34% of workers today worry about this devastating retirement expense

34% of workers today worry about declining health in retirement that requires long-term care

There's a reason so many people worry about leaving the workforce: Committing to a fixed income is a scary notion when we stop and think about the many expenses that could rise in retirement. These include home repairs, automobile maintenance, and, of course, healthcare.

3 REASONS YOUR SOCIAL SECURITY BENEFITS COULD TAKE A SERIOUS HIT

While healthcare is the one expense that tends to go up, not down, during retirement, those who do their part to read up on Medicare can position themselves to save accordingly. But there's a related expense that tends to catch seniors off-guard, to the point where they and their families risk catastrophic costs. It's none other than long-term care, and it's an expense that an estimated 70% of adults aged 65 and older will encounter at some point in their lifetime.

Not shocking, 34% of workers today worry about declining health in retirement that requires long-term care, according to a recent Transamerica survey. And the reality is, they have every right to be concerned.

What do long-term care costs look like today?

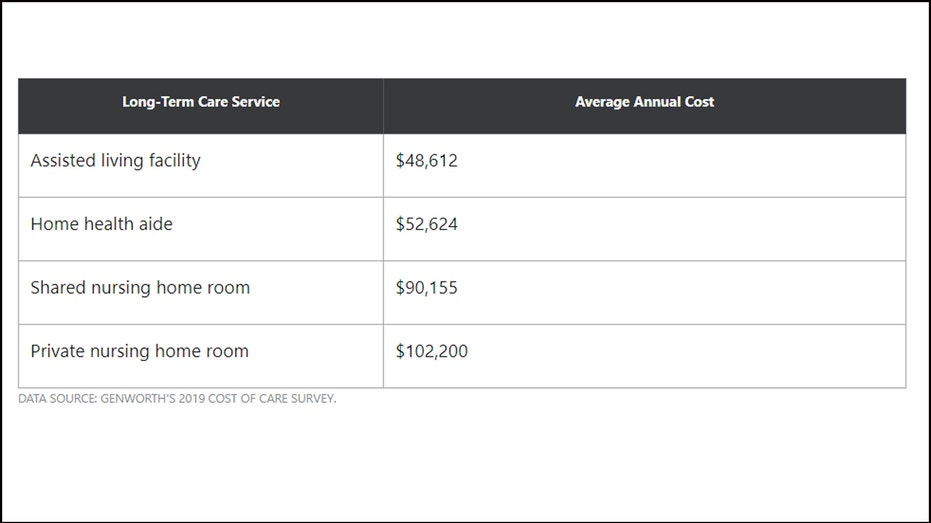

Long-term care costs can vary based on where you live and the type of care you need. Here's an overview of the expenses you might face:

How to pay for long-term care

If you're worried about paying for long-term care, there are a few things you can do to ease that concern. First, plan to sign up for long-term care insurance once you reach your mid-50s. Having a policy to pick up the tab for some of your costs could save you a world of money and stress when you're older, and if you apply in your mid-50s, you're more likely to not only get approved, but snag a decent rate on your premiums based on your health. At the same time, you won't end up paying those premiums for too long.

THIS IS THE SINGLE BIGGEST RETIREMENT SAVINGS MISTAKE YOU CAN MAKE

It also pays to contribute to a health savings account, or HSA, if you're eligible. To qualify, you must be enrolled in a high-deductible health insurance plan, defined this year as an individual deductible of $1,400 or more, or a family level deductible of $2,800 or more. With an HSA, you contribute funds that you can either use immediately for medical expenses, or invest and save for the future. The money you put into an HSA can be withdrawn at any time, so you can carry it all the way into retirement and use it to pay for long-term care. You can even use an HSA to pay your long-term care premiums.

3 SIGNS YOU'LL HAVE TO RETIRE EARLY BECAUSE OF CORONAVIRUS (AND HOW TO MAKE IT WORK)

Finally, padding your 401(k) or IRA will give you more money to spend freely in retirement. That means you can use your savings to manage any additional long-term care costs your insurance policy or HSA don't cover.

It's natural to be worried about paying for long-term care as a senior, but rather than waste energy stressing about it, map out a plan to tackle that expense head-on. Without a crystal ball, it's impossible to predict whether you'll end up needing that care and to what extent, but you're always better off erring on the side of being overprepared.