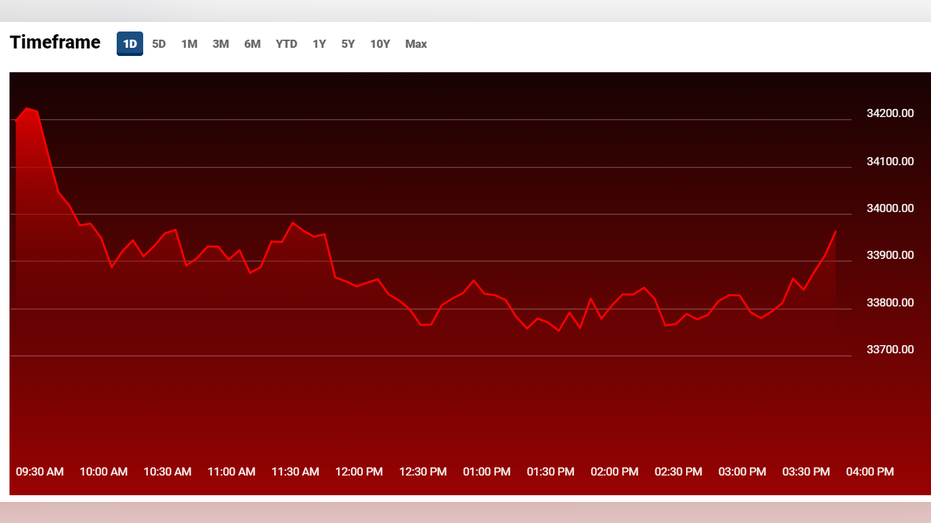

Dow posts biggest single-day drop this year as COVID-19 worries resurface

Oil tumbles as OPEC, allies reach deal to raise production

Stocks move higher to end the week

FOX Business’ Stuart Varney and Lauren Simonetti break down Friday’s market open, Big Tech and travel stocks.

U.S. stock markets suffered among their steepest single-day declines of the year on Monday as the recent rise in COVID-19 infections stoked fears of an economic slowdown.

New COVID-19 infections jumped 70% last week to about 30,000 a day as the Delta variant continued to spread. Deaths rose to an average of 250 a day, mostly in unvaccinated people.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 50135.87 | +20.20 | +0.04% |

| SP500 | S&P 500 | 6964.82 | +32.52 | +0.47% |

| I:COMP | NASDAQ COMPOSITE INDEX | 23238.66991 | +207.46 | +0.90% |

The Dow Jones Industrial Average fell 724 points, or 2.09% the worst session of 2021. While the S&P 500 and the Nasdaq Composite declined 1.58% and 1.06%, respectively, the worst drop since May.

Selling in the equity markets caused investors to seek safety in the U.S. Treasury market with the yield on the 10-year note falling 10 basis points to 1.18%, the lowest since March of 2020 as tracked by Dow Jones Market Data Group.

In stocks, rate-sensitive banks, like JPMorgan Chase & Co. Bank of America Corp. and Citigroup Inc., were lower.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| JPM | JPMORGAN CHASE & CO. | 322.10 | -0.30 | -0.09% |

| BAC | BANK OF AMERICA CORP. | 56.41 | -0.12 | -0.21% |

| C | CITIGROUP INC. | 123.77 | +1.08 | +0.88% |

Stocks tied to the reopening of the global economy were under extra pressure including Delta Air Lines Inc., Carnival Corp. and Las Vegas Sands Corp., amid concerns a COVID-19 resurgence could cause virus-wary travelers to stay home. Restaurants also taking a hit.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| DAL | DELTA AIR LINES INC. | 75.00 | -0.35 | -0.46% |

| CCL | CARNIVAL CORP. | 32.81 | -1.18 | -3.47% |

| LVS | LAS VEGAS SANDS CORP. | 57.18 | -0.32 | -0.56% |

| SHAK | SHAKE SHACK | 97.19 | -1.07 | -1.09% |

Meanwhile, energy companies were in the crosshairs as West Texas Intermediate crude oil tumbled $5.39 to $66.42 a barrel, the lowest since May 28, after OPEC and its allies agreed to raise production by an additional 2 million barrels per day beginning in August.

In deals, Zoom Video Communications Inc. agreed to buy cloud-based call center operator Five9 Inc. for $14.7 billion in stock. The deal, which was done at a 13% premium to Five9’s closing price on Friday, will pay Five9 shareholders 0.5533 Zoom shares for each Five9 share they own.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| ZM | ZOOM COMMUNICATIONS INC. | 95.39 | +3.19 | +3.46% |

| FIVN | FIVE9 INC. | 17.04 | -0.04 | -0.23% |

Elsewhere, Johnson & Johnson is considering a plan that would put its Baby Powder and other talc-related operations into a new business that would then file for bankruptcy, Reuters reports, citing seven people familiar with the matter. Such a move could result in lower payouts for lawsuits not settled before a bankruptcy filing.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| JNJ | JOHNSON & JOHNSON | 238.64 | -1.35 | -0.56% |

Overseas markets were sharply lower.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

European bourses were sharply lower with Germany’s DAX 30 slipping 2.62, France's CAC 40 losing 2.54% and Britain’s FTSE 100 falling 2.34%.

In Asia, Hong Kong’s Hang Seng index slid 1.84%, Japan’s Nikkei 225 tumbled 1.25% and China’s Shanghai Composite was little changed.