What are I bonds and how do they work?

Interest rate is expected to drop to about 6.47% on Nov. 1

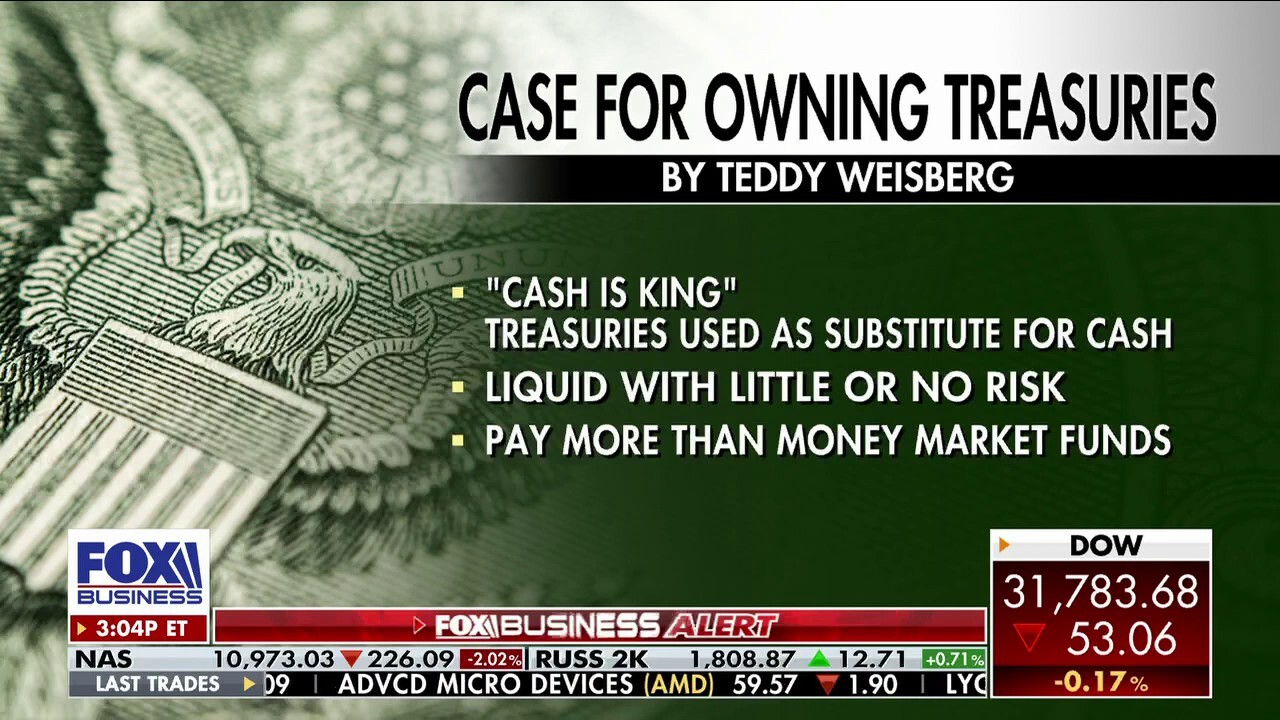

Treasuries are 'no-brainer' in turbulent market: Weisberg

Carnivore Trading CEO Dutch Masters and Seaport Securities founder Teddy Weisberg reveal their strategies for investing in a down market on "The Claman Countdown."

I bonds will pay less interest in the months ahead but still remain attractive for many investors. These inflation-adjusted U.S. savings bonds are predicted to earn a 6.47% annual rate for six months, starting Nov. 1. Previously, I bonds earned a 9.62% annual rate when bought before Oct. 28.

The yield for I bonds far exceeds cash, and the bonds are appealing for investors who want to grab a higher rate of return without the risk of the stock market. I bonds have been popular with investors this year.

More than 95,000 new accounts were created and more than $994 million in I bonds were purchased on Friday alone, a Treasury Department spokesman said. In October, more than 731,000 new accounts were created and more than $6.9 billion in I bonds were purchased.

The U.S. Department of the Treasury headquarters in Washington, Aug. 29, 2020. (Reuters/Andrew Kelly / Reuters Photos)

IRS RAISES 401(K) CONTRIBUTION LIMIT BY RECORD AMOUNT AS INFLATION RAGES

But understanding how, when and how much of these bonds to buy can get tricky. For example, you don’t want to face any early withdrawal penalties.

To help untangle the rules and strategies for making the most of I bonds, here are answers to some of the most frequently asked questions posed by Wall Street Journal readers.

What are I bonds?

I bonds are inflation-adjusted Series I savings bonds backed by the U.S. government.

