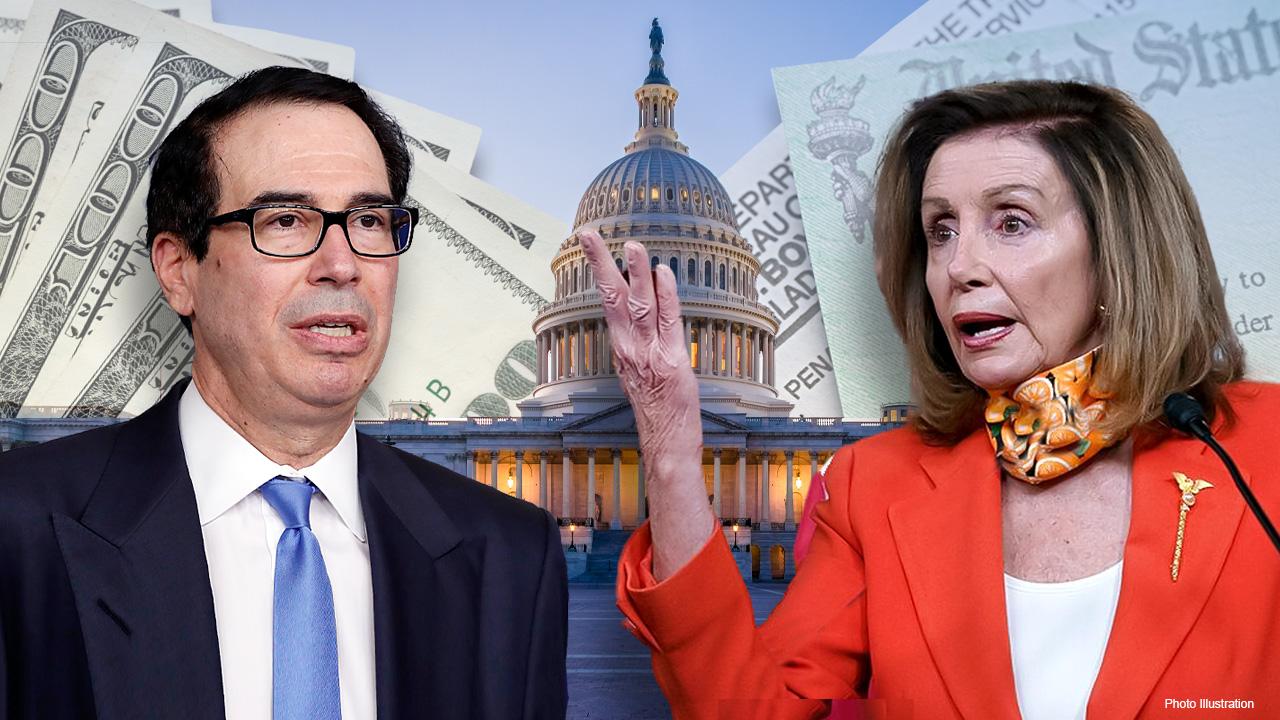

Stocks rally on Mnuchin-Pelosi stimulus hopes and record home sales

September finished as a losing month for U.S. stocks.

Stocks rose on Wednesday but came off the best levels of the session after Treasury Secretary Steven Mnuchin and House Speaker Nancy Pelosi failed to reach a stimulus deal but will keep talking.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 50115.67 | +1,206.95 | +2.47% |

| SP500 | S&P 500 | 6932.3 | +133.90 | +1.97% |

| I:COMP | NASDAQ COMPOSITE INDEX | 23031.213218 | +490.63 | +2.18% |

The Dow Jones Industrial Average, which reclaimed the 28,000 level before pulling back, gave up a 560 point advance to close up 328 points or 1.2%. While the Nasdaq Composite rose 0.72% and the S&P 500 0.82%.

Jobs, Housing Offset

Outside of politics, the economic data was solid with pending home sales rising a record 8.8% in August.

