The stock market in Biden’s first year

Biden's returns lag behind both Donald Trump and Barack Obama in their first years

Bulls and bears question if now is the time to buy stocks

Seaport Securities founder Teddy Weisberg and The Price Futures Group energy analyst Phil Flynn discuss value in a 'choppy' market on 'The Claman Countdown.'

The U.S. stock market is getting whipsawed as President Biden's second year in office gets underway.

The Nasdaq composite slipped into correction territory midweek, down 10% from its peak, as the Dow Jones Industrial Average and S&P 500 continued to retreat from record levels through Thursday.

THE ECONOMY DURING BIDEN'S FIRST YEAR

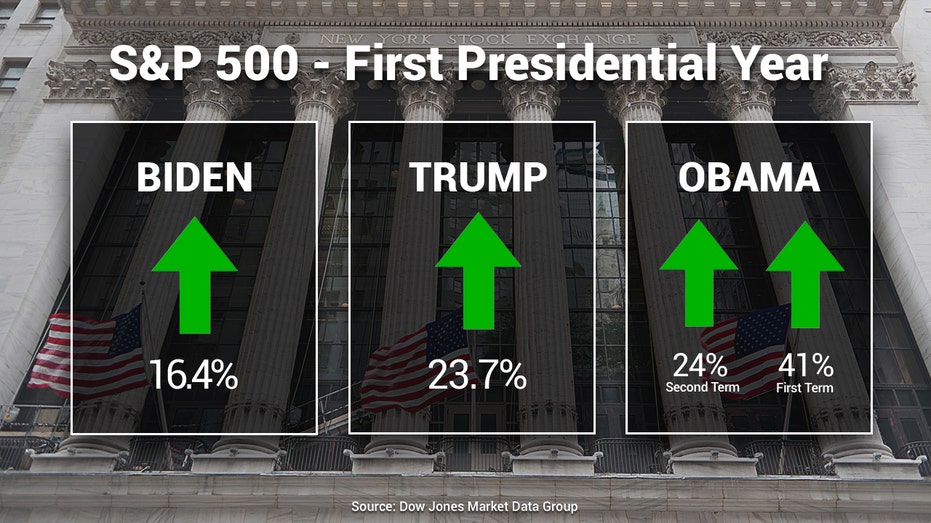

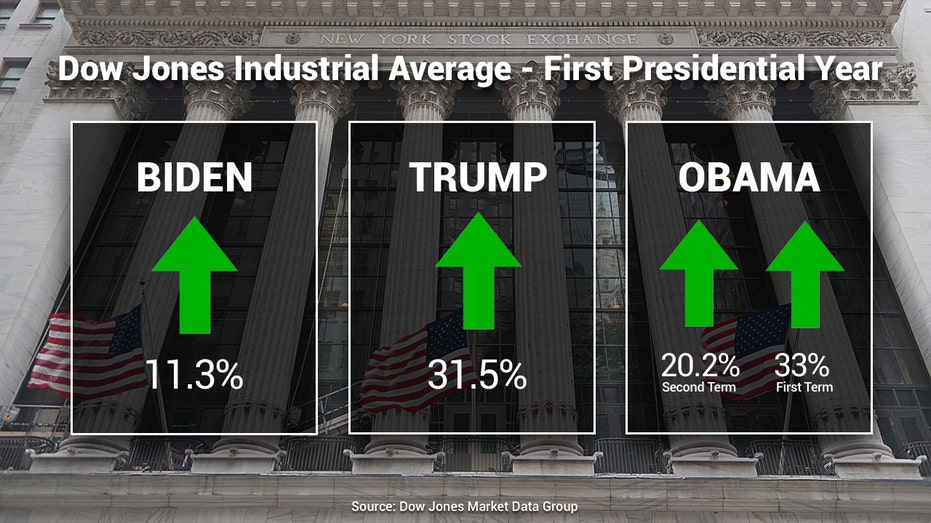

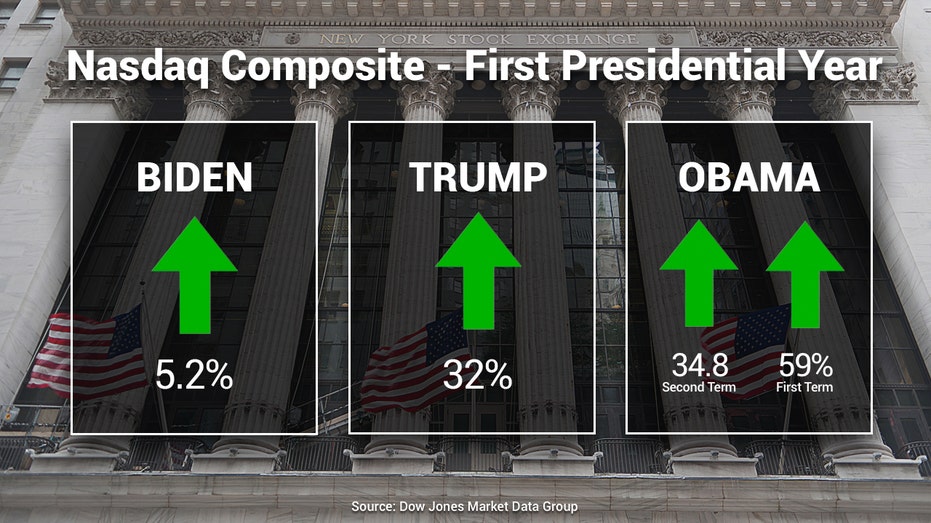

As for the performance of equities in Biden’s first year in office, all three of the major benchmarks rose. However, his returns lag both Donald Trump and Barack Obama in their first years, as detailed and tracked by Dow Jones Market Data Group.

Biden is facing headwinds amid record-high inflation, an uneven economic recovery from the COVID-19 pandemic and a Federal Reserve ready to hike interest rates.

The S&P 500, the broadest measure of the stock market, has gained 16% under Biden, several points behind Trump and Obama’s roughly 24%. After the first year under a Democratic president, the index is up 77% of the time, rising 8.5% on average.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| SP500 | S&P 500 | 6932.3 | +133.90 | +1.97% |

WHERE ARE SURGING CONSUMER PRICES HITTING AMERICANS THE HARDEST?

The Dow 30 has advanced 11%, trailing Trump’s 31.5% gain and Obama’s 20%. Following the first year under a Democratic president, the index is up 73% of the time, averaging an 8.2% gain.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 50115.67 | +1,206.95 | +2.47% |

And the tech-heavy Nasdaq composite, which fell into correction territory on Wednesday, has gained nearly 5%, while both Trump and Obama saw advances north of 30%.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:COMP | NASDAQ COMPOSITE INDEX | 23031.213218 | +490.63 | +2.18% |

After the first year under a Democratic president, the index is up 100% of the time, returning an average of 11.2%.

CLICK HERE TO READ MORE ON FOX BUSINESS

The Federal Reserve also played a role in Biden's first year as policymakers laid the groundwork for the first-rate hike since March of 2020 with at least three planned for 2022.

JPMORGAN CEO DIMON SEES 6 OR 7 RATE HIKES IN 2022

However, headwinds emerged as economists and business leaders say more may be needed.

Goldman Sachs is forecasting 4 while JPMorgan CEO Jamie Dimon said as many as 7 could be in the cards.