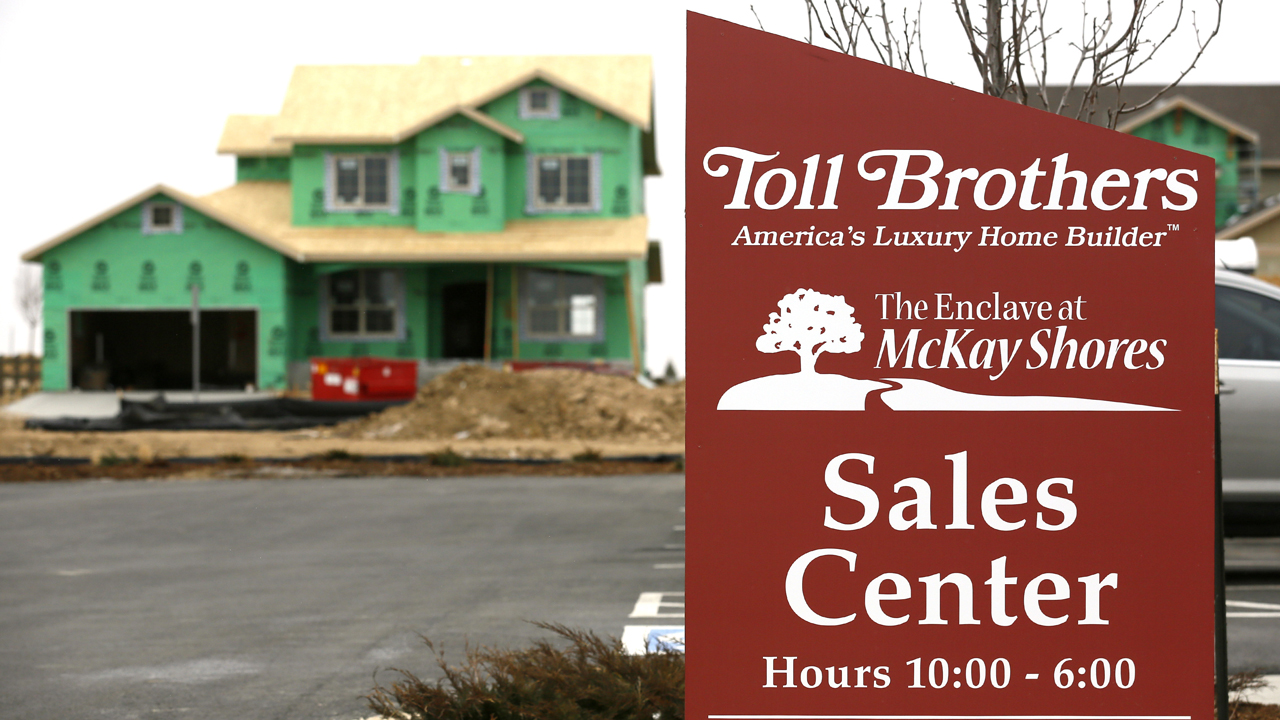

Toll Brothers sees 20% growth in 2022 amid strong demand

The company said it expects to deliver between 11,250 and 12,000 units in the full year

Toll Brothers says it is looking at revenue growth for fiscal 2022 of 20% as demand grows.

The luxury homebuilder on Tuesday reported quarterly adjusted earnings of $3.02 per share, topping the expectation for $2.49 per share.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Revenue for the quarter was up 18.2% to $2.95 billion from a year ago. That also beat estimates of for $2.88 billion.

CLICK HERE FOR FOX BUSINESS' REAL-TIME CRYPTOCURRENCY PRICING DATA

"We are very pleased with our fourth-quarter results, which cap an extraordinary year of record revenues, earnings, contracts and backlog value for Toll Brothers," said Douglas Yearley, chairman and chief executive officer. "In the fourth quarter, we grew home sales revenues by 18%, achieved an adjusted gross margin of 25.9%, and nearly doubled our pre-tax income and earnings per share from one year ago."

FANNIE MAE SAYS MORTGAGE RATES TO END 2022 AT 3.3%

The company said it expects to deliver between 11,250 and 12,000 units in the full year at an average delivered price of between $875,000 and $895,000.

In fiscal 2021, the company said it delivered 9,986 homes, bringing home sales revenues to $8.43 billion.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| TOL | TOLL BROTHERS INC. | 153.23 | +2.67 | +1.77% |

"Demand remains very strong. The housing market continues to benefit from solid fundamentals, including favorable demographics, pent-up demand from over a decade of underproduction of new homes, low mortgage rates, a tight resale market, and permanent changes to the way Americans view life, work and home," added Yearley. "We believe these trends will continue to drive strong demand for our first-time, move-up and active adult communities well into the future."

CLICK HERE TO READ MORE ON FOX BUSINESS

Toll Brothers shares have gained 63% so far this year.