Stocks saying Bernie Sanders doesn't stand a chance in 2020

One legendary investor says stocks would plunge 40% if Bernie Sanders wins the White House

Investors are showing no signs of concern that Sen. Bernie Sanders will end up in the White House in January.

Sanders, I-Vt., who has all but secured a top-two finish in the Iowa caucuses, has rocketed to the top of the field of Democratic presidential candidates in recent polls. The online platform PredictIt now gives him a 48 percent chance of winning the party's nomination, up from 25 percent at the end of last year.

At the same time, the stock market has shrugged off President Trump’s impeachment trial and the coronavirus outbreak, gaining about 3 percent this year.

“The lack of any stock market reaction to Sanders' surge suggests that investors either still don't believe he can win the Democratic nomination against the more centrist candidates or, alternatively, that Sanders will win the nomination but, in doing so, his lack of appeal to independents makes it even more likely that Trump will be re-elected," wrote Andrew Hunter, senior U.S. economist at London-based Capital Economics.

VARNEY: BILLIONAIRE BLOOMBERG IS THE DEMOCRATS' NEW 'MODERATE' HOPE

The possibility of a Sanders presidency has prompted a number of high-profile investors to warn of economic harm and stock-market fallout from his policies.

Sanders, the self-declared democratic-socialist, has promised to wipe out more than $1 trillion of U.S. student debt, in addition to taking on massive spending projects such as the Green New Deal and Medicare-for-all.

His health care plan alone would cost from $32 trillion to $36 trillion and his proposal to pay for the program would increase taxes by $14.3 trillion over the next decade, hitting Americans at every income level, according to the conservative U.S. advocacy group Americans for Tax Reform.

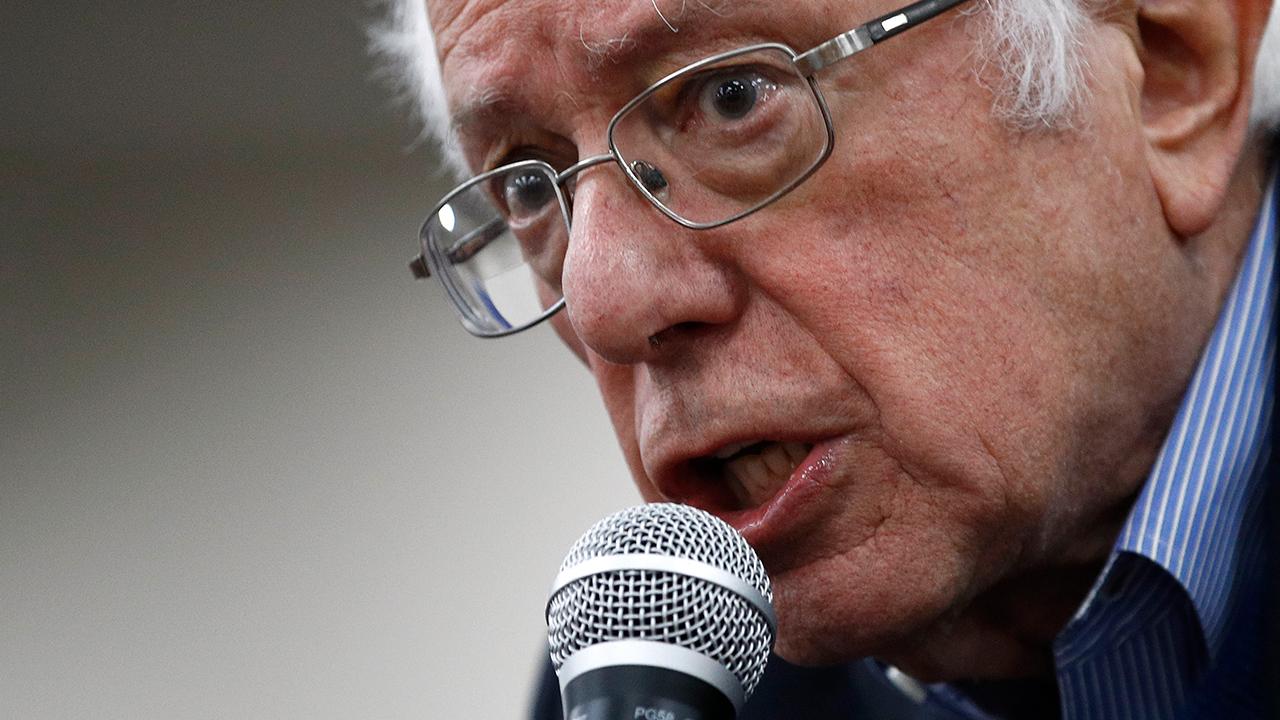

Sanders leaves the Senate chamber in January. (AP Photo/J. Scott Applewhite)

"What a Sanders win means is much bigger government deficits, and much more money-printing by the Fed because there is no way to finance all of the spending that will happen with tax hikes on the rich," Peter Schiff, CEO of Westport, Connecticut-based Euro Pacific Capital, told FOX Business last month. "We'll get tax hikes on the rich, but they’re not going to provide the revenue to pay for the programs."

As for financial markets, many on Wall Street worry that a Sanders victory could cause a sharp drop in equity prices amid investor concern over the “potential for higher taxes, more stringent regulatory requirements, and anti-trust probes and restrictions on drug prices,“ according to Mark Haefele, chief investment officer at UBS Global Wealth Management.

Legendary hedge fund managers Stanley Druckenmiller and Paul Tudor Jones said a Sanders victory in November could cause the stock market to plunge, predicting 40 percent and 20 percent drops, respectively.

Managed health care might be hit particularly hard. Vocal support for Medicare-for-all from Sanders and Democratic rival Sen. Elizabeth Warren of Massachusetts “put immense downward pressure" on managed-care companies during two separate periods last year, according to Lachlan Towart, analyst at UBS Global Wealth Management.

However, the iShares U.S. Healthcare Providers ETF is up 1.5 percent in 2020, suggesting investors aren’t too concerned about a Sanders victory – yet, anyway.

CLICK HERE TO READ MORE ON FOX BUSINESS

"We suspect that if Sanders continues to do well in the Super Tuesday primaries in a month's time, then there might be a more discernible hit to market sentiment," Hunter said.