Amazon paid tax rate of 1.2% on $13B in profits last year

Amazon said it paid $162 million in federal income taxes on $13.3 billion of U.S. pre-tax income

For the first time in three years, Amazon, long the subject of criticism from lawmakers across the political aisle, owed federal income taxes.

In its annual regulatory filing with the Securities and Exchange Commission, Jeff Bezos' sprawling e-commerce empire said it paid $162 million in federal income taxes on $13.3 billion of U.S. pre-tax income, an effective tax rate of 1.2 percent. It deferred more than $914 million in taxes.

"We follow all applicable federal and state tax laws, and our U.S. taxes are a reflection of our continued investments, compensation of our employees, and the current tax rules," Amazon wrote in a blog post on Jan. 31. The company highlighted its "federal income tax expense" of more than $1 billion, including the $162 million it paid in 2019, and the $914 million deferred to future years.

"This means that instead of avoiding 100 percent of its income tax liability, Amazon appears to have avoided only 94 percent of its tax bill last year," Matthew Gardner, senior fellow at the Institute on Taxation and Economic Policy, wrote in a blog post.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AMZN | AMAZON.COM INC. | 210.32 | -12.37 | -5.55% |

That would amount to a tax rate close to 7.5 percent, which is still well below the 21 percent corporate tax rate in the U.S., lowered by the Trump administration's Tax Cuts and Jobs Act in 2017 from the Obama-era 35 percent rate. At that rate, the Seattle-based company would have owed close to $2.9 million last year.

In its regulatory filing, the world's largest online retailer said it reduced its taxable income via "tax benefits relating to excess stock-based compensation deductions and accelerated depreciation deductions."

