Stocks can still deliver in December

'Sticking with our optimistic outlook,' investor says

Stock investors wrestling with a bad case of December déjà vu after this week’s early selloff need not worry just yet: History is on the side of the bulls.

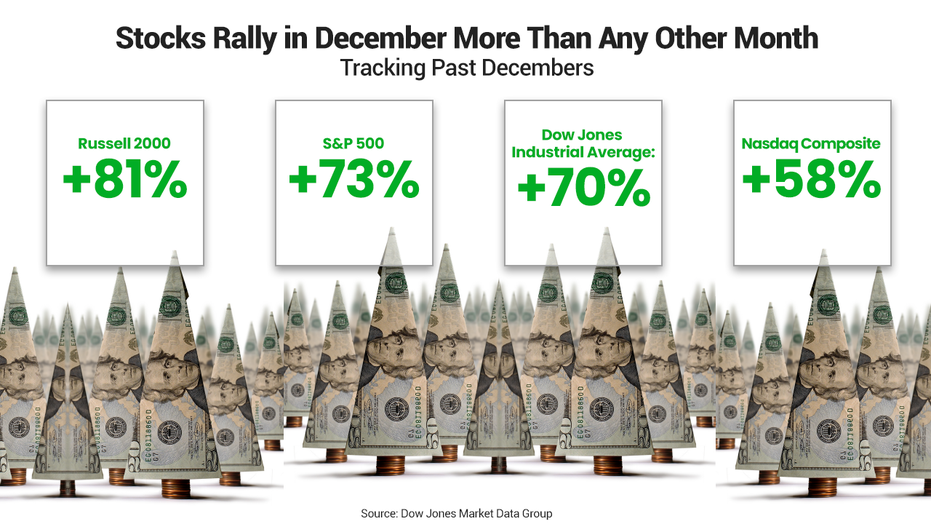

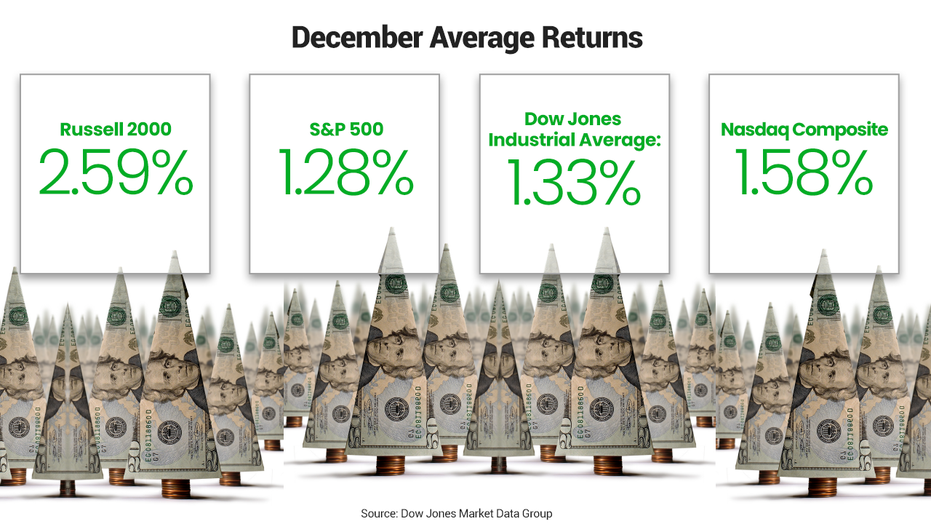

The Dow Jones Industrial Average, S&P 500, Nasdaq Composite and Russell 2000, which tracks domestic companies, have ended higher more often in the last month of the year than any other, according to the Dow Jones Market Data Group.

Despite continuous mixed signals on trade and ongoing weakness in the manufacturing sector, Federated Investors Global Equities Chief Investment Officer Steve Auth is staying invested. "We're sticking with our optimistic outlook on equities," he said during an interview on FOX Business' 'The Claman Countdown.'

Average returns, while modest, range from 1 percent to 3 percent, and would top off what has been a year of records for U.S. stocks.

All three of the major U.S. averages are up double digits this year and are sitting at all-time highs.

The volatility that kicked off the month and shaved nearly 550 points from the Dow was driven by headlines on U.S-China trade talks that signaled a one-step-forward, one-step-back scenario, with President Trump spooking markets on Tuesday when he said a deal could wait until after the 2020 election.

As for the United States-Mexico-Canada trade agreement, it's waiting for action from House Democrats who have pushed for changes since regaining control of the chamber in November 2018 elections.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Despite the rosy historical trends, last December produced the worst returns since 1931 for U.S. stocks, partly due to concerns the U.S. economy was slowing.

Still, the markets drove higher in 2019, fueled by record-low unemployment and a U.S. economy that posted third-quarter GDP growth of 2.1 percent, ahead of expectations.

As for 2020, the team at Bank of America predicts “the bull market in U.S. equities will celebrate its 11th anniversary,” with the S&P 500 tacking on a 5 percent jump to 3,250 early in the year. The firm released its annual outlook on Tuesday.