Group warns recession is here, energy prices, 2-day Fed meeting and more: Tuesday's 5 things to know

Investors will be waiting for second-quarter earnings from heavyweights Microsoft and Visa as well as 3M, Coca-Cola and McDonalds

Here are five key things that could impact Thursday's trading.

‘MILD RECESSION’ IS HERE: The Schork Group principal Stephen Schork warned Monday that the United States is experiencing a "mild recession" and the "pull" on energy prices will be greater as the severity of the downturn intensifies.

"We know we’ve got runaway inflation," Schork noted on Monday, arguing that there are "only two ways to attack inflation," through supply construction or demand destruction." He stressed that as it pertains to supply construction with regard to energy, more oil, natural gas and fossil fuels are needed in the market.

"The same goes for food. We are in a severe situation where we are not producing enough food, especially when we see this fall harvest and because of manipulation in that market."

FORMER CONGRESSMAN AMONG NINE CHARGED WITH INSIDER TRADING

The Schork Group principal Stephen Schork discusses energy markets, arguing that the U.S. is already in a "mild recession." (iStock)

THE INFLATION PINCH: Walmart on Monday lowered its profit outlook for the second quarter and the full year, saying soaring inflation is taking a toll on the retail giant. The news sent Walmart shares tumbling after the closing bell. The company announced it expects adjusted earnings per share for Q2 to decline to around 8 or 9% and drop to the 11- to 13% range for fiscal year 2023.

KLONDIKE DISCONTINUES CHOCO TACO AFTER NEARLY 4 DECADES ON THE MARKET

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| WMT | WALMART INC. | 124.87 | -1.75 | -1.38% |

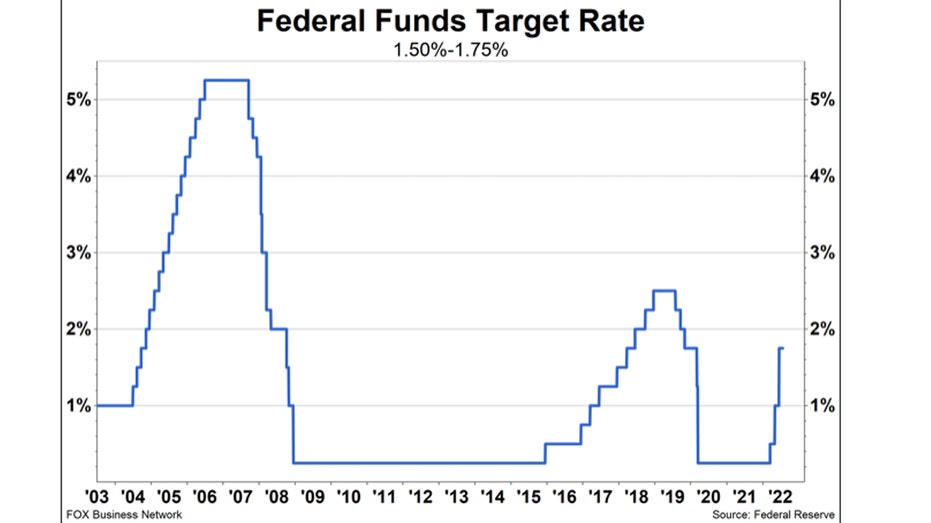

FED MEETING KICKS OFF: The two-day FOMC meeting, the fifth policy meeting of the year by the Federal Reserve, kicks off Tuesday morning. It concludes Wednesday afternoon with the rate decision, policy statement and post-meeting press conference with Fed chairman Jerome Powell.

This May 4, 2021, file photo shows the Federal Reserve building in Washington. (AP Photo/Patrick Semansky, File / Associated Press)

The Fed is widely expected to raise the Federal Funds rate by three-quarters of a percentage point to a range of 2.25%-2.5%. It would be the central bank’s second consecutive 75-basis point rate hike (June saw the first 75 bps hike since November 1994), following a half-point hike in May and a quarter-point increase in March. Prior to that, the Funds rate had been in a 0%-0.25% range following two emergency rate cuts in March 2020 in response to the global pandemic.

HUGE EARNINGS REPORT DAY: Five Dow members are scheduled to report second-quarter earnings – 3M, Coke and McDonald’s in the morning and Microsoft and Visa after the close. Ahead of the opening bell, carmaker General Motors, industrial conglomerate General Electric, health insurer Centene, package delivery powerhouse United Parcel Service, aerospace and defense heavyweight Raytheon Technologies and homebuilder Pulte Group to name a few.

After the closing bell, Microsoft and Google parent Alphabet are slated to report. Microsoft is expected to say fiscal fourth-quarter earnings-per-share rose 5.7% from a year ago to $2.29 on a 14% jump in revenue to $52.44 billion. Microsoft breaks down its operations into three main segments: Intelligent Cloud (Azure, SQL and Windows servers), More Personal Computing (Windows, Xbox, Surface and PC accessories) and Productivity & Business Processes (Office 365, Skype, LinkedIn).

BIDEN SAYS ‘WE'RE NOT GOING TO BE IN A RECESSION' AHEAD OF GDP NUMBERS: ‘GOD WILLING’

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| MMM | 3M CO. | 165.13 | +0.95 | +0.58% |

| COKE | COCA COLA CONSOLIDATED | 176.79 | +6.50 | +3.82% |

| MCD | MCDONALD'S CORP. | 327.00 | -0.75 | -0.23% |

| MSFT | MICROSOFT CORP. | 398.46 | -0.23 | -0.06% |

| V | VISA INC. | 318.89 | -1.42 | -0.44% |

HOME PRICES, HOME SALES, CONSUMER CONFIDENCE: At 9 a.m. ET, the May home prices report will be released. There is no estimate for the non-seasonally adjusted 20-city index, but economists surveyed by Refinitiv expect the seasonally adjusted index to rise 1.5% month-over-month.

For the year, home-price growth as measured by the 20-city index is anticipated to cool to 20.6%, down from a record 21.2% annual increase in April. At 10 a.m. ET, the Census Bureau is expected to say sales of new single-family homes fell 5.2% in June to a seasonally adjusted annual rate of 660,000. That would be the fifth decline in six months as higher mortgage rates and record-high prices shut many homebuyers out of the market. For context, April’s reading of 629,000 was the lowest in two years.

A home sits for sale in Geneva, Illinois, June 23, 2009. (REUTERS/Jeff Haynes / Reuters Photos)

CLICK HERE TO READ MORE ON FOX BUSINESS

Also at 10 a.m. ET, the Conference Board will release its consumer confidence index for July. It’s expected to fall a point and a half, the third straight monthly decline, to 97.2, the lowest since February 2021. Confidence is down sharply from a post-pandemic high of 128.9 in June of last year on inflation concerns.