Twitter adopts 'poison pill' to prevent Elon Musk takeover

The limited duration shareholder rights plan will expire on April 14, 2023

Elon Musk is the ‘ultimate wild card’: Mike Gunzelman

Fox News Headlines 24/7 sports reporter Mike ‘Gunz’ Gunzelman argues that Elon Musk is ‘unpredictable’ after the Tesla CEO announced he has a backup plan to buy Twitter.

Twitter's board of directors has unanimously adopted a limited duration shareholder rights plan following Tesla CEO Elon Musk's $54.20 per share offer to take the social media giant private.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| TWTR | NO DATA AVAILABLE | - | - | - |

Shares closed marginally lower on Thursday ahead of the observance of Good Friday.

TWITTER FACES ‘FULL BLOWN ELON CIRUCS’: ANALYST

Under the plan, which is also referred to as a "poison pill", shareholders' rights will become exercisable if an entity, person or group acquires beneficial ownership of 15% or more of Twitter's outstanding common stock in a transaction not approved by the board.

In the event that the rights become exercisable, existing Twitter shareholders — except for the person, entity or group triggering the plan — would be entitled to purchase additional shares of common stock at a discount.

Elon Musk's Tweet displayed on a screen and Twitter logo. (Jakub Porzycki/NurPhoto via Getty Images / Getty Images)

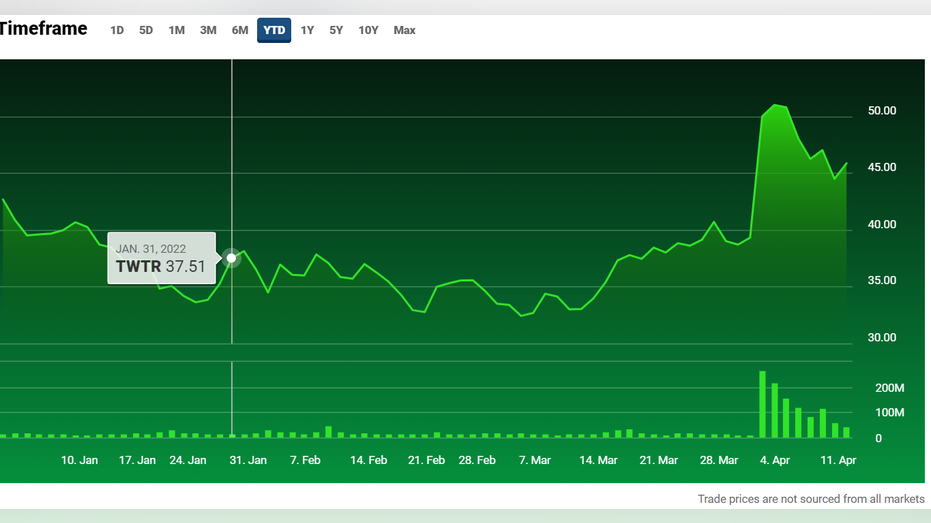

Twitter Shares YTD

The board says the plan "is intended to enable all shareholders to realize the full value of their investment in Twitter" and will "reduce the likelihood that any entity, person or group gains control of Twitter through open market accumulation without paying all shareholders an appropriate control premium or without providing the Board sufficient time to make informed judgments and take actions that are in the best interests of shareholders."

"The Rights Plan is intended to enable all shareholders to realize the full value of their investment in Twitter. The Rights Plan will reduce the likelihood that any entity, person or group gains control of Twitter through open market accumulation without paying all shareholders an appropriate control premium or without providing the Board sufficient time to make informed judgments and take actions that are in the best interests of shareholders."

The plan, which will expire on April 14, 2023, does not prevent Twitter's board from engaging with parties or accepting an acquisition proposal if they believe it is in the best interest of the company and its shareholders.

CLICK HERE TO READ MORE ON FOX BUSINESS

Musk's $43 billion bid comes less than two weeks after he disclosed a 9.2% stake in Twitter on April 4. Though Musk was initially invited to join Twitter's board, he later declined the offer. As part of joining the board, Musk would've been unable to own more than 14.9% of Twitter's stock while serving on the board or for 90 days after. Musk's board term would have expired at Twitter’s 2024 annual meeting.

Host Chris Anderson and Elon Musk speak at SESSION 11 at TED2022: A New Era. April 10-14, 2022, Vancouver, BC, Canada. Photo: Gilberto Tadday / TED (Photo: Gilberto Tadday / TED)

Though Elon Musk has said that the offer is his "best and final" one, he revealed at TED2022 on Thursday that he is prepared with a plan B. When asked for specific details, he declined to elaborate.