What is contango?

Occurs when the spot price is lower than the future price

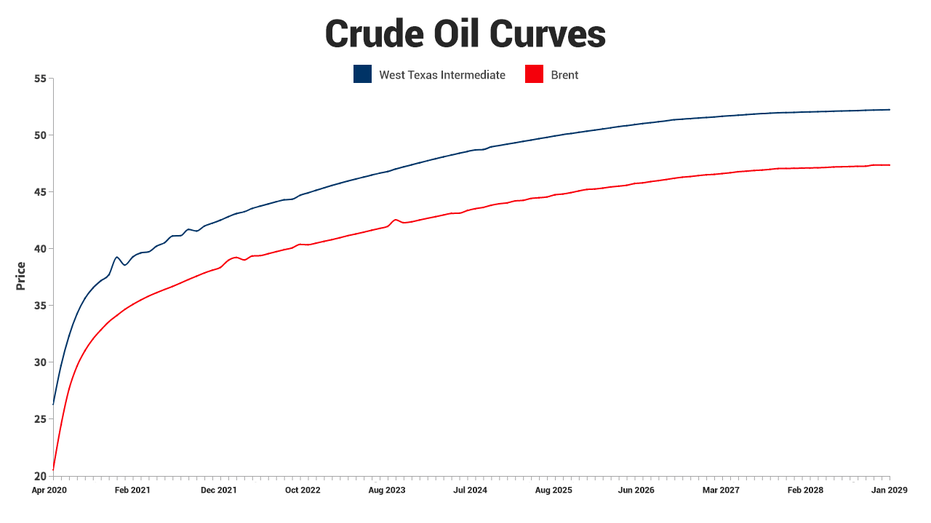

Contango occurs when the spot price is lower than the future price, or in other words, investors are willing to pay a premium for a commodity in the future. This causes an upward-sloping price curve.

The premium takes into account the costs such as storage, transportation and insurance.

For example, the COVID-19 pandemic caused global oil demand to fall by 30 million barrels per day at a time when Russia and Saudi Arabia, two of the world’s largest suppliers, were engaged in a price war, leaving the world awash in crude.

CLICK HERE TO READ MORE ON FOX BUSINESS

The imbalance between supply and demand pushed the spot price down to historic lows, but future prices remained elevated due to costs of carry as producers stored excess supplies in tankers with the hope of selling the oil for more in the future.