Coronavirus to fuel gold-miner deals: Barrick Gold CEO

'There's a real opportunity that there might be some acquisition options coming out of this'

Get all the latest news on coronavirus and more delivered daily to your inbox. Sign up here.

The COVID-19 pandemic could lead to a flurry of deals in the gold mining industry, according to Barrick Gold CEO Mark Bristow.

The pandemic has caused some miners to put operations on care and maintenance, shrinking gold supplies. At the same time, major central banks and governments have been injecting cash into their economies, devaluing their currencies and spiking interest in gold, a traditional safe haven.

“There's a real opportunity that there might be some acquisition options coming out of this,” Bristow told FOX Business. “We’re certainly keeping very busy looking at those options.”

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GOLD | GOLD COM INC | 55.30 | +4.95 | +9.83% |

All of this comes as gold is seeing a declining reserve base due to miners not investing in their future and production forecasts pointing to a 20 percent to 30 percent decline in new gold supply over the next 10 years.

CORONAVIRUS RELIEF MAY HELP GOLD MINERS STRIKE MOTHER LODE

The gold mining industry has 14 so-called tier-one assets, according to Bristow, and Barrick already has six of them, including three in Nevada, two in Africa and one in the Dominican Republic. The company has a handful of other assets that are on the verge of becoming tier one, which refers to mines that have produced more than 500,000 ounces of gold per year for at least 10 years at the lower half of the cost curve.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GLD | SPDR GOLD SHARES TRUST - USD ACC | 455.37 | +13.34 | +3.02% |

Bristow says the opportunity created by the COVID-19 pandemic is similar to what happened following the 2008 global financial crisis when miners found themselves in an environment that was ripe for deals as the price of gold surged from about $700 per ounce to $1,900 before collapsing and leaving a trail of destruction.

“You've got to be careful that you don't blow your brains out like the industry did between 2009 and the run-up to the peak in 2012,” Bristow said.

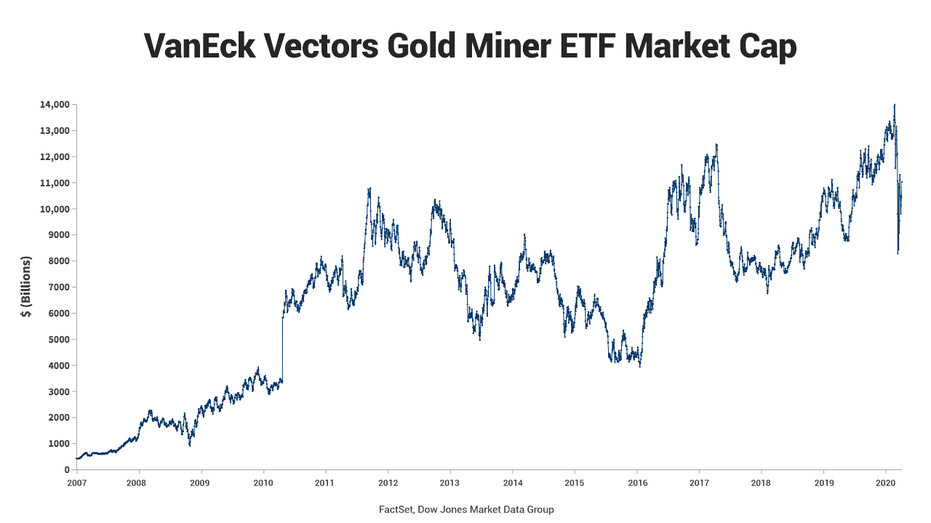

The VanEck Vectors Gold Miner ETF hit a peak market capitalization of $10.79 billion in September 2011 before falling to below $4 billion in January 2016.

The value of mergers and acquisitions in the gold industry increased by 45 percent to $18.2 billion in 2019, according to a report released in February by the consultancy Metals Focus. That number was 43 percent below the 2010 peak of $32.2 billion, the report said.

Even with the coronavirus, Bristow says the Toronto-based Barrick, the world’s No. 2 gold miner, aims to become the “most valued gold company" and will continue to acquire “best-in-class assets,” according to Bristow, as well as hire the best people.

“That always delivers superior returns,” he said.

The company recently released its 10-year plan, which sets out a path to reach 5 million ounces of annual production with its current resources.

Should Barrick make any new acquisitions or discover more gold, it would build on that foundation of 5 million ounces. The icing on the cake for the company may be the price of the yellow metal itself. "At these gold prices, we're in very good shape because we've allocated and invested and built our business based on a long term gold price of $1,200,” Bristow said.

Gold this year has gained more than 10 percent and is hovering around $1,677 an ounce.