WeWork stock is back but whittled down

WeWork is now focusing on longer membership commitments

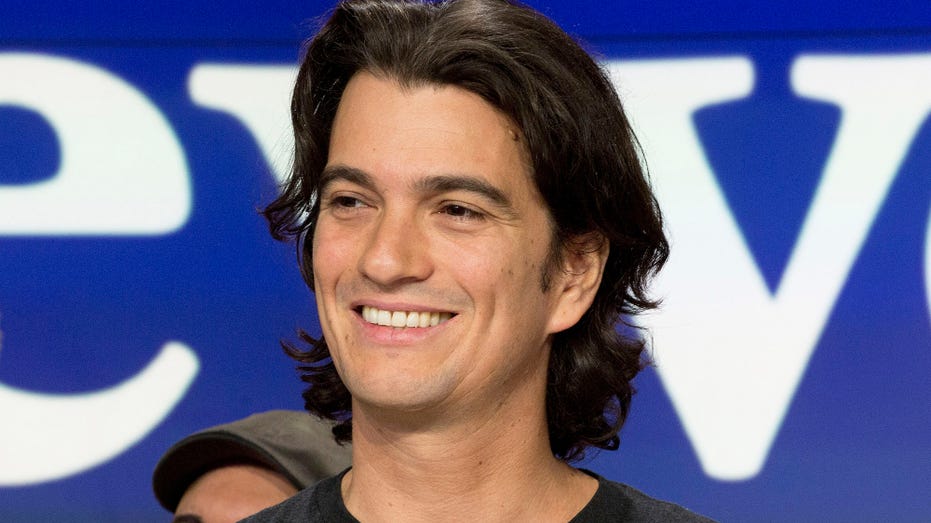

Fmr. WeWork CEO Adam Neumann celebrates IPO debut in New York City

WeWork co-founder and embattled former CEO Adam Neumann, celebrated the company’s initial public offering in New York City outside The Standard Hotel.

WeWork's shares rose Thursday amid its long-awaited stock market debut albeit on a much smaller scale than its 2019 heyday, when they were originally set to go public.

The company, which leases buildings and divides them into office spaces to sublet to members, is trying to capitalize on the unprecedented work environment turned upside down due to virus-related restrictions and it has a new plan of action.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| WE | NO DATA AVAILABLE | - | - | - |

On Wednesday, more than two years later, the New York City company closed its agreement to merge with BowX Acquisition, a special purposes acquisition company. SPACs are groups of investors that band together to speed a company to a public listing, usually at the expense of transparency for outside investors.

In 2019, the company had even been valued at around $47 billion before investors began to buck, fed up with exorbitant spending on top of the erratic behavior from the company's CEO and founder Adam Neumann who was later ousted.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Adam Neumann, co-founder and former CEO of WeWork. (AP Photo/Mark Lennihan, File)

This time, the revitalized company is focusing on longer membership commitments with only 10% of its members having month-to-month commitments to date. More than 50% of its members have committed for more than a year.

SPAC SHAREHOLDERS APPROVE DEAL THAT WILL TAKE WEWORK PUBLIC

A WeWork location in Manhattan. (iStock / iStock)

CLICK HERE TO READ MORE ON FOX BUSINESS

Japan's SoftBank, a major early investor, stepped in to keep the company afloat and will hold a majority stake as part of the SPAC. Neumann is not out of the picture either. He will hold voting power of more than 10% in the newly formed company.

The Associated Press contributed to this report.