Dow 30,000 makes history, S&P hits fresh record on Yellen, vaccine optimism

Tesla's market cap hit $526B for first time

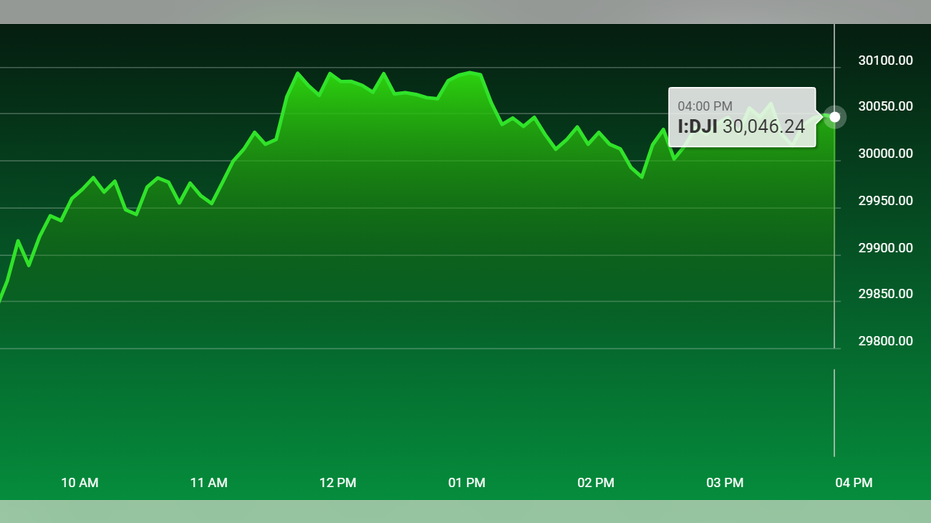

U.S. equity markets rallied sharply Tuesday, catapulting the Dow Jones Industrial Average to above the 30,000 level for the first time as the S&P 500 also booked a fresh record.

Vaccine optimism combined with another solid read on U.S. home prices drove a broad market rally led by Dow members Chevron, JPMorgan and IBM.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| CVX | CHEVRON CORP. | 180.86 | +1.63 | +0.91% |

| IBM | INTERNATIONAL BUSINESS MACHINES CORP. | 298.93 | +9.04 | +3.12% |

| JPM | JPMORGAN CHASE & CO. | 322.35 | +12.34 | +3.98% |

President Trump, speaking at the White House, called the level a "sacred number."

The rally was also supported by the likelihood that projected President-elect Joe Biden will formally appoint former Federal Reserve Chair Janet Yellen as his would-be Treasury secretary.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| SP500 | S&P 500 | 6932.3 | +133.90 | +1.97% |

| I:COMP | NASDAQ COMPOSITE INDEX | 23031.213218 | +490.63 | +2.18% |

The Dow Jones Industrial Average climbed 454 points, or 1.54%, while the S&P 500 and the Nasdaq Composite added 1.62% and 1.31%, respectively with all 11 of the major sectors rising.

The S&P CoreLogic Case-Shiller index report for September showed home prices rose 6.6% year-over-year, making for their biggest annual increase since April 2018. Prices in Phoenix remained red-hot, growing at an 11.4% annual pace.

Looking at stocks, those tied to the reopening of the economy continued to gain momentum after AstraZeneca on Monday became the third company to announce positive news regarding its COVID-19 vaccine.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AZN | ASTRAZENECA PLC | 193.10 | +5.91 | +3.16% |

Oil giants Exxon Mobil Corp. and Conoco Philips rose as West Texas Intermediate crude oil climbed $1.84 to $44.91 per barrel, the highest since March.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| XOM | EXXON MOBIL CORP. | 149.05 | +2.97 | +2.03% |

| COP | CONOCOPHILLIPS | 107.62 | +2.64 | +2.51% |

| USO | UNITED STATES OIL FUND - USD ACC | 76.98 | +0.28 | +0.37% |

Other stocks tied to the reopening of the economy, including cruise operators and airlines, were also higher.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| TSLA | TESLA INC. | 411.11 | +13.90 | +3.50% |

| NIO | NIO INC. | 5.04 | +0.33 | +7.01% |

| LI | LI AUTO INC. | 18.97 | +1.18 | +6.63% |

Tesla shares finished in record territory, above $500 for the first time, a day after CEO Elon Musk became the world's second-wealthiest person. Other electric-vehicle makers, including Nio and Li Auto, ended mixed.

Looking at earnings, Tiffany & Co. said strong sales in China and a smaller-than-expected decline in the U.S. resulted in revenue falling 1% from a year ago to $1.01 billion, ahead of the $980.7 million that analysts surveyed by Refinitiv were anticipating. The company said its merger with luxury goods retailer LVMH will close in early 2021.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| TIF | NO DATA AVAILABLE | - | - | - |

| DKS | DICK'S SPORTING GOODS | 208.29 | +2.76 | +1.34% |

| BBBY | BEYOND INC. | 5.47 | +0.31 | +6.01% |

Dick's Sporting Goods CEO Ed Stack will step down from his role at the end of January as he moves into the executive chairman position. He will be replaced by President Lauren Hobart. The announcement came alongside the sporting goods retailer's quarterly results, which showed comparable sales grew a record 23.2% year-over-year.

Best Buy Co. reported comparable sales rose 23% year-over-year, topping the 14.7% advance that was expected, amid strong demand for work-from-home computer products.

The consumer confidence index for November saw a slight dip to 96.1 vs. the 98 expected by economists, however, October was revised higher to 101.4, according to the Conference Board.

CLICK HERE TO READ MORE ON FOX BUSINESS

In Europe, the STOXX Europe 600 traded up 0.83% while Britain’s FTSE 100, France’s CAC 40 and Germany’s DAX 30 all climbed at least 1.2%.

Asian markets finished mixed with Japan’s Nikkei 225 surging 2.5%, Hong Kong’s Hang Seng index tacking on 0.39% and China’s Shanghai Composite index sliding 0.34%.