Netflix shares knocked as Goldman warns on 'consumer recession' fears

Goldman has also issued sell ratings for Airbnb, Roblox, Ubisoft, eBay

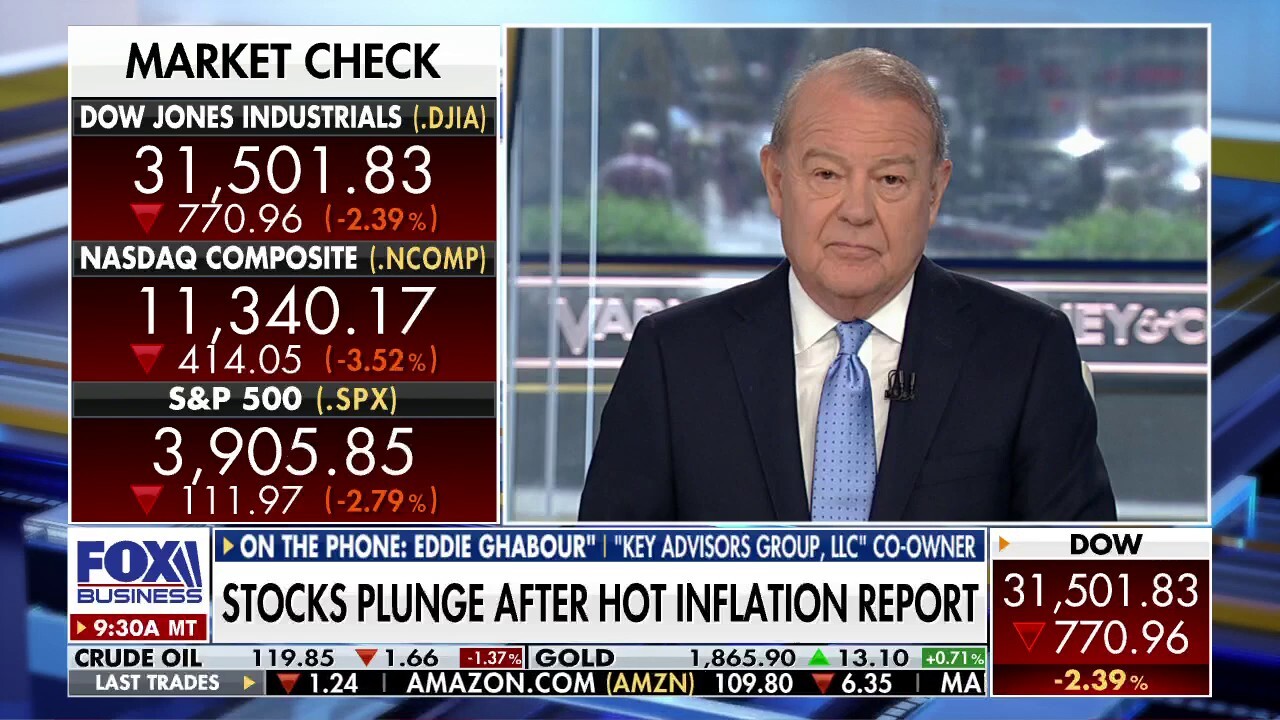

Market is nowhere near the bottom: Expert

Key Advisors Group LLC co-owner Eddie Ghabour weighs in on the risk of a recession.

Shares of Netflix tumbled Friday after Goldman Sachs fired a warning over the streaming giant's future business.

Analyst Eric Sheridan downgraded the stock from a "neutral" to sell" rating and slashed its 12-month price target from $265 to $186 per share.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| NFLX | NETFLIX INC. | 77.00 | -0.99 | -1.27% |

"We have concerns around the impact of a consumer recession as well as heightened levels of competition on demand trends (both in the form of gross adds and churn), margin expansion, & levels of content spend and view NFLX as a show-me story with a light catalyst path in the next 6-12 months," Sheridan wrote in a note to clients on Thursday.

"We have concerns around the impact of a consumer recession as well as heightened levels of competition on demand trends (both in the form of gross adds and churn), margin expansion, & levels of content spend and view NFLX as a show-me story with a light catalyst path in the next 6-12 months…"

Goldman has lowered its 2022-2023 revenue estimates for Netflix to "incorporate a greater probability of a weaker macro environment."

Netflix

"More specifically, we modestly lower our paid streaming subs across every region but incorporate higher ARPU levels in the US in 2024 & beyond to reflect Netflix’s initiatives around its ad-supported tier and password sharing," Sheridan added.

NETFLIX PLACES BID TO CREATE PRODUCTION STUDIO AT FORMER NEW JERSEY ARMY BASE

In the first quarter of 2022, Netflix reported a loss of 200,000 subscribers, its first decline in over a decade. The company attributed the decline to factors including account sharing among more than 100 million households, competition with other streaming services, sluggish economic growth, inflation, Russia’s invasion of Ukraine and continued disruption from the COVID-19 pandemic.

Netflix has started testing a policy that charges users for sharing subscriptions outside of households in Costa Rica, Chile, and Peru. Meanwhile, its cheaper, ad-supported subscription tier could reportedly roll out by the end of the year.

The company, which currently has nearly 222 million subscribers globally, expects to lose another 2 million subscribers by the end of the second quarter.

CLICK HERE TO READ MORE ON FOX BUSINESS

Shares of Netflix have fallen more than 60% year to date.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| ABNB | AIRBNB INC. | 125.81 | +1.54 | +1.24% |

| RBLX | ROBLOX CORP. | 64.44 | +1.38 | +2.19% |

| UBSFY | UBISOFT ENTERTAINMENT SA | 0.93 | -0.05 | -4.98% |

| EBAY | EBAY INC. | 84.75 | +2.57 | +3.13% |

In addition to Netflix, Goldman has issued sell ratings for Airbnb, Roblox, Ubisoft and eBay.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AMZN | AMAZON.COM INC. | 204.86 | +0.07 | +0.03% |

| GOOGL | ALPHABET INC. | 302.85 | -0.48 | -0.16% |

| META | META PLATFORMS INC. | 644.78 | +1.56 | +0.24% |

| UBER | UBER TECHNOLOGIES INC. | 72.94 | +0.17 | +0.23% |

| IAC | IAC INC. | 36.53 | +0.21 | +0.58% |

| ANGI | ANGI INC. | 8.08 | -0.05 | -0.62% |

| MTCH | MATCH GROUP INC. | 30.69 | +0.41 | +1.35% |

| BMBL | BUMBLE INC. | 2.87 | +0.17 | +6.30% |

Meanwhile, Goldman has maintained a buy rating on Amazon, Alphabet, Meta Platforms, Uber, Barry Diller's IAC, real estate tech firm Angi and online dating apps Match and Bumble.