal 2022 forecast on Thursday, even as persistent labor woes chipped away profits ahead of the peak holiday season when the number of packages it handles often doubles.

Shares in the company, which also reported flat year-over-year adjusted profit for the fiscal second quarter, were up 5% to $250.50 in after-hours trading.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

FedEx Chief Operating Officer Raj Subramaniam said labor pressures should ease going forward.

"We are essentially staffed up for peak," said Subramaniam. He added that the carrier believes it can retain required labor for the remainder of its fiscal year.

FedEx Corp. said it would boost capital spending by 22% this year to add capacity to its network, after a surge in e-commerce packages caused ground delivery delays and left some freight customers without service.

Concerns have eased that this year's festive season could see a repeat of 2020's "Shipageddon" pandemic delivery delays. Retailers have reduced the pressure on carriers like FedEx and United Parcel Service by urging early shopping and expanding pick-up and gig-delivery options. At the same time, most stores remain open despite accelerating numbers of Omicron variant infections.

Memphis, Tennessee-based FedEx now expects full-year earnings, excluding items, of $20.50 to $21.50 per share, as it had first forecast. In September, FedEx lowered that range to $19.75 to $21.00 per share.

Adjusted net income was $1.3 billion, or $4.83 per share, for the quarter ended Nov. 30, unchanged from the year earlier.

During the company's fiscal second quarter, labor shortages again disrupted normal work flows - resulting in network inefficiencies, higher purchased transportation costs, and higher wage rates. Those factors increased costs by an estimated $470 million year-over-year, primarily at FedEx Ground. The company put those costs at $450 million for its fiscal first quarter.

In the latest quarter, FedEx paid "significantly" higher taxes, but benefited from lower fuel prices.

Revenue increased 14% to $23.5 billion, fueled in part by elevated demand for e-commerce home deliveries - including some holiday gifts.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| FDX | FEDEX CORP. | 369.23 | +5.27 | +1.45% |

Experts and some customers said FedEx is trailing UPS and the U.S. Postal Service in on-time deliveries, however.

"FedEx delivery times are really lagging and I believe it's due to their staffing issue," said Cathy Morrow Roberson, president of consultancy Logistics Trends & Insights.

From Nov. 14 to Dec. 4 - which included the Thanksgiving and Cyber Monday holiday shopping days - on-time performance was 85.7% for FedEx, 96.4% at UPS, and 95.1% for the U.S. Postal Service, according to delivery invoice auditor ShipMatrix.

CLICK HERE TO READ MORE ON FOX BUSINESS

Results for the week of Dec. 5 so far appear to be mostly in line with prior weeks, ShipMatrix founder Satish Jindel said.

FedEx's Ground deadline for Christmas delivery was Wednesday, Dec. 15.

(Reporting by Lisa Baertlein in Los Angeles; Editing by Sonya Hepinstall)