Underlying Labor-Market Fundamentals Strong Despite Soft September Job Growth

The labor market continued chugging along in September.

The U.S. economy added 156,000 net new jobs last month, fewer than Wall Street expectations for a gain of 175,000, according to data released Friday morning by the Labor Department. The labor force participation rate ticked up to 62.9% from 62.8%, as the jobless rate also climbed to 5% in September from 4.9% in August. Both of those measures were expected to remain steady.

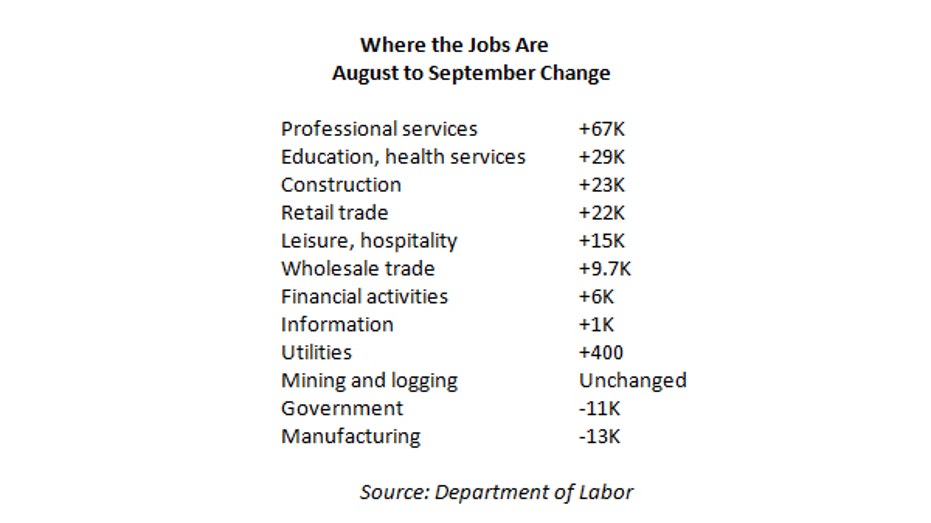

The biggest job gains came from professional and business services, health care, food services and retail, while mining employment was unchanged and factory jobs shed a more-than-expected 13,000 jobs. While job gains were slightly weaker than expected, the figures provided a generally good outlook for the economy, according to Ameriprise Senior Economist Russell Price.

“It gives further indication the economy is doing fairly well and that consumers are likely to see good financial prospects. That’s a positive trend heading into the important retail holiday season,” he explained.

Price said a possible explanation for a weaker-than-expected headline figure was a later-than-usual Labor Day holiday last month that he estimates trimmed between 15,000 and 20,000 new jobs from the overall employment gains. Because of that, he said there could be a bit of a rebound in the October payrolls report. He added that revisions in September, which accounted for the loss of about 7,000 jobs from the prior two months, were more of a “smoothing of the trends” than a significant adjustment to the data. July’s payroll gains were revised lower to 252,000 jobs from a previous reading of 275,000, while August figures were revised up to 167,000 from an initially-reported 151,000.

The September payrolls figures come on the heels of increasingly positive U.S. economic data including improving consumer confidence and better-than-estimated reports from the Institute for Supply Management on factory and services sector growth. The non-manufacturing sector of the economy surged last month while the employment index posted its biggest gain on record as it rose 6.5 points, coming in above its six- and 12-month averages. While the manufacturing index overall rose from August, the employment component remained in contraction territory.

“[In the September payrolls report,] the distribution of industries adding jobs was good. Manufacturing was down as expected and the government shed 11,000 jobs, which is a little bit concerning because you don’t expect much from government. But, state and local revenues have been declining recently, which could add to the pressure,” Price said.

As U.S. economic data have improved, the calls have grown louder for higher short-term interest rates. Job growth in the U.S. has averaged 178,000 net new jobs per month, above the range of 80,000 to 150,000 that officials at the Federal Reserve consider sufficient to tighten the labor market and prop up wages.

At the Federal Open Market Committee’s September policy meeting, three members dissented from the decision to keep rates on hold, citing economic improvements that warrant a move away from crisis-era monetary policy. However, Fed Chief Janet Yellen said she preferred taking a patient approach to rate hikes so as not to stand in the way of workers coming back into the labor force.

“A much stronger payroll reading or flat or declining participation rate would have increased rate-hike expectations and a much weaker report would have increased fears of consumer weakness as we approach the end of 2016,” said Dennis DeBusschere, senior managing director at Evercore ISI.

He added that in light of this report, a December rate hike remains on the table, while the path of interest-rate increases remains gradual.

Federal funds futures, a tool used to predict market expectations for changes in monetary policy, showed odds of a December rate hike rose to 65.9% following the September jobs report from 63.9% ahead of the data’s release.