The interest rate on I bonds is recalculated every six months. The I bond interest rate is based on a calculation tied to the consumer price index. The overall CPI increased 8.2% in September from the same month a year ago, according to the Bureau of Labor Statistics. I bonds will likely pay about 6.47% interest beginning Nov. 1.

Bonds bought from May through nearly the end of October will earn 9.62% for six months before adjusting to reflect the new inflation data. I bonds have a 12-month lock-up period.

For example, a $10,000 I bond bought on Oct. 28 would earn an annualized rate of 9.62% for six months. At that point, the interest earned of $481 would be added to the original $10,000 and the new annualized rate of 6.47% would be earned on $10,481, resulting in another $339 in interest for a total of $820 in interest earned over 12 months, said Elliot Pepper, a financial planner in Baltimore.

There is a $10,000 annual limit per person for I bonds, yet there are certain strategies to exceed that ceiling.

Where do I buy I bonds?

Investors create an account on the TreasuryDirect website to buy electronic bonds. They can also buy paper bonds with their tax refund through an Internal Revenue Service program. If you have extended your tax return and have an overpayment, you can elect to purchase I bonds with the refund, said Pamela Ladd, senior manager for public accounting for the American Institute of Certified Public Accountants.

I bonds aren’t available in tax-sheltered vehicles such as individual retirement accounts, Roth IRAs or 401(K)s. Nor can brokers or financial advisers purchase them for you.

What are the benefits of I bonds?

"I bonds are as safe as cash but yield a much higher rate of return," said Pepper. As long as you’re comfortable with the 12-month lock-up period, I bonds are a great place to invest excess cash right now, he said.

During the time that the I bond is held, there are no federal taxes due. Even though you’re getting the benefit of compounding interest every six months, you don’t pay any federal taxes until you actually cash out the bonds.

CLICK HERE TO GET THE FOX BUSINESS APP

Additionally, there are no state or local taxes on the interest earned, which is a big benefit for investors in high-tax states, said Pepper. Contrast this with a traditional bank certificate of deposit where you’ll be subject to both federal and state taxes as the interest is earned, he said.

Is it too late to get the 9.62% annual rate?

Yes. According to the TreasuryDirect website, investors must have completed their purchase and received a confirmation email by Oct. 28 to lock in the 9.62% rate.

TreasuryDirect reopened for account creation and purchases on Oct. 31. Beginning Monday, purchases will receive the rate that will be published on Nov. 1 (likely 6.47%), Treasury said.

When is I bond interest paid?

Interest is paid in a lump sum when the bond is cashed.

An I bond earns interest monthly from the first day of the month in the issue date, so if you purchase a bond on Nov. 20, you would get interest for the entire month of November, Ladd said.

The interest, which is compounded twice a year, accrues for up to 30 years or until you cash the bond, whichever comes first, Ladd added.

CLICK HERE TO READ MORE ON FOX BUSINESS

I didn’t use my tax refund to purchase $5,000 in I bonds when I filed my tax return. Is it too late to buy I bonds with my refund money?

Yes. Up to $5,000 of your tax refund is eligible to be put into I bonds a year, under the IRS program. You can still buy up to $10,000 in I bonds this year if you haven’t already done so. The option to buy up to $5,000 more with your tax refund is a separate program.

But if you already filed your return for the year and didn’t opt to purchase I bonds with any refund money, it is too late. Form 8888 (used for allocating a refund to an I bond) isn’t permitted if filing an amended tax return, Pepper said.

When do I bonds mature?

You can cash out I bonds after 12 months, but there will be a penalty equal to three months of interest if you cash out in the first five years. I bonds earn interest for up to 30 years.

You can cash a minimum of $25 at a time and must leave at least $25 in your TreasuryDirect account when doing partial redemptions.

How do I buy I bonds for my children?

Children under 18 can own I bonds, however, they can’t open a TreasuryDirect account, said David Stolz, a certified public accountant in Tacoma, Washington.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

A parent may open an account for the child and the account will be linked to the adult’s account, which will allow them to buy electronic I bonds in the name of the child. These I bonds would be purchased under the child’s name and Social Security number, he said.

The annual I bond purchase limits are based on the recipient not the giver. The child could receive up to $10,000 in electronic I bonds and up to $5,000 in paper I bonds a year.

How do I purchase I bonds in my trust?

You can add an additional $10,000 to the annual I bond purchase limit with a properly registered trust, said Stolz. When you register your account at TreasuryDirect, you have the option to create an entity account, including trusts and partnerships.

Trusts require an account manager who can act alone on behalf of the trust, and the wording in the registration must specifically identify the trust, he said.