Is Wall Street's 'sell in May and go away' dead in 2023?

The S&P 500 has gained over 7% in 2023, while the Nasdaq is up 17%

Wall Street investors will not get Fed clarity today: Alli McCartney

QI Research CEO and chief strategist Danielle DiMartino Booth and UBS Private Wealth Management managing director Alli McCartney react to the Fed voting unanimously to raise interest rates on 'Making Money.'

The old saying on Wall Street, "Sell in May and go away" — when big investors move to the sidelines until the fall — may not be wise this year with the banking crisis far from over and the Federal Reserve in rate-hiking mode.

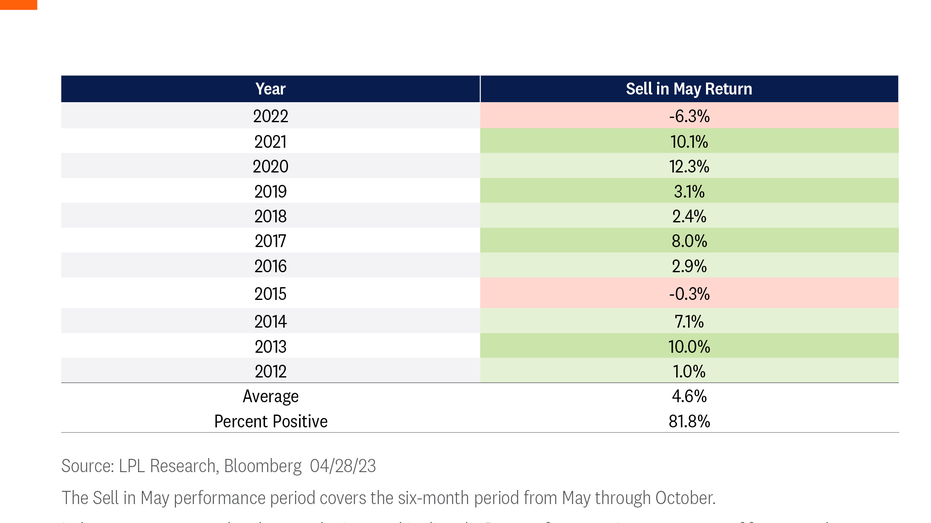

"Recent history suggests the maxim has been more rhyme than reason," Adam Turnquist, Chief Technical Strategist for LPL Financial, told FOX Business when looking at returns over the past decade.

STOCK MARKET NERVOUSNESS IS OVERDONE: ADAM JOHNSON

"Since 2012, the S&P 500 has traded higher by an average of 4.6% during the sell in May period, with 10 of the 12 years posting positive returns," he added. "Typically, investors are off Wall Street during summer and return in the fall when seasonal returns are more constructive."

S&P 500

This May, Turnquist said traders should be on the lookout for a modest overweight equities allocation and stick to larger cap quality names with strong balance sheets and solid free cash flows.

And from a macro perspective, "this year is especially unique as the market faces elevated levels of uncertainty, despite the market shrugging off most of the negative headlines" said Turnquist. "Maybe the pattern should be sell in June," he added.

The Federal Reserve hiked interest rates for the 10th time on Wednesday, while also signaling a pause in the cycle could be in the cards.

Jamie Dimon, chairman and CEO of JPMorgan Chase (Ting Shen/Bloomberg via Getty Images / Getty Images)

Additionally, the week was wrought with more banking problems. JPMorgan took over First Republic after the FDIC intervened. The move sent ripples through other regional banks.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| XLF | FINANCIAL SELECT SECTOR SPDR ETF | 54.26 | +0.98 | +1.84% |

| JPM | JPMORGAN CHASE & CO. | 322.35 | +12.34 | +3.98% |

| PACW | NO DATA AVAILABLE | - | - | - |

| WAL | WESTERN ALLIANCE BANCORP | 94.38 | +3.35 | +3.68% |

| TFC | TRUIST FINANCIAL CORP. | 55.81 | +0.67 | +1.22% |

Traders work on the floor of the New York Stock Exchange. (Spencer Platt/Getty Images / Getty Images)

FIRST HORIZON SHARES TANK AFTER TD BANK DEAL SCRAPPED

Outperforming the S&P 500 since December 2021, LPL Financial data also identified the industrial sector as potential opportunity for investors this May amid elevated geopolitical tension, defense spending, and as production returns to the U.S. in the post-pandemic world.

FORD'S PROFIT RISES ON TRUCK DEMAND BUT EV OUTLOOK SENDS SHARES LOWER

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| XLI | INDUSTRIAL SELECT SECTOR SPDR ETF | 173.18 | +4.81 | +2.86% |

SMALL BUSINESS CHECKUP: RECESSION, INFLATION, LENDING TOP CONCERNS

Meanwhile, the S&P has gone up 7.6% over the past six months, roughly in line with the historical average, while suggesting a typical gain for the next six months might be in order, according to LPL Financial predictions.

"A breakout above 4,200 on the S&P 500 could change the bearish tone and underpin a short covering rally toward the August highs near 4,300," Turnquist concluded.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| SP500 | S&P 500 | 6932.3 | +133.90 | +1.97% |

Investors are second-guessing the Fed after a choppy week of trading on U.S. stock markets. (AP Photo/Seth Wenig / AP Images)