Stocks gain as Trump and Pelosi tussle over stimulus progress

IBM leads Dow after deal making

Stocks closed higher, despite House Speaker Nancy Pelosi tempering the status of ongoing stimulus talks.

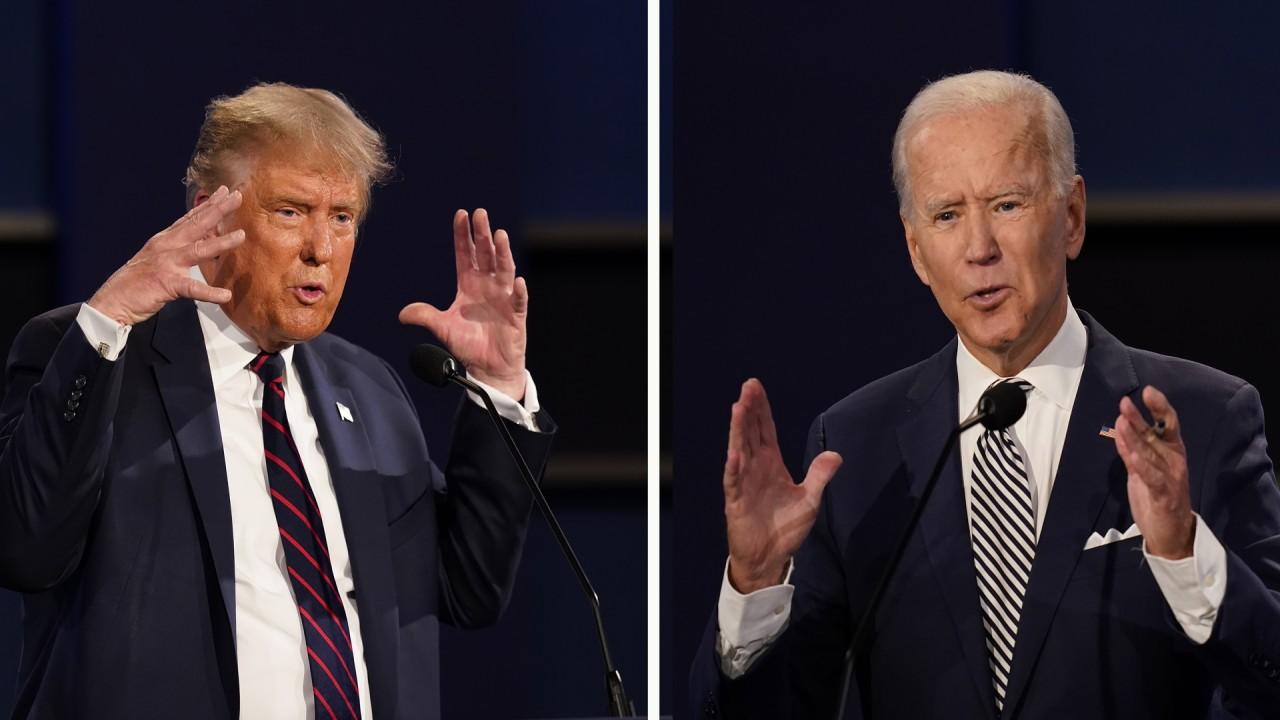

"There is no standalone bill without the bigger bill" she stated during her weekly press conference, taking the wind out of equities, briefly, before rebounding. This countered what President Trump told FOX Business' Maria Bartiromo a few hours earlier when he noted the stimulus conversations were "productive talks."

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:COMP | NASDAQ COMPOSITE INDEX | 23101.82661 | +70.61 | +0.31% |

| SP500 | S&P 500 | 6935.42 | +3.12 | +0.05% |

The S&P 500 and the Nasdaq Composite rose 0.8% and 0.5%, respectively while the Dow Jones Industrials rose over 122 points or 0.4% the second consecutive gain back-to-back gain.

Treasury Secretary Mnuchin and Pelosi spoke again late in the afternoon on whether there are real prospects of a "comprehensive bill" according to her spokesperson.

IBM popped after it announced plans for a spinoff of its managed infrastructure services unit into a newly public traded company, as the tech services giant continues to focus on its hybrid cloud business.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 49878.1 | -237.57 | -0.47% |

| IBM | INTERNATIONAL BUSINESS MACHINES CORP. | 298.93 | +9.04 | +3.12% |

In other deal news, struggling GameStop is partnering with Microsoft, in both a cloud and hardware deal, to capture both segments of customers as more gamers move online.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GME | GAMESTOP CORP. | 24.98 | +0.29 | +1.17% |

| MSFT | MICROSOFT CORP. | 401.14 | +7.47 | +1.90% |

Airline stocks rose, despite Pelosi's comments that indicated the sector won't receive a stand-alone package.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| DAL | DELTA AIR LINES INC. | 75.35 | +5.57 | +7.98% |

| UAL | UNITED AIRLINES HOLDINGS INC. | 115.91 | +9.82 | +9.26% |

| AAL | AMERICAN AIRLINES GROUP INC. | 15.24 | +1.08 | +7.63% |

INITIAL CLAIMS IN SPOTLIGHT

Initial jobless claims were slightly more than expected, coming in at 840,000 compared to an estimate of 825,000 for the week ending Oct. 3.

Though 11 million people have been added to U.S. payrolls since the U.S. shut down in March as a result of the coronavirus pandemic, there are still more than 20 million Americans unemployed.

According to data compiled by FOX Business, the number of claims over the 29 weeks since the lockdown started totals 63.6 million, or nearly 40% of the U.S. workforce.

In other political news, the debate between Vice President Mike Pence and Sen. Kamala Harris took place Wednesday night without a hitch and increased optimism surrounding additional fiscal stimulus. It did however raise more questions about the Biden-Harris plan on fracking.

EARNINGS COME TO FOCUS

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| DPZ | DOMINO'S PIZZA INC. | 394.88 | +1.45 | +0.37% |

| CCL | CARNIVAL CORP. | 33.99 | +2.54 | +8.08% |

Earnings season is starting to kick into gear, as Domino's Pizza Inc. and Carnival Corp. report results before the open, giving investors additional insight into the health of the consumer.

Domino's is expected to earn $2.78 per share on revenue of $952.97 million, up significantly from the year-ago quarter, when it earned $2.05 a share and generated $820.81 million in sales.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| MCD | MCDONALD'S CORP. | 327.16 | +3.68 | +1.14% |

Domino's competitor McDonald's Corp. shares were active after the fast-food giant said U.S. same-store sales rose 4.6% in the third quarter.

Carnival, which has been impacted severely by the pandemic, is expected to lose $2.22 a share.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| SQ | NO DATA AVAILABLE | - | - | - |

Square Inc. gained 1.5% after the financial technology company said it would invest $50 million in Bitcoin, noting the cryptocurrency "aligns with the company's purpose."

CLICK HERE TO READ MORE ON FOX BUSINESS

West Texas Intermediate crude rose over 1% to $41.19 per barrel level. On Wednesday, the U.S. Energy Information Administration said weekly crude inventories rose 0.5 million barrels, higher than the 0.3 million traders were expecting.

Gold gained ground on Thursday, rising to $1,888.60 an ounce.