Stocks fall, bond yields rise as investors get taste of 2022

The 10-Year Treasury yield flirted with 1.8% this week

Biden continues to blame inflation on businesses

Former treasury secretary Steven Mnuchin joins ‘Kudlow’ to discuss the current state of economy under the Biden administration.

Investors got a taste of what higher interest rates may mean for financial markets, including stocks, sectors and bonds.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| SP500 | S&P 500 | 6861.89 | -19.42 | -0.28% |

The S&P fell 1.8% this week, the worst start to a calendar year since 2016, as tracked by Dow Jones Market Data Group.

The 10-Year Treasury yield settled at 1.76%, a 12-month high, as the Federal Reserve disclosed that policymakers may accelerate the pace of interest rate hikes due to hot inflation.

Steven Mnuchin, former treasury secretary under President Trump, gave his forecast for rates after the release of the Fed’s meeting minutes from the December meeting Wednesday.

WHERE INFLATION IS HITTING AMERICANS THE HARDEST

"Clearly, the Fed is gonna raise rates, the Fed is going to normalize the portfolio. It’s just how quick or how fast they do it. Eighteen months from now we will be sitting with 3% 10-year treasuries," Mnuchin told FOX Business’ Larry Kudlow, who served as Trump’s top economic advisor.

U.S. EMPLOYERS ADD 199,000 JOBS, UNEMPLOYMENT DIPS TO 3.9%

The December jobs report, while mixed, is likely strong enough to keep the Fed on its mission, economists said. Employers added 199,000 positions, below the 400,000 expected. Still, unemployment fell to 3.9%, and average hourly earnings rose 4.7% over a 12-month period.

CLICK HERE TO READ MORE ON FOX BUSINESS

Higher yields historically benefit banks that can earn more as a result. So investors snapped up financial stocks driving the SPDR Financial exchange-traded fund to a record on Friday.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| XLF | FINANCIAL SELECT SECTOR SPDR ETF | 52.14 | -0.44 | -0.84% |

| BAC | BANK OF AMERICA CORP. | 52.77 | -0.59 | -1.12% |

| WFC | WELLS FARGO & CO. | 87.58 | -0.97 | -1.10% |

| JPM | JPMORGAN CHASE & CO. | 308.03 | -0.76 | -0.25% |

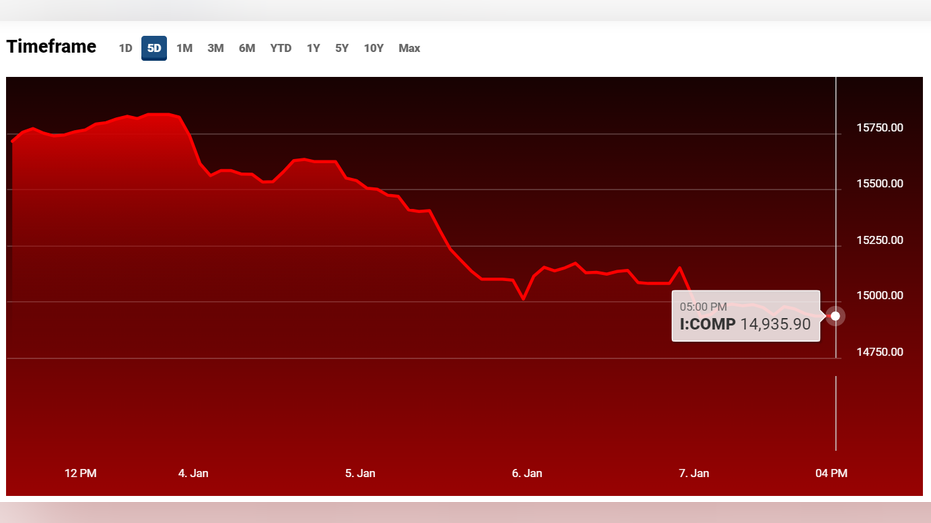

Higher growth names, including the tech-heavy Nasdaq Composite, tanked 4.5% this week.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:COMP | NASDAQ COMPOSITE INDEX | 22682.729157 | -70.91 | -0.31% |

Tech behemoths, including Microsoft, fell over 6% for the week, while Apple and Tesla slipped around 3%.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| MSFT | MICROSOFT CORP. | 398.46 | -0.23 | -0.06% |

| AAPL | APPLE INC. | 260.58 | -3.77 | -1.43% |

| TSLA | TESLA INC. | 411.71 | +0.39 | +0.09% |

Fresh inflation data will come next week with the release of the Consumer Price Index on Wednesday followed by Producer Prices the following day.

On Tuesday, Federal Reserve Chair Jerome Powell will be on Capitol Hill for his renomination hearing.

He will likely be grilled by lawmakers on the central bank’s wrong-way inflation call and the uber tight job market after a record 4.5 million people quit their jobs in November in what continues to be dubbed the ‘Great Resignation’ in the American workforce.