GET FOX BUSINESS ON THE GO BY CLICKING HERE

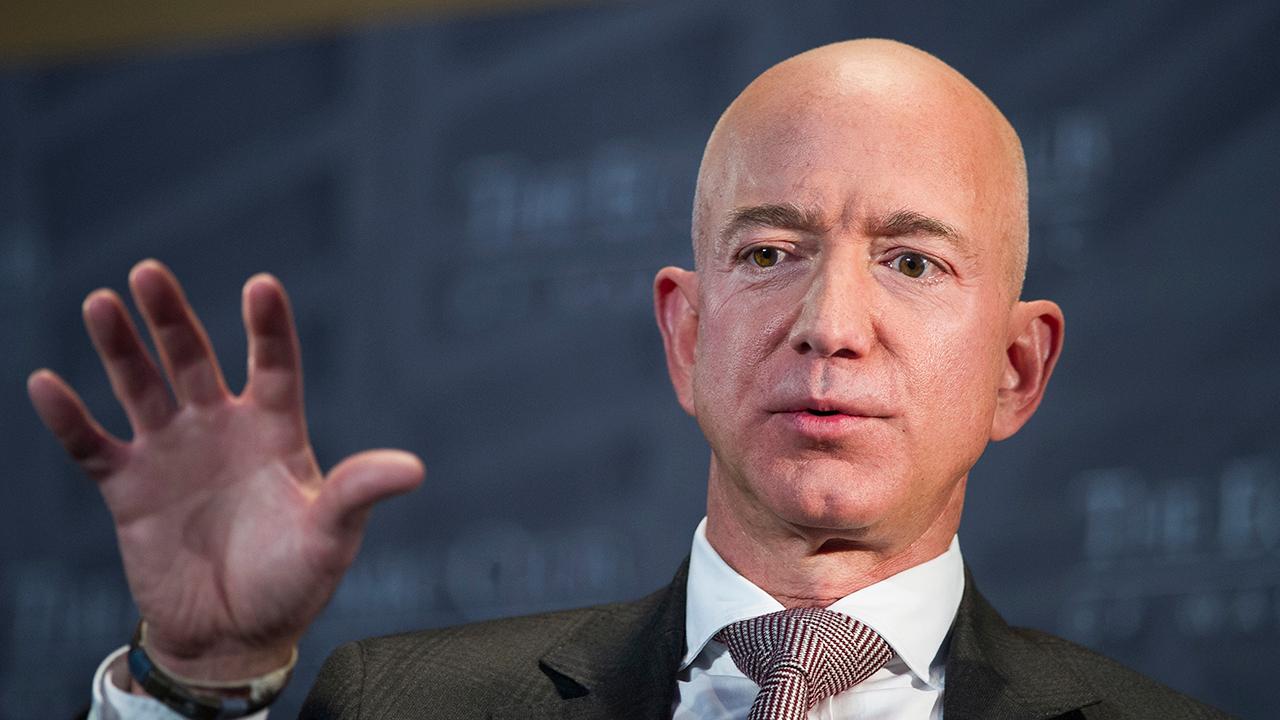

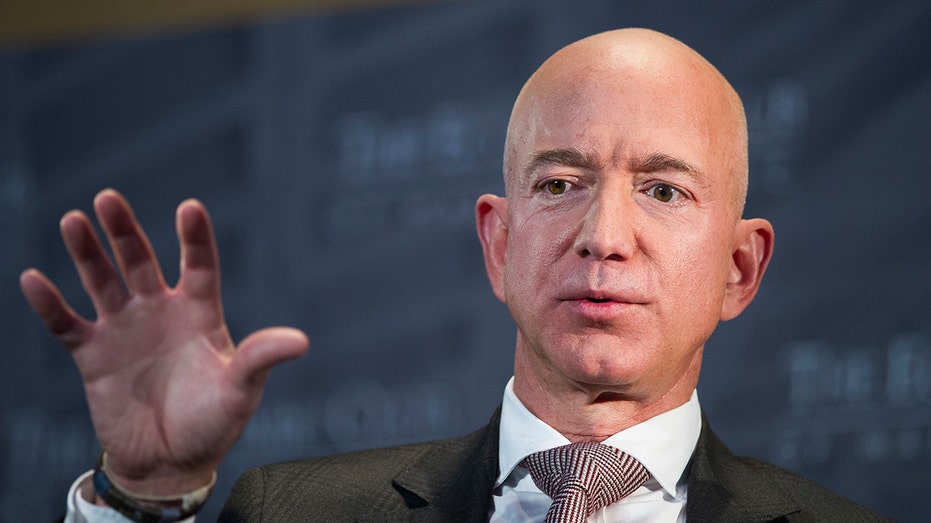

Bezos speaks at The Economic Club of Washington. (AP Photo/Cliff Owen, File)

The company described itself as the largest job creator in the U.S., touting its more than 500,000 employees across 40 states. Its summary of U.S. taxes included more than $1 billion in "federal income expenses," "more than $2.3 billion in other federal taxes," including payroll taxes and customs duties and "more than $1.6 billion state and local taxes, including payroll taxes, property taxes, state income taxes and gross receipts taxes," Amazon said.

According to Gardner, however, payroll taxes are ultimately footed by employees in the form of reduced compensation. Like the sales tax -- which fall on consumers -- the federal government requires companies to collect a payroll tax. Currently, all employees and employers pay a 6.2 percent payroll tax on wages capped out at $132,900.

WARREN, SANDERS' WEALTH TAXES COULD COST AMERICAN WORKERS $1T, ECONOMISTS SAY

"Congratulating an employer for collecting the payroll tax is like congratulating yourself for breathing," Gardner said.

In 2018 and 2017, Amazon paid zero taxes on a respective $11.2 billion and $5.6 billion in profits by leveraging unspecified tax credits and stock-based compensation deductions.

Amazon is worth more than $1 trillion, while Bezos, the richest person in the world, has an estimated net worth of $126 billion.

CLICK HERE TO READ MORE ON FOX BUSINESS

Vermont Sen. Bernie Sanders, a front-runner in the Democratic presidential race, frequently rails against Amazon for taking advantage of the tax code, all while it rakes in billions of dollars.

During a Fox News town hall with Bret Baier and Martha MacCallum in April, Sanders criticized the American tax system, calling it "absurd."

"While millions of people today are paying actually more in taxes than they anticipated, Amazon, Netflix and dozens of major corporations, as a result of Trump's tax bill, pay nothing in federal taxes,” he said. “I think that's a disgrace."

Under Sanders' wealth tax proposal — ranging from a 1 percent tax on those worth $32 million to 8 percent on wealth over $10 billion — Bezos would pay an estimated $9 billion a year in levies.