Stimulus checks headed for stock market

Stimulus checks could go out by end of month, according to White House

With the next round of $1,400 stimulus checks days away from being delivered, retail investors may funnel a good chunk of that newfound money into U.S. stocks.

A recent Deutsche Bank survey found that 37% of Main Street investors, some of who could be members of the Reddit community, will plow a “large chunk” of stimulus money, about $170 billion, “directly into equities.”

These small but mighty investors have gained notoriety in recent months, creating volatility and heavy volume in a number of heavily shorted stocks, such as GameStop Corp., AMC Entertainment Holdings Inc. and Bed Bath & Beyond Inc.

AMC CEO'S MESSAGE TO THE REDDIT COMMUNITY

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GME | GAMESTOP CORP. | 23.91 | +0.01 | +0.06% |

| AMC | AMC ENTERTAINMENT HOLDINGS INC | 1.24 | -0.02 | -1.59% |

| BBBY | BEYOND INC. | 5.15 | +0.10 | +2.08% |

The list has expanded to include Koss Corp. and Rocket Companies Inc., to name a few.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| KOSS | KOSS | 4.17 | -0.01 | -0.24% |

| RKT | ROCKET COS INC | 18.35 | -0.10 | -0.54% |

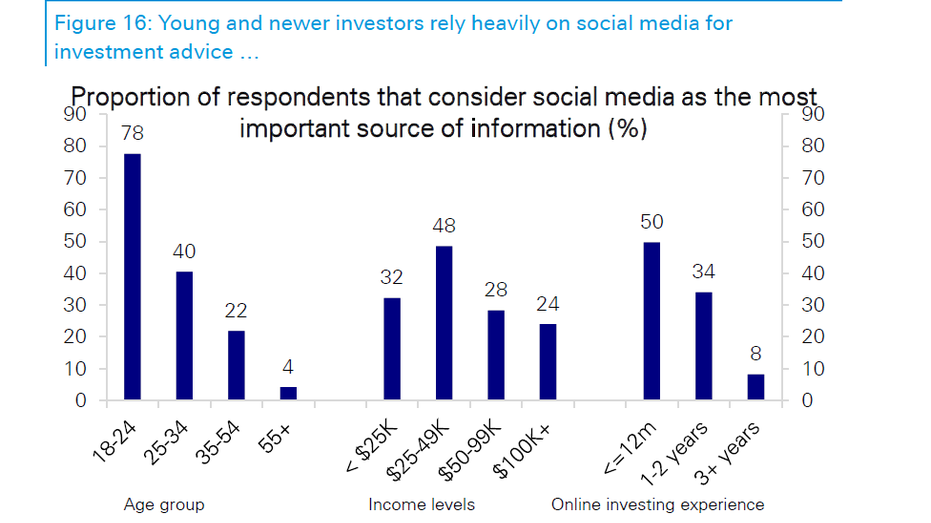

The interest in these names is being fueled in part by social media platforms, such as Reddit’s WallStreetBets, where ideas are exchanged, debated and likely followed by actionable trades.

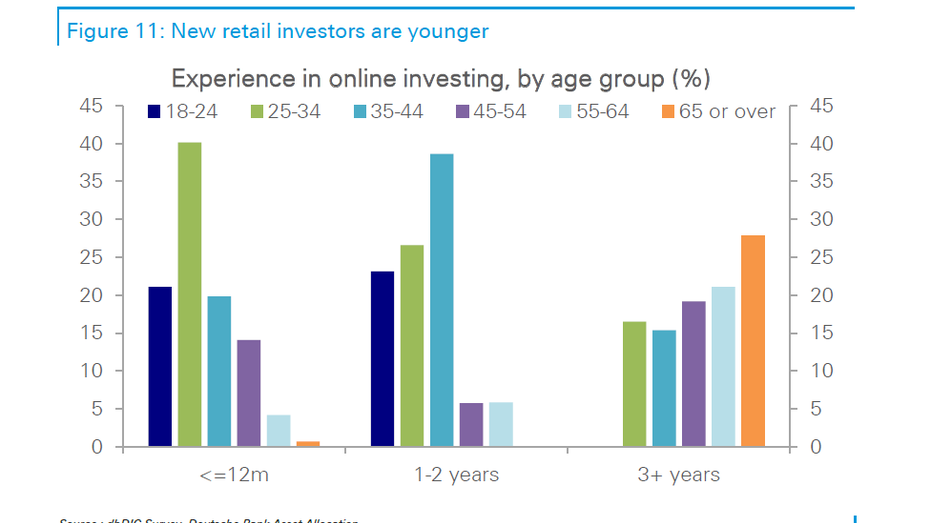

Deutsche Bank also found that the bulk of these new retail traders are under the age of 34, with about 61% between the ages of 18 and 24. They value social media as the most important source of information.

Earlier this year, the power of these groups forced popular trading app Robinhood to abruptly restrict trading in the heavily shorted stocks, fueling a near market meltdown on Jan. 27. The action propelled total composite trading volume on the New York Stock Exchange, Nasdaq, NYSE American and NYSE Arca to the highest levels since May 2019.

CHARLES SCHWAB CEO: WE DIDN'T RESTRICT STOCKS LIKE OTHERS

Online brokers including TD Ameritrade, owned by Charles Schwab, E*Trade, owned by Morgan Stanley as well as InterActive Brokers are all seeing a surge in daily average trades.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| SCHW | THE CHARLES SCHWAB CORP. | 93.87 | -1.51 | -1.58% |

| MS | MORGAN STANLEY | 174.36 | -2.23 | -1.26% |

| IBKR | INTERACTIVE BROKERS GROUP INC. | 73.99 | -0.91 | -1.21% |

The S&P 500, up 73% since the March 23, 2020, pandemic-produced low, has in part been supported by the growing army of retail traders.

“We view surging exposure by new retail investors in the US as having been a key driver of the speed, duration and composition of the equity market rally since the March bottom,” the Deutsche Bank team said.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

This pattern may bode well for future gains, which may see a tailwind from over $4.2 trillion in cash sitting on the sidelines, as tracked by Refinitiv Lipper. Chris Robinson of TJM Institutional Services tells FOX Business that cash, combined with this latest round of stimulus and perhaps more relief packages down the road, could keep stocks humming along.