Chinese stock listings on NYSE, Nasdaq under microscope

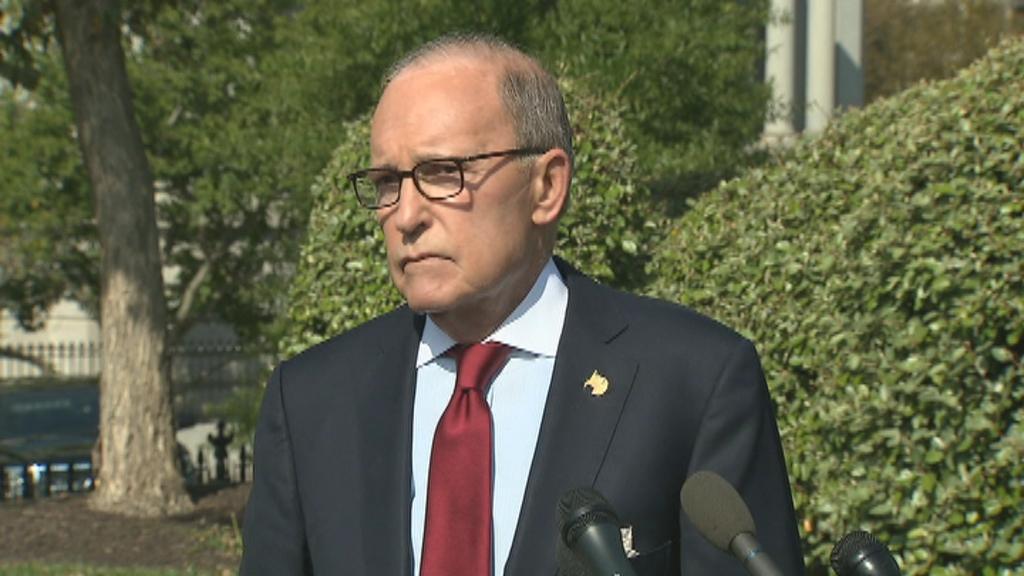

Top White House economic advisor Larry Kudlow says “delisting” Chinese companies from U.S. exchanges “is not on the table” however there is a new push to scrutinize some of these listings.

“What we are looking at is investor protection, U.S. investor protections…” Kudlow told FOX Business. “There have been complaints by the stock exchanges about this, the SEC has heard complaints so we’ve opened up a study group to take a look at it,” he said noting that the probe is in its infancy.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| ICE | INTERCONTINENTAL EXCHANGE INC. | 168.98 | +0.64 | +0.38% |

| NDAQ | NASDAQ INC. | 84.83 | -0.68 | -0.80% |

There are roughly 156 Chinese companies listed on U.S. exchanges combined, as of February 2019, carrying a total market cap of $1.2 trillion, as tracked by the U.S.-China Economic Security Review Commission.

These companies range in size from behemoths such as online retailer Alibaba to smaller China Automotive Systems. Additionally, some of these companies are 30 percent state-owned including PetroChina and China Telecom to name a few. Last month, Hudson Institute Senior Fellow Michael Pillsbury, an expert on China, pointed out that some of these companies, due to state control, are unaudited. "China says our large companies' internal affairs are state secrets, we are not going to let you audit them. This is really shocking to the average investor that so many Chinese companies are on Wall Street unaudited."

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BABA | ALIBABA GROUP HOLDING LTD. | 162.51 | +4.75 | +3.01% |

| PTR | PETROCHINA CO. LTD. | 46.8296 | -0.24 | -0.51% |

| CHA | CHAGEE HOLDINGS LTD. | 10.99 | +0.39 | +3.68% |

| CAAS | CHINA AUTOMOTIVESYSTEMS | 4.49 | +0.05 | +1.13% |

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The Nasdaq declined to comment when reached by FOX Business as did the Securities and Exchange Commission along with the NYSE, which is owned by Intercontinental Exchange.

On Tuesday Bloomberg reported that U.S. negotiators are considering restricting government pension fund investments in China but haven't made a final decision.

The next round of talks between the U.S. and China are set to kick off on Thursday in Washington D.C. with USTR Robert Lighthizer and Treasury Secretary Steven Mnuchin.

Kudlow indicated that the U.S. is optimistic heading into the discussions.

“We are open to whatever they may bring,” he said during an interview on Fox News. But the President has said it has “gotta be the right deal” he stressed.

FOX Business' Blake Burman contributed to this report.