FOMC meeting begins, housing report release and more: Tuesday's 5 things to know

On Tuesday, investors will get another economic gauge when the Commerce Department releases new home construction figures

FOX Business Flash top headlines for September 19

Check out what's clicking on FoxBusiness.com

Here are the key events taking place on Tuesday that could impact trading.

FED RELIEF IN 2024?: The Federal Reserve is unlikely to pivot and cut its benchmark interest rate until 2024 at the soonest as it tries to crush the hottest inflation in four decades, according to Goldman Sachs strategists.

The bank's economists — led by Jan Hatzius — predicted in an analyst note on Monday that the U.S. central bank will raise interest rates four more times between now and the end of 2023, eventually holding them at a range between 4.25% to 4.50% until 2024.

The analyst note comes ahead of the Fed's two-day meeting this week, during which Hatzius now sees policymakers approving a third consecutive 75-basis-point interest rate increase — triple the usual size.

INFLATION ROSE FASTER THAN EXPECTED IN AUGUST, KEEPING PRICES PAINFULLY HIGH

Jerome Powell, chairman of the U.S. Federal Reserve, speaks during a news conference following a Federal Open Market Committee (FOMC) meeting in Washington, D.C., on Wednesday, May 4, 2022. (Al Drago/Bloomberg via Getty Images / Getty Images)

Goldman Sachs then predicted that the Fed will deliver back-to-back half-percentage point increases in November and December, followed by one quarter-percentage point hike in 2023 and one rate cut in 2024.

"We see several reasons for the change in plan," Hatzius wrote. "The equity market threatened to undo some of the tightening in financial conditions that the Fed had engineered, labor market strength reduced fears of overtightening at this stage, Fed officials now appear to want somewhat quicker and more consistent progress toward reversing overheating, and some might have reevaluated the short-term neutral rate."

Although Goldman economists, like many other experts, initially thought the Fed would reduce the size of rate increases after July, that changed after the August inflation data released last week came in hotter than expected. The consumer price index unexpectedly rose 0.1% in August from the previous month, dashing hopes for a slowdown. On an annual basis, prices are up 8.3% — near the highest level since 1981.

Stocks fell sharply after the surprisingly hot report on fears of an even more aggressive Fed, with the Dow sliding 1,276 points — the worst day since June 2020.

HOUSING REPORT: Investors are eagerly awaiting a Tuesday morning housing report to gauge another factor how inflation is affecting the economy.

At 8:30 a.m. ET, the Commerce Department is expected to say the number of new homes under construction in August dipped 0.1% to a seasonally adjusted annual rate of 1.445 million.

That would mark the second straight monthly decline to the lowest in a year-and-a half (since February 2021).

Housing starts have tumbled 20% in the three months since hitting a near 16-year high of 1.810 million in April (the highest since June 2006) as increased borrowing costs and rising prices slammed affordability.

NAHB CEO GIVES GRIM ASSESSMENT OF HOUSING MARKET: 'WE'VE GIVEN BIRTH TO A HOUSING RECESSION'

Houses under construction at the Norton Commons subdivision in Louisville, Kentucky, US, on Friday, July 1, 2022. (Luke Sharrett/Bloomberg via Getty Images / Getty Images)

Permits for future construction, a good gauge of future housing activity, are anticipated to fall 4.5% to 1.610 million in August, the lowest since September (for context, January’s print of 1.899 million was the highest since May 2006).

It would also be the fifth consecutive monthly decline in building permits, which hasn’t happened since the end of the global financial crisis.

Tuesday’s report follows the NAHB’s housing market index, out Monday morning, which dipped more than expected to the lowest since May 2020 as high mortgage rates and construction costs weighed on the mood of homebuilders

FED TO MEET, RATE HIKE ON HORIZON: The two-day Federal Open Minutes Committee (FOMC) meeting, the sixth policy meeting of the year, kicks off Tuesday morning.

It concludes Wednesday afternoon with the Fed’s rate decision, policy statement, summary of economic projections, and post-meeting press conference with Fed chairman Jerome Powell.

