3 strategic Social Security moves that will leave you richer

Want more money from Social Security? Here's how to snag it

You'll often hear that Social Security can't fund your retirement alone, and that's true. Those benefits will generally replace about 40% of your pre-retirement wages if you're an average earner, and most seniors need 70% of their former income or more to live comfortably. But still, it does pay to get as much money out of Social Security as you can, and these moves can help you do just that.

HALF OF RETIREES WISH THEY'D BUDGETED MORE FOR THIS

1. File at full retirement age or beyond

Age 62 happens to be the most popular age to sign up for Social Security, and it's the earliest age you're allowed to do so. But if you claim benefits at 62, you're guaranteed to slash them for life. If you're willing to take that hit in exchange for getting your money early, so be it, but if you want to secure a much higher monthly benefit, don't file before reaching full retirement age, or FRA.

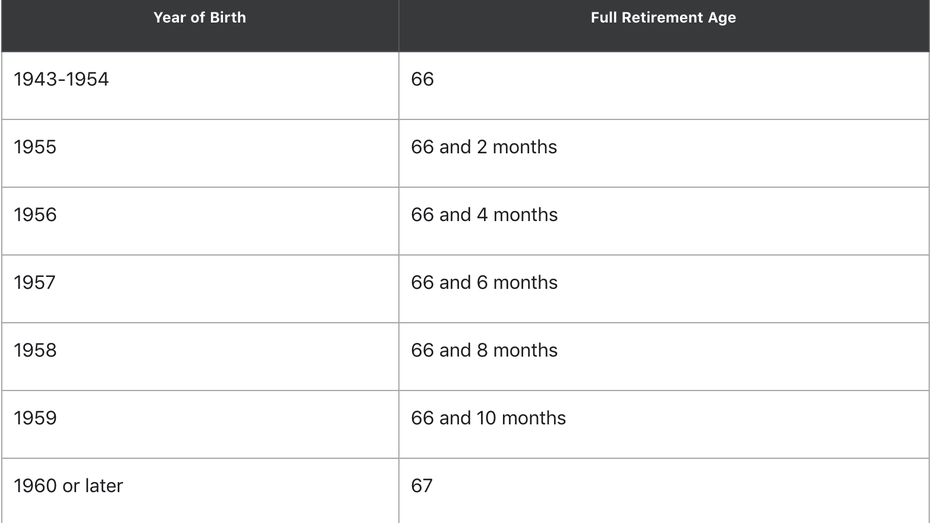

FRA depends on the year you were born, and this table will help you determine what yours is:

(Credit: Motley Fool)

That said, you also have the option to delay your Social Security filing past FRA. For each year you do, up until age 70, your benefits will grow 8%. Given that that's comparable to what the stock market has averaged annually over time, that's a really good deal, especially since that boost is guaranteed, whereas investment returns aren't.

THIS LESSER KNOWN RETIREMENT SAVINGS TOOL IS LOADED WITH TAX BENEFITS

2. Make sure you don't file past the age of 70

Filing for Social Security at age 70 will effectively give you the highest monthly benefit you can get. Filing beyond that point, however, will cause you to lose money.

Once you turn 70, you can't grow your benefits any longer, so there's no sense in not claiming them. And while Social Security will pay you up to six months of retroactive benefits so that if you file by 70 1/2, you'll be made whole, filing beyond that point will mean giving up several months of benefits for no good reason.

4 RETIREMENT PLANNING STRATEGIES TO LEAN ON IN UNCERTAIN TIMES

3. Keep your retirement savings in a Roth IRA

You may not want to hear this, but it's true: Social Security benefits, like other types of income, are subject to federal taxes. But you may be able to avoid those taxes if your income outside of Social Security is low enough. And you can pull that off by housing your retirement savings in a Roth IRA.

Roth IRA withdrawals are yours to enjoy tax-free, so they don't count as income when determining whether your Social Security benefits will be subject to taxes at the federal level. And if your earnings are too high to contribute to a Roth IRA directly, don't sweat it. You can always fund a traditional IRA and then convert it to a Roth afterward. You'll pay taxes on the amount you move over, but since you'd be funding a Roth IRA with after-tax dollars anyway, that really shouldn't be a problem if you plan for it.

Even if Social Security doesn't pay you enough money to live on, you should still aim to squeeze as much money out of the program as you can. After all, you spent your entire career paying into the system, and now it's your turn to capitalize on it. The above moves could easily result in a more generous payday from Social Security, so be sure to factor them into your retirement planning.

CLICK HERE TO READ MORE ON FOX BUSINESS