How Lego beat Barbie and Monopoly

Maker of toy bricks reports rise in sales, pushing further ahead of U.S. rivals

Less than a decade ago, Lego A/S inched ahead of Barbie maker Mattel Inc. as the world’s biggest toy company.

Today, the maker of those brightly colored bricks is generating almost twice the revenue of Mattel, outpacing both it and rival Hasbro Inc., maker of the Monopoly board game and Nerf guns, through the pandemic, recent supply-chain tumult and soaring inflation.

On Tuesday, Lego said sales for 2022 rose 17% compared with the previous year to 64.6 billion Danish kroner, equivalent to $9.27 billion. Net profit was up 4% to 13.8 billion kroner.

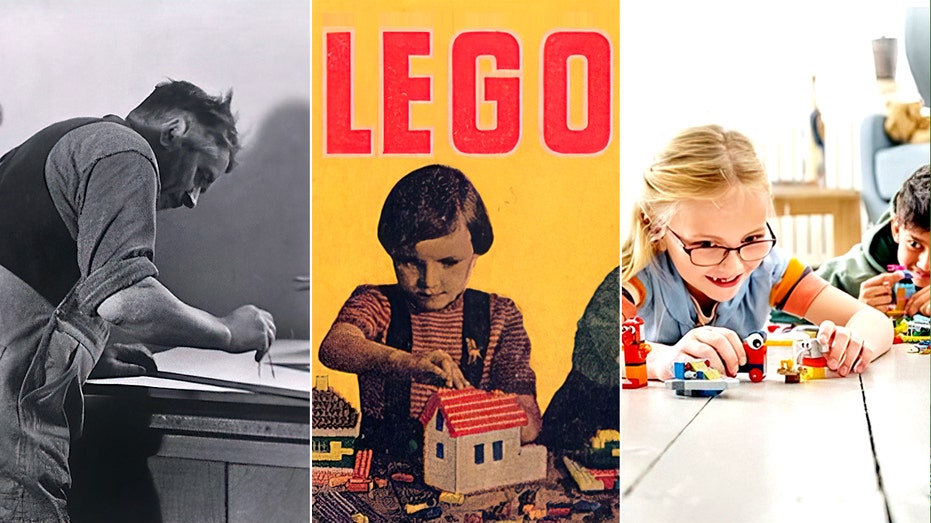

Far left: Danish carpenter Ole Kirk Kristiansen (1891 to 1958) created the first LEGO in 1932 with a wooden car. He expanded the brand with toy bricks, which have been played with by generations of children. (The LEGO Group / Fox News)

Lego Chief Executive Niels Christiansen credits investments it made in recent years in new stores and products, as well as in e-commerce and digital engagement. Despite the economic turbulence stemming partly from Russia’s invasion of Ukraine, last year’s performance exceeded Lego’s expectations, Mr. Christiansen added.

"Overall, we are very satisfied," said Mr. Christiansen. "In a year with a lot of challenges [we achieved] a bottom line growing compared to the year before." And, he said, "we reached more kids than ever before with the Lego brand."

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| MAT | MATTEL INC. | 21.49 | +0.38 | +1.80% |

| HAS | HASBRO INC. | 93.84 | -1.59 | -1.67% |

The widening gap between Lego and its rivals has been driven by success in tapping new markets such as China, engaging new generations of fans with the help of movie and videogame tie-ups and piggybacking on the appeal of other popular brands, notably Star Wars, with themed sets. The company has also benefited from rolling out more of its own stores and having its own dedicated factories, close to end markets, which have allowed it to largely avoid supply-chain snags.

The Lego City and Icons series — sets that include police and fire stations and vehicles, and a newer range of more challenging builds that include sets based on famous landmarks — were among the brand’s bestsellers last year, alongside its Star Wars and Harry Potter franchise tie-ins, the company said.

Lego has also pushed into digital play. Last year, it said it had success with products such as the Lego Builder app and the "Lego Star Wars: The Skywalker Saga" videogame. The company’s digital activities are still primarily about drawing children into the Lego experience and encouraging them to buy physical toys, Mr. Christiansen said.

LEGO/"Star Wars" Holiday Special illustration (credit: "Star Wars" blog post)

Those digital efforts will expand this year, with Lego and its partner Epic Games Inc. planning to launch a child-friendly version of the metaverse following a $1 billion investment made by the toy maker in the U.S. videogames developer last year.

LEGO GROUP MOVING NORTH AMERICAN HQ TO BOSTON

Content helped build Lego into the world’s largest toy maker. Its movies, TV shows and videogames take advantage of licensing deals with some of the world’s biggest brands, like Batman and Star Wars, to grow its customer base. Photo illustration: Ryan Trefes

The 90-year-old Danish company’s performance stands in contrast to the downbeat results of other leading toy makers, which blamed the economic volatility and soaring inflation of last year for sluggish sales.

Last month, Barbie maker Mattel said its 2022 sales were flat at $5.4 billion compared with the year before, while annual revenue at Hasbro declined by 9% to $5.9 billion. Both U.S. toy makers endured a tough holiday period in which sales were down significantly compared with the same period in 2021.

Star Wars Lego holiday set.

Hasbro, which makes toys including Transformers and Play-Doh, said it would lay off 15% of its global workforce after its disappointing holiday performance and as it forecast a tough market for toys this year.

LEGO TO INVEST MORE THAN $1B IN VIRGINIA BRICK PLANT

Lego, meanwhile, said demand for its brick sets remained strong over Christmas. Investment across all product categories and price points enabled the company to appeal to consumers irrespective of their spending power, Mr. Christiansen said. Moreover, parents continue to buy Lego for their children even in tough economic times because they perceive it as an educational toy that will remain in use for many years, he said.

Still, profits at Lego grew modestly relative to the rise in sales last year. Mr. Christiansen attributed this to exceptional growth in the prior year. He also said the company wasn’t entirely immune to economic challenges last year, with higher costs for raw materials and transportation denting profit growth.

Children playing with Legos (LEGO Group)

Lego responded with single-digit-percentage price increases in around one-third of its product range in September, while holding prices down on the rest, Mr. Christiansen said.

CLICK HERE TO GET THE FOX BUSINESS APP

The company opened 155 new stores, many of them in China, over the course of the year, offsetting the decision to close its 81 stores in Russia in the wake of the country’s invasion of Ukraine. Overall, the company said it reached a total store count of 904.

Looking ahead, Mr. Christiansen said Lego expects revenue to increase by a single-digit percentage this year. To help meet growing demand, the company is set to open a new factory in Vietnam this year, and another manufacturing plant in the U.S. in 2025.