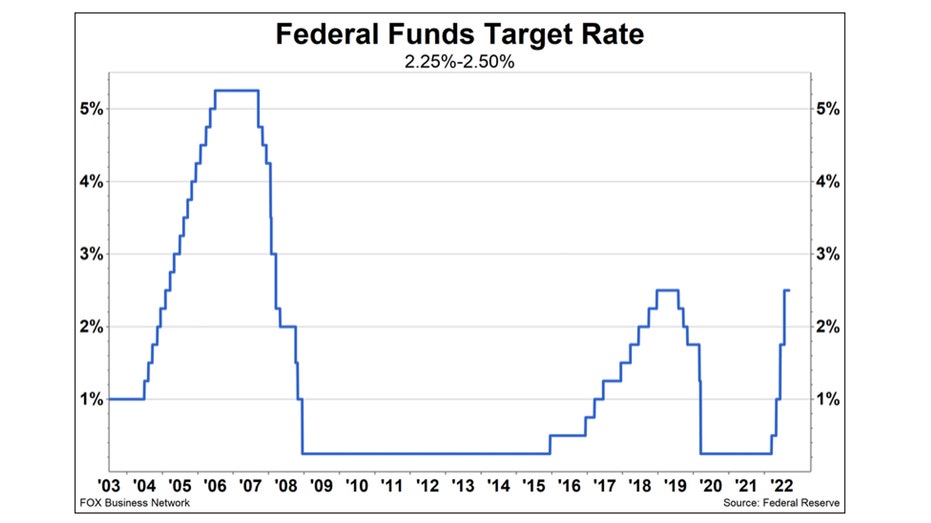

The Federal Reserve is widely expected to raise the Federal Funds rate by three-quarters of a percentage point to a range of 3%-3.25%, up from the current range of 2.25%-2.50%.

It would be the central bank’s third consecutive 75-basis point rate hike, following moves in July and June.

FED RATE HIKES WON'T STOP INFLATION IF GOVERNMENT SPENDING STAYS HIGH, PAPER SAYS

Prior to June, the Fed hadn’t done a 75 bps rate increase since November 1994. The Fed lifted the Funds rate by half a point in May and a quarter-point in March.

Before that, the Funds rate had been in a 0%-0.25% range following two emergency rate cuts in March 2020 in response to the global pandemic.

The Federal Reserve’s balance sheet currently stands just shy of $9 trillion, having doubled since the pandemic as the Fed bought trillions in Treasuries and mortgaged-backed securities to try and hold off an economic collapse. The central bank began winding down its balance sheet (quantitative tightening, or QT) in June by allowing up to $47.5 billion per month ($30 billion of Treasuries and $17.5 billion of MBS) to mature without reinvesting the proceeds. That figure has doubled as of last week.

The Federal Reserve’s preferred measure of inflation, the year-over-year change in core personal consumption expenditures, cooled a little more than expected in July to 4.6%. It was the fourth month in the last five of slowing growth, down from a 39-year high of 5.3% in February, but still significantly above the 1.5% level at the start of the year.

MARKETS, BONDS HIGHER: Major U.S. stock indexes inched up Monday and bond yields hit their highest level in more than a decade as investors looked ahead to the Federal Reserve's interest-rate decision later this week.

The S&P 500 rose 26.56 points, or 0.7%, to 3899.89. The broad market index opened with losses but rallied in the last hour of trading, putting it firmly into positive territory. The Dow Jones Industrial Average advanced 197.26 points, or 0.6%, to 31019.68. The technology-focused Nasdaq Composite climbed 86.62 points, or 0.8%, to 11535.02.

Last week, both the S&P and Nasdaq notched their biggest weekly declines since June amid a slew of corporate warnings that raised alarm bells about the trajectory of the U.S. economy.

FedEx

Companies such as FedEx and General Electric were among those that pointed to signs of economic troubles.

General Electric

The messages sparked worries among investors about how well corporate earnings can hold up as the Fed keeps raising rates and the U.S. potentially heads for a recession.

This week, investors are largely focused on a round of interest-rate decisions by central banks.

The Fed's decision, to be announced Wednesday, will be followed Thursday by the Bank of England. Investor sold government bonds in the run-up to the Fed meeting, sending yields to their highest level in years.

MARKET NEWSMAKERS: Healthcare was one of the sectors that posted losses Monday, weighed down by losses among vaccine makers.

Moderna tumbled $9.84, or 7.1%, to $127.90, making it the worst-performing stock in the S&P 500, after President Biden said in a televised interview that the COVID-19 pandemic was over.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| MRNA | MODERNA INC. | 41.01 | +0.14 | +0.34% |

| NVAX | NOVAVAX INC. | 8.25 | +0.38 | +4.83% |

| PFE | PFIZER INC. | 27.22 | +0.73 | +2.76% |

| COST | COSTCO WHOLESALE CORP. | 1,001.16 | +11.87 | +1.20% |

| LEN | LENNAR CORP. | 114.04 | -1.35 | -1.17% |

Novavax fell $1.98, or 6.5%, to $28.43, while Pfizer shed 59 cents, or 1.3%, to $45.44.

CLICK HERE TO READ MORE ON FOX BUSINESS

Later this week, investors will parse results from companies including Costco Wholesale and home builder Lennar. They also will get full results from FedEx on Thursday after its sales warning last week.