Nvidia announces 10-for-1 stock split, shares hit $1,000

Nvidia's stock split comes after a 90%-plus gain in the shares this year

It’s not too late to buy Nvidia: D.R. Barton

Financial coach D.R. Barton tells ‘Varney & Co.,’ ‘you’ve got to get in’ Nvidia's ‘game’ as their profit margins continue to grow.

Nvidia is rolling out a 10-for-1 stock split, cashing in on the AI boom it has been driving and giving investors a hefty nugget.

The stock crossed the $1,000 mark on Thursday, closing at an all-time high, adding to the 90%-plus advance this year.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| NVDA | NVIDIA CORP. | 185.41 | +13.53 | +7.87% |

Shares closed at $949.50 on Wednesday. Post split, which is effective June 7, 2024, one Nvidia share would be worth $94.95. Nvidia shares have risen over 231,485% since its IPO in January 1999.

Additionally, the company boosted its dividend by 150% to $0.10 vs. $0.04 per share.

The announcement came as first quarter revenue of $26 billion, up 262% from the same period a year ago, beat estimates of $24.6 billion, as tracked by LSEG. The company also delivered a higher-than-expected second quarter revenue forecast of $28 billion compared to a $26 billion estimate.

OPENAI AND NEWS CORP. INK DEAL

Nvidia

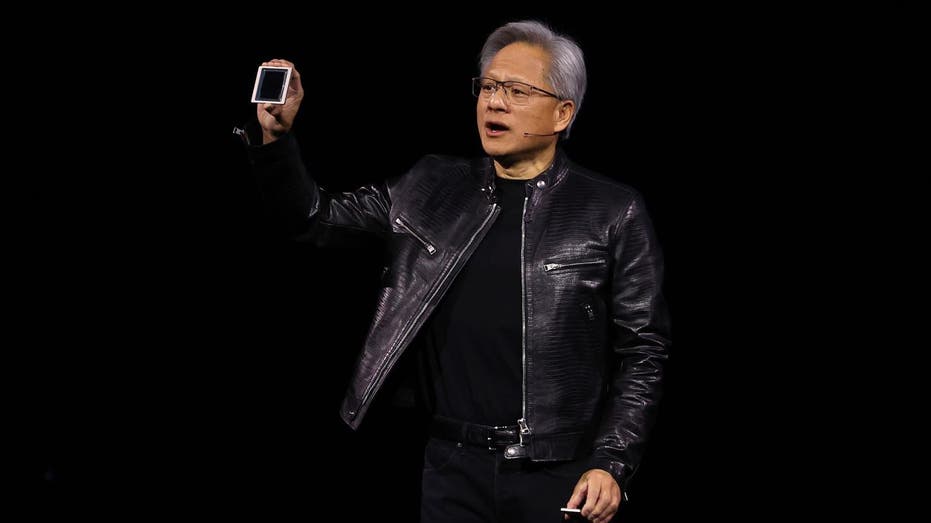

Nvidia is considered the poster child for AI, leading other rivals, including Meta and Google, under the direction of CEO Jensen-Huang, who is also the company's largest individual shareholder, owning nearly 4% of company shares, as tracked by Thomson Reuters.

"The next industrial revolution has begun — companies and countries are partnering with NVIDIA to shift the trillion-dollar traditional data centers to accelerated computing and build a new type of data center — AI factories — to produce a new commodity: artificial intelligence," said Huang in the earnings announcement.

Nvidia CEO Jensen Huang delivers a keynote address during the Nvidia GTC Artificial Intelligence Conference at SAP Center in San Jose, California, on March 18. (Justin Sullivan/Getty Images / Getty Images)

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| META | META PLATFORMS INC. | 661.46 | -8.75 | -1.31% |

| GOOGL | ALPHABET INC. | 322.86 | -8.39 | -2.53% |

Stock splits are in vogue this year as companies with high-priced shares roll out these divides, rewarding current investors and enticing new ones.

HOW NVIDIA BECAME THE KING FROM A HUMBLE MEETING AT DENNY'S

Chipotle's board of directors approved a 50-for-1 split of its common, shareholders of record as of June 18 will receive the additional shares after the market closes on June 25.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| CMG | CHIPOTLE MEXICAN GRILL INC. | 39.39 | +0.94 | +2.44% |

| WMT | WALMART INC. | 131.18 | +4.24 | +3.34% |

CLICK HERE TO READ MORE ON FOX BUSINESS

The burrito maker followed a similar move by Walmart earlier this year. The nation's largest retailer split its shares 3-for-1 in February so more employees could be shareholders. CEO Doug McMillon said it follows the mission of the retailer's founder.

"Sam Walton believed it was important to keep our share price in a range where purchasing whole shares, rather than fractions, was accessible to all of our associates," McMillon wrote in February.