Which oil stocks are best positioned when crude rebounds from crash?

The S&P 500 Energy Sector is in a bull market

The battered S&P 500 Energy Sector has raced into bull-market territory despite crude oil prices treading near 18-year lows.

The sector gained 22.27 percent in the five days through Wednesday, making it the third-fastest trek from a bear market low to a bull market in history, buoying holders of the sector-linked Energy Select SPDR Fund. The exchange-traded fund rose 3.6 percent on Thursday.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| XLE | ENERGY SELECT SECTOR SPDR ETF | 53.25 | +1.04 | +1.99% |

“The pain trade is clearly a rally in highly-indebted companies, and many oils clearly fit that category,” wrote Paul Sankey, managing director at Mizuho Securities.

CORONAVIRUS HYPERINFLATION RISK LOOMS, BUY GOLD: PETER SCHIFF

U.S. shale companies were pummeled this month by oil prices that tumbled as much as 63 percent from March 9 when Saudi Arabia slashed prices for its customers and lowered production in response to Russia's refusal to join OPEC in deepening output cuts.

Prices had already been under pressure as the COVID-19 pandemic caused governments to issue “stay-at-home” orders, people to practice social distancing and the cancellation of non-essential travel.

Analysts at Piper Sandler & Co. say the sharp drop in prices will likely have to persist for six to 12 months before serving as the knockout blow to some shale companies. On aggregate, the U.S. shale patch needs West Texas Intermediate crude oil, the benchmark for U.S. prices, to trade in the upper $40s to survive.

“We think companies that can survive a prolonged $30-per-barrel WTI environment (and potentially lower) and still provide attractive leverage to a crude recovery will ultimately outperform,” wrote Mark Lear, senior research analyst at Piper Sandler & Co.

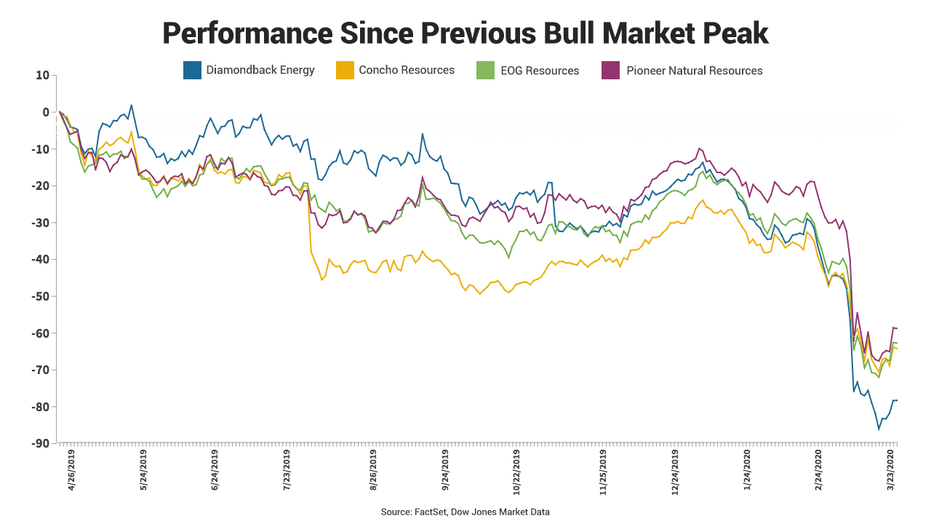

While Lear believes investors should remain on the sidelines for the time being as the current supply/demand dynamics haven’t yet played out, he thinks Concho Resources, EOG Resources, Diamondback Energy and Pioneer Natural Resources are best positioned for success when the current crunch is over.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| FANG | DIAMONDBACK ENERGY INC. | 166.93 | +2.15 | +1.30% |

| PE | NO DATA AVAILABLE | - | - | - |

| EOG | EOG RESOURCES INC. | 113.70 | +1.21 | +1.08% |

| CXO | NO DATA AVAILABLE | - | - | - |

| PESXQ | NO DATA AVAILABLE | - | - | - |

“Start building positions in quality oil companies with good management, higher debt if quality is okay and the company is able to service its debt,” Sankey wrote. “So, Parsley and Diamondback.” He also likes Concho Resources, EOG Resources and Pioneer Natural Resources.