MAGA stocks drive market higher as Trump fights for White House

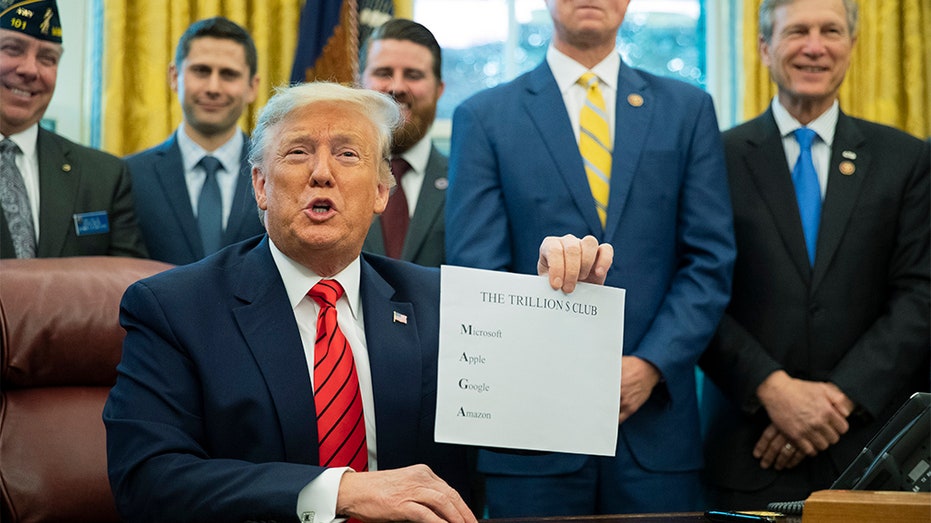

Microsoft, Amazon, Google and Apple all have valuations over $1 trillion

A group of four companies with President Trump’s favorite acronym are leading the stock market’s charge to record highs.

Together they are responsible for about 17 percent of the S&P 500 and almost 70 percent of the index’s gain in 2020. Their strong start to the year has helped propel the S&P 500 to 10 record-high closes in 28 trading days, according to Dow Jones Market Data Group.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| MSFT | MICROSOFT CORP. | 401.14 | +7.47 | +1.90% |

| AMZN | AMAZON.COM INC. | 210.32 | -12.37 | -5.55% |

| GOOGL | ALPHABET INC. | 322.86 | -8.39 | -2.53% |

| AAPL | APPLE INC. | 278.12 | +2.21 | +0.80% |

“The reason that I think these stocks are so strong is that they are perceived to be the transformative companies that we have right now, that they are more than just good businesses,” Jim Bianco, president and macro strategist at Bianco Research and the first person to notice the MAGA acronym, told FOX Business. “They are businesses that are going to devour whole industries.”

CORONAVIRUS TO AXE $280B FROM GLOBAL WEALTH ENGINE

Still, there are potential challenges ahead for the stocks and the tech industry as a whole, posing a quandary for Trump, who is seeking a second term in the White House. He has criticized some of the tech giants but touted stock market gains as proof his economic policies are working.

Silicon Valley has come under increased scrutiny from Republicans and Democrats alike in the Trump era, with some lawmakers suggesting that a few of the companies should be broken up. The Federal Trade Commission and Trump's Justice Department are both examining anti-competitive practices in the tech industry.

On Tuesday, the FTC ordered the four tech companies and Facebook to hand over information related to their acquisitions of smaller companies from 2010 through 2019.

AP Photo/Manuel Balce Ceneta

In the meantime, Bianco pointed to Amazon’s disruption of the retail industry and Google’s of the newspaper business as examples of “creative destruction” in the American economy, and said legacy businesses need to “adapt in a major way” or risk becoming "taxi drivers in an Uber world.”

“You've got these transformational companies that are roaring ahead," Bianco said. "And as an investor, they're supporting your whole portfolio.”

That is something that Scott Wren, senior global equity strategist for Wells Fargo Investment Institute, says is a common occurrence as the stock market heads towards a peak.

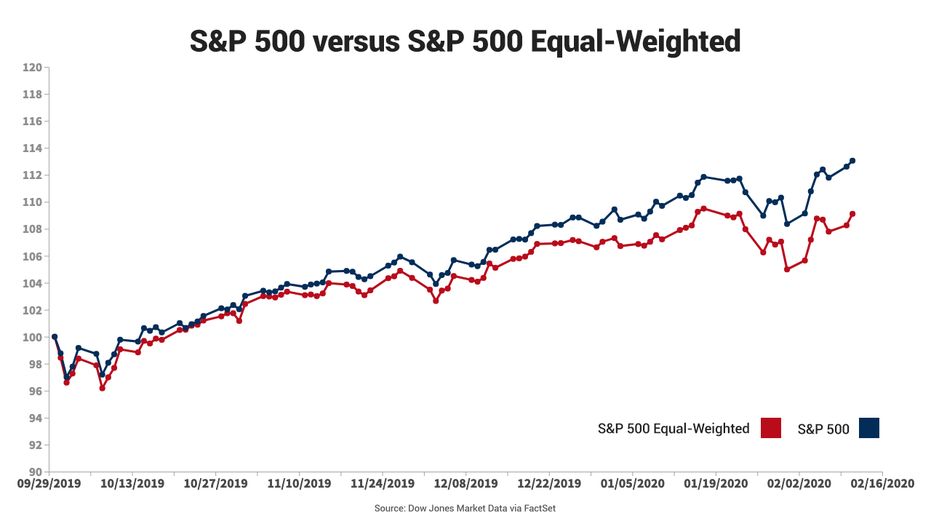

He noted that the S&P 500, which is a market capitalization-weighted index, meaning the biggest companies wield greater influence, has outperformed the S&P 500 Equal-Weighted index by 300 basis points since October.

“One indicator as you head into the later part of the cycle and what ultimately takes you to the top is the market narrows a lot,” usually over a 12- to 24-month period, he told FOX Business.

“It’s not unusual over the six or nine months before you trade to the ultimate top in the stock market that you might have 800 to 1,200 basis points of performance differential between the S&P 500 and the Equal-Weighted S&P 500.”

CLICK HERE TO READ MORE ON FOX BUSINESS

Two common indicators that a market really is nearing its peak are investors who haven't maxed out their holdings jumping in to chase returns and stocks becoming pricier as a result.

While “we’re starting to get some chasing,” he conceded, trends are “not anywhere close to the level, say over a six- or nine-month period, that would be typical at the top.”