Oil tankers fill up as coronavirus crushes crude demand

Supertankers are en vogue as land storage fills up

Oil tankers are massing off the coast of California and elsewhere as burgeoning supplies leave producers scrambling to find storage.

“Stay-at-home” orders issued by governments worldwide to slow the spread of COVID-19 have reduced global crude demand by 30 million barrels per day, worsening a supply glut that has left the world awash in oil.

The surplus has storage capacities nearing their max, causing producers to turn to offshore supertankers as an alternative means of hoarding their crude.

GOLDMAN SACHS HAS SIMPLE 3-PART CORONAVIRUS PLAN TO CAPITALIZE ON REOPENING OF US ECONOMY

Supertankers are a “good place to park all of your crude in one place,” Stewart Glickman, an energy analyst at New York-based CFRA Research, told FOX Business. Most tankers are already accounted for, however, and “prices are through the roof” for the ones that aren’t, he pointed out.

An oil tanker sits anchored off the Fos-Lavera oil hub near Marseille, France, October 15, 2015. (Reuters/Jean-Paul Pelissier)

A very large crude carrier that can hold 2 million barrels of oil was fetching more than $5 per barrel per month, five times the price from a year ago, before prices eased off their highs. There are currently 140 million to 160 million barrels at sea.

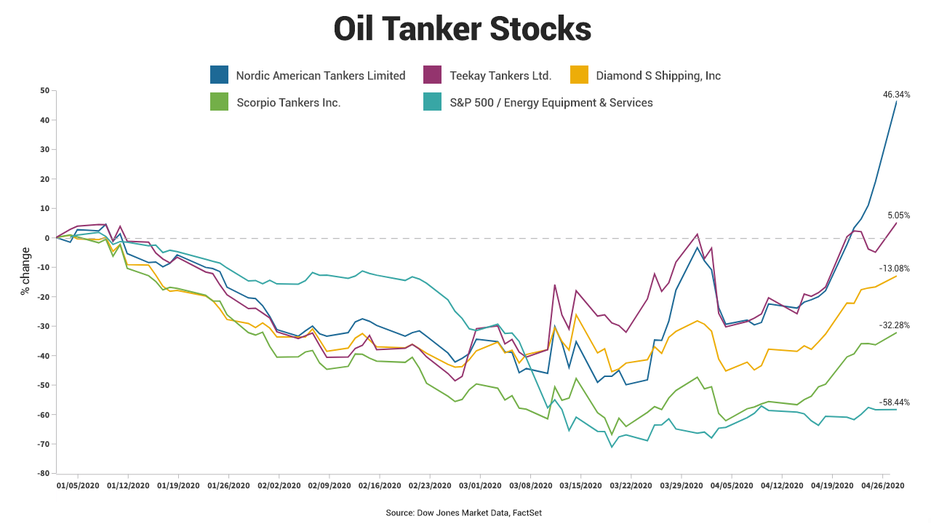

Strong demand for tankers has caused the shares of companies within the space – Scorpio Tankers, Teekay Tankers, Diamond S Shipping and Nordic Amren Tanker Shipping – to outperform oil services and equipment companies that have been hit hard by crude oil prices falling 78 percent this year.

Demand for tankers began when “OPEC started to increase production in early March,” Peter McNally, global sector lead for industrials, materials and energy at the New York-based research firm Third Bridge, told FOX Business.

That’s when Russia and Saudi Arabia, two of the world’s largest producers, embarked on a price war that led to both countries joining the No. 1 producer -- the U.S. -- in pumping out record amounts of crude oil just as demand was beginning to be impacted by the global response to COVID-19.

“Very few people had a sense of how quickly demand was falling and as demand started to fall and refiners started to run at reduced rates or even just close, the question of where to put this oil emerged,” McNally said.

U.S. crude oil inventories swelled by 17 percent over the past seven weeks and are straining storage capacity. Inventory at Cushing, Oklahoma, a key U.S. oil hub, ballooned to 59.7 million barrels last week, up 8.7 percent from the week prior, according to the U.S. Energy Information Administration. The storage facility tops out at about 76 million barrels.

CLICK HERE TO READ MORE ON FOX BUSINESS

If inventories build at the same pace they’ve been going at since mid-March, they will “probably run out by the end of May,” Glickman said, adding “it might even be faster than that” if companies panic and start trying to obtain storage before competitors.

The fact that crude futures contracts for delivery over a year from now are valued at more than twice current prices gives producers an incentive to store their output in hopes of bigger profits later.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

While companies will shut production to limit supply, Glickman says the biggest catalyst for price increases will be demand coming back. A V-shaped recovery would provide a “nice groundswell of support for higher prices,” he said, but admitted there’s no “visibility as to when economies are actually going to return.”