Dow adds 1,167 points as Trump talks economic initiatives

Equity markets are bouncing back after their biggest drop since the 2008 financial crisis

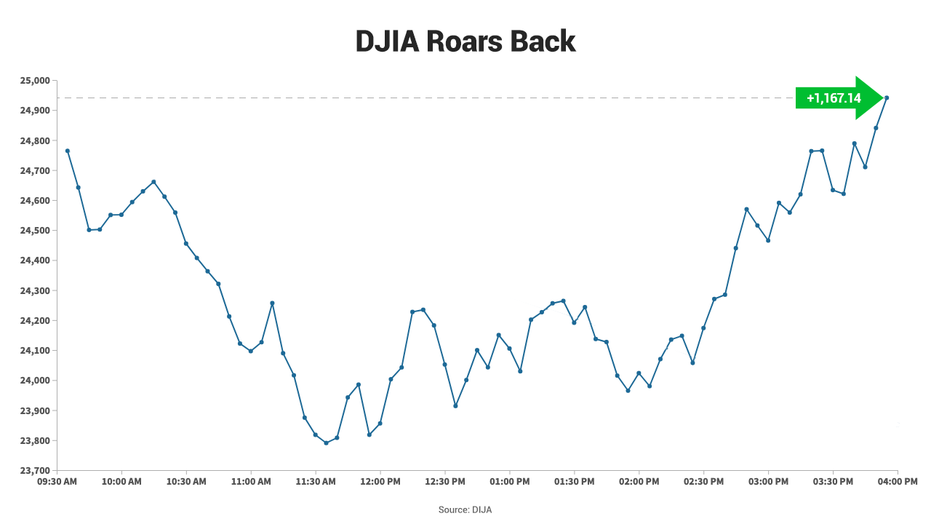

U.S. equity markets ebbed and flowed on Tuesday before breaking away with the Dow Jones Industrial Average adding over 1,167 points clawing back from a deficit.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 50135.87 | +20.20 | +0.04% |

| SP500 | S&P 500 | 6964.82 | +32.52 | +0.47% |

| I:COMP | NASDAQ COMPOSITE INDEX | 23238.66991 | +207.46 | +0.90% |

The Dow's point gain was the third-best on record. The S&P 500 and Nasdaq Composite also rallied tacking on nearly 5 percent.

Investors were encouraged after President Trump backed “very substantial relief” for the areas of the economy hardest hit by the new coronavirus outbreak.

He said Tuesday he had a "great meeting" with Senate Republicans, and that "there's a great feeling about doing a lot of things.

This followed his remarks on Monday. “We are going to take care of, and have been taking care of, the American public and the American economy,” Trump said at a White House press briefing where he floated a payroll tax cut, making sure those infected by COVID-19 don’t miss a paycheck and helping embattled industries, such as airlines and cruise operators.

TRUMP TO FIGHT CORONAVIRUS ECONOMIC IMPACT WITH PAYROLL TAX CUT PROPOSAL AND OTHER PROGRAMS

The rebound helps recoup some of Monday’s losses of more than 7 percent which were the steepest for stock indexes since the 2008 financial crisis.

Looking at stocks, airlines and cruise ship companies, some of the hardest-hit groups since the COVID-19 outbreak, turned higher in response to Trump’s comments.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AAL | AMERICAN AIRLINES GROUP INC. | 14.99 | -0.25 | -1.64% |

| UAL | UNITED AIRLINES HOLDINGS INC. | 116.20 | +0.29 | +0.25% |

| DAL | DELTA AIR LINES INC. | 75.00 | -0.35 | -0.46% |

| CCL | CARNIVAL CORP. | 32.81 | -1.18 | -3.47% |

| NCLH | NORWEGIAN CRUISE LINE HOLDINGS LTD. | 22.85 | -0.47 | -2.02% |

Banks, which have been hit hard by expectations of further rate cuts from the Federal Reserve, recouped some of their recent losses while previously high-flying tech names, including Apple and Tesla, saw gains.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BAC | BANK OF AMERICA CORP. | 56.41 | -0.12 | -0.21% |

| JPM | JPMORGAN CHASE & CO. | 322.10 | -0.30 | -0.09% |

| WFC | WELLS FARGO & CO. | 94.61 | +0.64 | +0.68% |

| AAPL | APPLE INC. | 274.62 | -3.50 | -1.26% |

| TSLA | TESLA INC. | 417.32 | +6.21 | +1.51% |

Meanwhile, energy stocks, which were hammered Monday after an oil-price war broke out between Saudi Arabia and Russia, rallied as West Texas crude surged 10.38 percent to $34.36 a barrel. Oil's plunge of more than 24 percent on Monday was the largest since the outbreak of the 1991 Persian Gulf War.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| XOM | EXXON MOBIL CORP. | 151.13 | +2.11 | +1.42% |

| CVX | CHEVRON CORP. | 182.60 | +1.74 | +0.96% |

| CLR | NO DATA AVAILABLE | - | - | - |

| OXY | OCCIDENTAL PETROLEUM CORP. | 46.66 | +0.35 | +0.76% |

On the earnings front, Dick’s Sporting Goods reported better-than-expected fourth-quarter results and announced the removal of its hunt category from 440 more stores.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| DKS | DICK'S SPORTING GOODS | 201.91 | -6.23 | -2.99% |

U.S. Treasurys gave up a large portion of Monday's gains, causing the yield on the 10-year note to spike to 0.792 percent. On Monday, the entire yield curve finished below 1 percent for the first time on record.

European markets reversed course with France’s CAC sliding 1.5 percent, Germany’s DAX losing 1.4 percent and Britain's FTSE closing down 0.1 percent.

CLICK HERE TO READ MORE ON FOX BUSINESS

In Asia, China’s Shanghai Composite led the way, up 1.8 percent, while Hong Kong’s Hang Seng and Japan’s Nikkei added 1.4 percent and 0.9 percent, respectively.