Gold drops but still has luster long term

'Margin calls and losses in other markets are driving investors to search for cash'

Gold prices plunged Thursday but experts say the dumping of the yellow metal is likely a short-term trade and the precious metal remains attractive.

Amid extreme volatility, investors are being forced to cover losses in other corners of the market brought on by concerns over the escalating coronavirus outbreak.

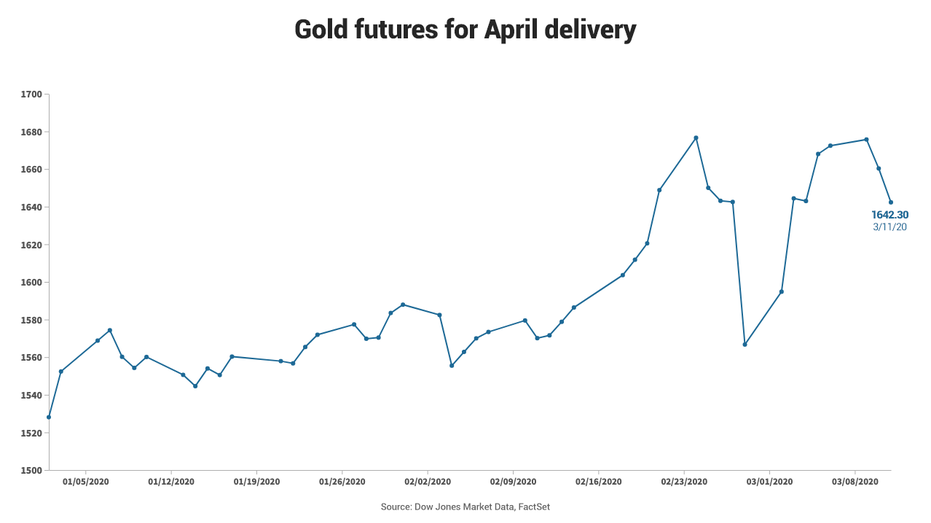

Gold futures for April delivery fell 3.2 percent to $1,589.30 an ounce, closing at their lowest level since Feb. 28. After Thursday’s drop, the precious metal was still up 4.3 percent this year.

“Margin calls and losses in other markets are driving investors to search for cash, and gold happens to be the liquid position they are choosing to cash out on,” wrote Christopher Louney, commodity strategist at RBC Capital Markets. “One thing that is incremental this time around is that we are seeing more significant strength in the dollar amid this scramble for liquidity, which is an added driver of today’s move lower.”

The COVID-19 outbreak has infected 118,332 people worldwide and killed 4,292, according to the latest figures provided by the World Health Organization.

The fast-spreading nature of the virus has prompted travel bans, cancellation of flights and events as well as social distancing, all of which have contributed to U.S. equity markets plunging more than 20 percent from their February peaks.

The S&P 500 and the Nasdaq joined the Dow in bear market territory on Thursday amid another day of heavy selling.

NEW YORK FED PUMPS LIQUIDITY INTO MARKETS

Typically, investors flock to gold during times of economic uncertainty, but in some instances, like the current global health crisis, even those assets that are considered safe-havens can see indiscriminate selling as investors seek to raise cash.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GLD | SPDR GOLD SHARES TRUST - USD ACC | 455.37 | +13.34 | +3.02% |

J.P. Morgan metals analyst Natasha Keneva says Thursday’s move below $1,620 an ounce opens up a trap door, which will likely result in a drop to somewhere between $1,481 and $1,536 an ounce.

She says the selloff in gold has been “bucking its traditional relationship with U.S. yields” and that the precious metal could “eventually catch up if rates stay depressed.”

“Gold’s role as a ‘perceived safe haven’ is largely what got us here, and despite these sharper moves lower, we do not think it represents the end of the risk-off narrative for gold,” Louney wrote.

CLICK HERE TO READ MORE ON FOX BUSINESS

He says gold prices are “likely to average at or even above” his team’s high scenario of $1,612 an ounce for the first half of 2020.