US economy means a merry Christmas for many

The economy is giving back to consumers and investors

The U.S. economy could be wrapped and tied with a big bow this year.

This holiday season, for many, it means a job and potentially a bigger paycheck as wages start to inch higher. With more companies hiring workers to meet demand, investors are optimistic about the health of American corporations and the future earning power of these businesses.

That in turn, combined with pro-U.S. trade deals that have come together in the latter half of the year, are helping drive the U.S. stock market to record levels.

In a recent interview with FOX Business, White House economic adviser Larry Kudlow described the economy as “terrific.”

“We are in a middle-class boom," he said during an appearance on FOX Business’ “Bulls and Bears” last week. "Wage-earners, people on the production line are making faster wage increases than their managers. Average income nationwide is up $5,000 after-tax, in the prior two administrations it was flat”

Kudlow makes a point...

Jobs

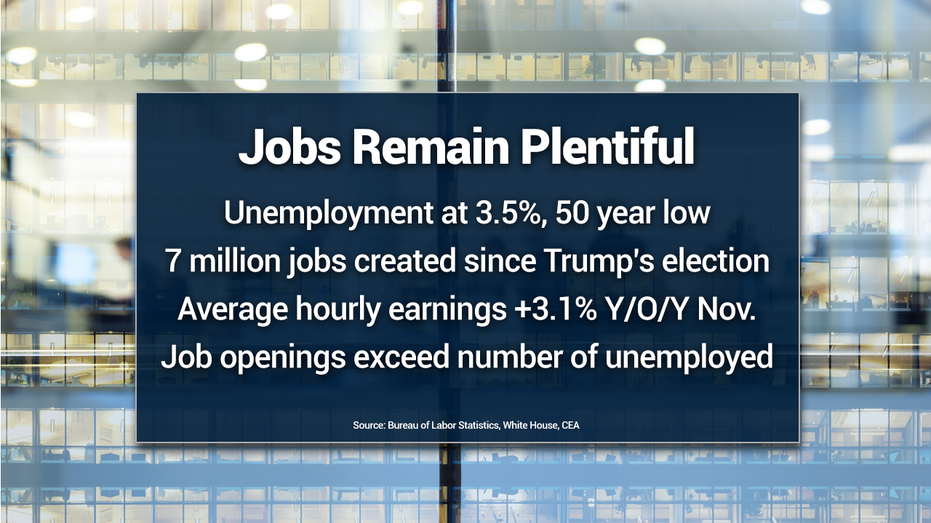

Since President Trump was elected, 7 million jobs have been created, helping drive the unemployment rate down to 3.5 percent, a 50-year low. There are more job openings than unemployed people, meaning each individual could theoretically be working.

Wages, which have been stagnant, are starting to perk up, albeit modestly, rising 3.1 percent year-over-year as of November, per the Bureau of Labor Statistics. Average hourly earnings are $28.29 with a week of take-home pay averaging $973.18 compared to $943.59 in November 2018.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The December read on the national job market, the final of the year, will come on Jan. 10, 2020.

Wealth Creation

Stocks celebrate a year of records.

The Dow Jones Industrial Average is +22 percent, the S&P 500 +29 percent and the Nasdaq Composite +35 percent for the year through Dec. 24 continuing to smash records in the shortened Christmas and forthcoming New Year’s week.

U.S. equities have been described by some as the best neighborhood across the globe to park your money, especially with the U.S. economy expected to see a tailwind in 2020.

By comparison the FTSE 100, a benchmark of U.K. blue chips, has gained a lesser 13 percent and China’s Heng Seng Index has risen just 8 percent.

STEVEN MNUCHIN EXPLAINS WHY NEARLY $1.5 TRILLION WORTH OF $100 BILLS REPORTEDLY DISAPPEARED

And next year is looking solid, according to the team at Goldman Sachs led by David Kostin, who cites “accelerating economic growth.” The team, in a note this week, forecasts that the S&P 500 will rise another 6 percent before taking a breather. “We believe the index will remain range-bound until the presidential election in November."

FIDELITY MUTUAL FUND GURU PETER LYNCH: MARKET WILL BE HIGHER IN 10 YEARS

A rising stock market has rewarded those 401 (k) investors staying the course. The number of customers with account balances of $1 million or more has hit a record, as tracked by Fidelity Investments through the third quarter.

Trade Bonanza

Trump and his team of trade advisers, including U.S. Trade Representative Robert Lighthizer, Treasury Secretary Steven Mnuchin, Commerce Secretary Wilbur Ross and adviser Peter Navarro, managed to secure three major trade deals in 2019.

The most notable: a phase one deal with China. When it appeared as if a deal was a long shot, the two sides came together. U.S farmers are expected to be early beneficiaries as China begins to receive U.S. agriculture exports.

The United States-Mexico-Canada Agreement (USMCA) toiled in Congress for months, but eventually the Democrats passed the legislation, which will now head to the Republican-controlled Senate before making its way to Trump’s desk. The deal, which helps improve U.S. trade economics with our partners to the North and South – Canada and Mexico – is expected to add at least 0.5 percent to the U.S. GDP, according to Mnuchin.

And the US-Japan agreement, sealed with little animosity, is expected to avoid costly tariffs on American-made cars.

BORIS JOHNSON'S UK WIN MAKES HIM CAPITALIST KING

Up next? The United Kingdom. Prime Minister Boris Johnson, who shares many of Trump’s pro-growth sensibilities, is expected to work closely with the United States on a tighter trade relationship after a successful Brexit planned for early 2020.

Housing Heating Up

The housing market, which has been plagued with a lack of affordable housing, especially in California, and slow movement on sales of existing homes in some other regions, is showing green shoots and could see a solid uptick in 2020.

The last read on builder confidence hit the highest level since 1999 and building permits, a sign of future growth, registered the best read since 2007 as of November, per the Commerce Department.

“I’ve been all over the country and builders are really, really gung ho," said Jerry Howard, National Association of Homebuilders CEO, during a recent interview on FOX Business’ "Varney and Company." "All this talk earlier in the year by the liberal media saying we are going to go into a recession, you can’t prove it by our industry, absolutely not.”

Howard noted the hot areas for housing, in his view, are the Southeast and Mountain West.

FED HOLDS INTEREST RATES STEADY, SIGNALS NO HIKES THROUGH 2020

The Federal Reserve has signaled it will not raise interest rates in 2020 and will, as of now, hike only one time in 2021. That likely means mortgage rates will hover between 3 and 4 percent, say economists, provided nothing major shifts.

CLICK HERE TO READ MORE ON FOX BUSINESS