On the employment front, the ADP Employment Change showed 749,000 jobs were added in September, stronger than expected, as the economy continues to recover from the ongoing coronavirus pandemic.

This helped offset GDP for the second quarter which dropped 31.4%, in-line with an expected decline of 31.7% tied to COVID-19.

These economic reports helped temper investor concerns after the nasty presidential debate between President Donald Trump and Democratic nominee Joe Biden. Biden and Trump clashed on everything from the coronavirus pandemic to the economy to racial injustice.

On the corporate front, a big day for initial public offerings with two highly-anticipated debuts by software maker Asana and big data analytics provider, Palantir.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| PLTR | PALANTIR TECHNOLOGIES INC. | 135.90 | +5.89 | +4.53% |

| ASAN | ASANA INC. | 8.76 | +0.30 | +3.55% |

Both companies went public in direct listings, eschewing the traditional initial public offering process. Shares of Asana, which makes software that allows employees of companies to organize, track and manage their work, opened at $27 per share while Palantir opened for trading at $10, up 38% from its initial $7.25 reference price.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| DIS | THE WALT DISNEY CO. | 108.69 | +3.71 | +3.53% |

In other news, The Walt Disney Company announced it would be laying off 28,000 employees, as its parks business in the U.S. has struggled, despite reopening in California and Florida.

DISNEYS HAWAII RESORT TO START PHASED REOPENING IN NOVEMBER

Disney's Chairman of Parks, Experiences and Products, Josh D'Amaro, announced the layoffs of "castmembers" Tuesday evening, citing "limited capacity due to physical distancing requirements" and the uncertainty of the duration of the pandemic. As such, D'Amaro said the company has made "the very difficult decision to begin the process of reducing our workforce."

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GM | GENERAL MOTORS CO. | 84.24 | +0.94 | +1.13% |

| NKLA | NO DATA AVAILABLE | - | - | - |

General Motors may decide to extend talks with Nikola Corporation on its $2 billion deal, CNBC reported.

The deal, which had been expected to close on Wednesday, is under scrutiny after short-seller Hindenburg Research said Nikola made false claims about its technology for its electric trucks. The company's former chairman, Trevor Milton, also recently resigned, amid allegations of sexual harassment.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| CZR | CAESARS ENTERTAINMENT INC. | 20.52 | +0.21 | +1.03% |

| PENN | PENN ENTERTAINMENT INC. | 13.41 | +1.02 | +8.23% |

| DKNG | DRAFTKINGS INC. | 26.62 | +1.10 | +4.31% |

Caesars Entertainment announced it would buy British-gambling company William Hill for 272 pence per share, valuing William Hill at $3.73 billion, or 2.9 billion British pounds. The deal puts other gaming stocks in focus.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AAPL | APPLE INC. | 278.12 | +2.21 | +0.80% |

Apple Inc. awarded CEO Tim Cook his first major stock grant since 2011, giving Cook an additional 333,987 restricted stock units that will vest in thirds on an annual basis starting in 2023, according to an SEC filing Tuesday.

APPLE BECOMES FIRST U.S. COMPANY WORTH $2 TRILLION

“Tim has brought unparalleled innovation and focus to his role as CEO and demonstrated what it means to lead with values and integrity," Apple's Board of Directors told FOX Business in a statement late Tuesday. "For the first time in nearly a decade, we are awarding Tim a new stock grant that will vest over time in recognition of his outstanding leadership and with great optimism for Apple’s future as he carries these efforts forward.”

Crude oil inventories also showed a healthy draw down signaling demand is picking up. West Texas Intermediate crude rose 93 cents to $40.22 per barrel.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| USO | UNITED STATES OIL FUND - USD ACC | 76.98 | +0.28 | +0.37% |

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The yield on the 10-Year Treasury rose to 0.677%.

CLICK HERE TO READ MORE ON FOX BUSINESS

Fox News' Marisa Schultz and FOX Business Lucas Manfredi contributed to this story.