GM authorizes $10 billion share repurchase to benefit shareholders following strike

The automaker is also targeting a stock dividend increase of 33%

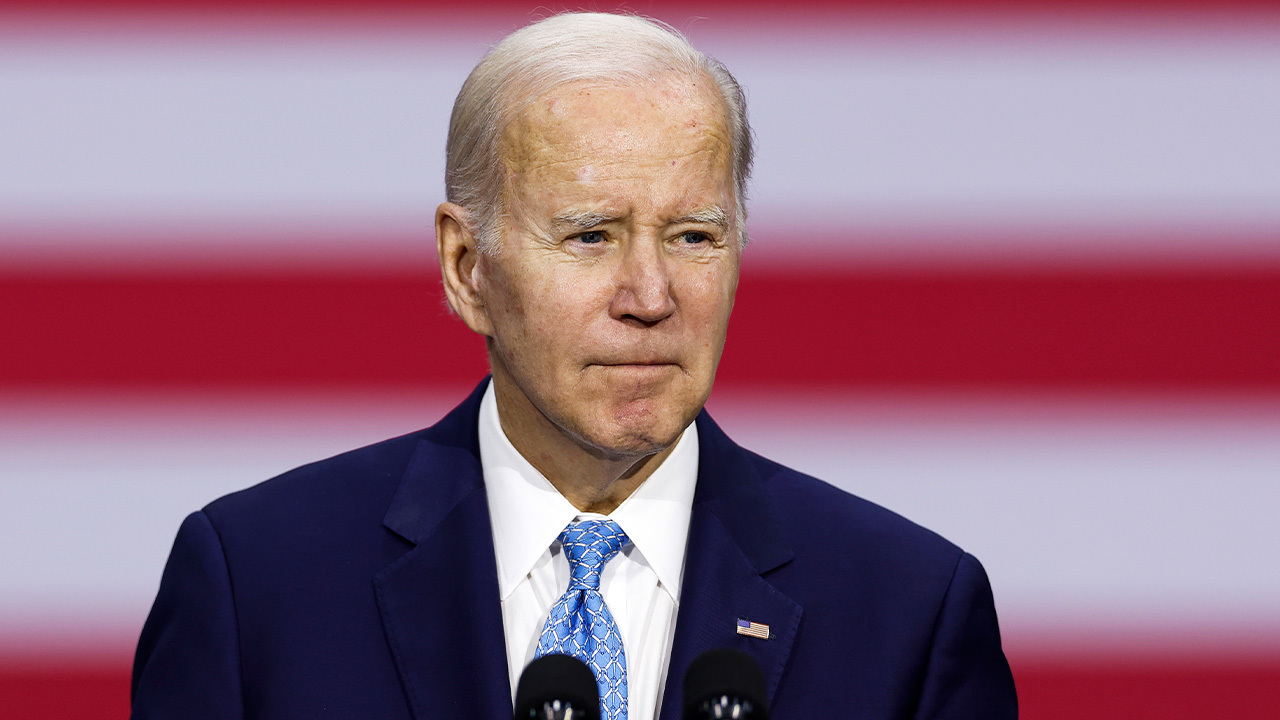

WATCH LIVE: Biden delivers remarks after autoworker strike comes to an end

The president meets with UAW members and gives a speech on 'Bidenomics.'

General Motors wants to give its shareholders a bigger return in 2024, now that the labor strikes have ended.

The automaker announced a $10 billion accelerated share repurchase program on Wednesday, with plans to increase its common stock dividend by 33% beginning in January. GM also reinstated its full-year 2023 earnings guidance.

GM'S CRUISE CEO KYLE VOGT RESIGNS FROM COMPANY

"We are finalizing a 2024 budget that will fully offset the incremental costs of our new labor agreements and the long-term plan we are executing includes reducing the capital intensity of the business, developing products even more efficiently, and further reducing our fixed and variable costs," GM Chair and CEO Mary Barra said in a statement. "With this clear path forward, and our strong balance sheet, we will return significant capital to shareholders."

Mary Barra, CEO of General Motors, discusses electric vehicles and global economics during a Bloomberg Television interview in New York, on Feb. 16, 2023. (Victor J. Blue/Bloomberg via / Getty Images)

The total of repurchased shares will be determined upon final settlement and will be based on the daily volume-weighted average prices of common stock during the term, which GM says will conclude in the fourth quarter of 2024.

CRUISE PAUSES DRIVERLESS VEHICLE OPERATIONS ACROSS US AMID SAFETY PROBE

GM twice raised its full-year earnings guidance before withdrawing it in the third quarter due to the labor disruptions, the manufacturer said in the announcement.

United Auto Workers attend a solidarity rally on Sept. 15, 2023, in Detroit. (Bill Pugliano / Getty Images)

The reinstated guidance will include an estimated $1.1 billion EBIT-adjusted impact from the United Auto Worker strike, primarily from lost production.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GM | GENERAL MOTORS CO. | 84.24 | +0.94 | +1.13% |

| F | FORD MOTOR CO. | 13.80 | +0.08 | +0.58% |

| STLA | STELLANTIS NV | 7.27 | -2.27 | -23.75% |

GM says it now expects full-year 2023 capital spending between $11 billion and $11.5 billion, powered by the retiming of select programs and capital-efficient investments. The company also said there would be adjusted automotive free cash flow between $10 billion and $11.5 billion, compared to the previous outlook of just $7 billion to $9 billion.

UAW RATIFIES LABOR DEAL WITH GENERAL MOTORS

Meanwhile, GM expects adjusted per-share earnings of $6.52 to $7.02, which includes the impact of the accelerated share repurchase.

General Motors

The auto giant recently paused operations for its driverless-car subsidiary Cruise following a suspension by the state of California. In October, the company said it would delay the opening of a Detroit EV plant, while nixing its plans to build 400,000 EVs by mid-2024.

A Cruise, which is a driverless robot taxi, is seen during operation in San Francisco on July 24, 2023. (Tayfun Coskun/Anadolu Agency via / Getty Images)

CLICK HERE TO READ MORE ON FOX BUSINESS