Berkshire Hathaway annual meeting 2020: 5 things to know

Warren Buffett will be present for the virtual event

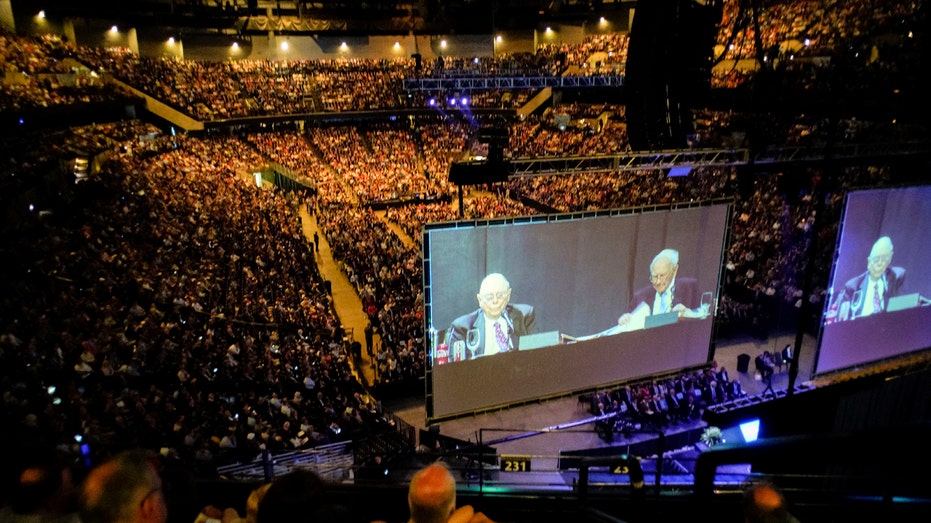

Berkshire Hathaway’s annual shareholders meeting is known as “Woodstock for capitalists” and stands as a unique celebration in the world of business.

The meeting drew more than 40,000 attendees last year. But the Warren Buffett-led event isn’t any more immune to the coronavirus than anyone else, so this year’s event will be closed to shareholders for the first time ever.

An image of Warren Buffett towers over Berkshire Hathaway shareholders as they visit and shop at company subsidiaries in Omaha, Neb. at the 2017 Berkshire Hathaway shareholders meeting. (AP Photo/Nati Harnik)

CORONAVIRUS CANCELED WARREN BUFFETT’S SHAREHOLDER PARTY. OMAHA IS SUFFERING

Even without the crowds and the “Woodstock” festivities, the event will go on and Berkshire’s leadership will take shareholder questions.

Here are five things to know before Berkshire Hathaway’s annual shareholder meeting:

You can still watch

Only CEO Warren Buffett and Greg Abel, Berkshire’s vice chairman of non-insurance operations, will be physically present for the meeting. But the event will be streamed live on Yahoo beginning with a pre-meeting show at 3 p.m. central time.

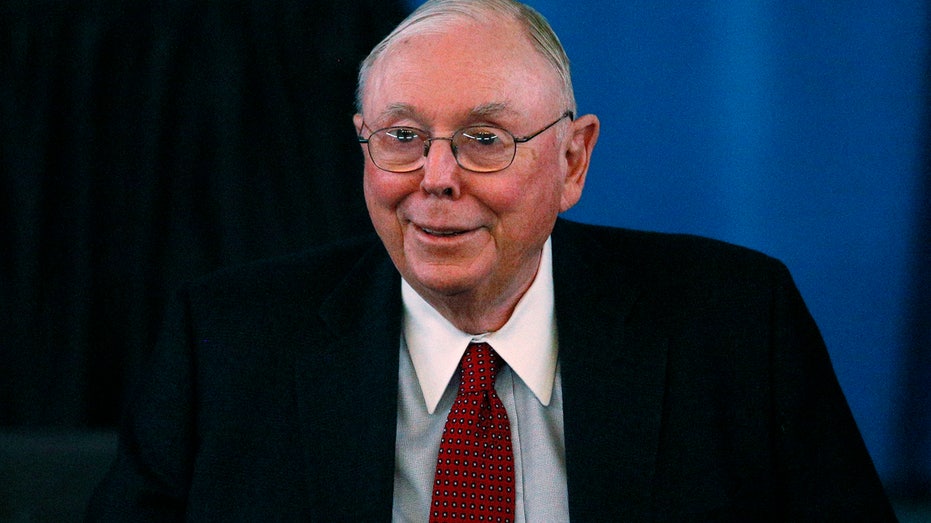

The board will not be physically present, including vice chairman Charlie Munger. But they’ll still be able to attend to all the typical business for the meeting.

Three journalists have also picked questions from shareholders to ask Buffett and Abel, so the typically-lengthy Q and A session will still go on.

Berkshire Hathaway Chairman and CEO Warren Buffett gestures during an interview by Liz Claman of the Fox Business Network in Omaha, Neb. (AP Photo/Nati Harnik, File)

WARREN BUFFETT SELLS SOME DELTA, SOUTHWEST AIRLINES STOCK

The coronavirus has pinched the conglomerate

Berkshire sold off sizeable stakes in Delta Air Lines and Southwest Airlines as the coronavirus battered the travel industry, including close to 13 million shares of Delta and about 2.3 million shares of Southwest.

Munger also told The Wall Street Journal last month that Berkshire would likely close some of its smaller holdings as a result of the pandemic, but didn’t specify which specific businesses would be affected.

Berkshire Hathaway Vice Chairman Charlie Munger (REUTERS/Rick Wilking)

BERKSHIRE HATHAWAY TO CLOSE SOME BUSINESSES AMID PANDEMIC

The board of directors will have a new member

Bill Gates announced that he was stepping down from Berkshire’s board of directors earlier this year.

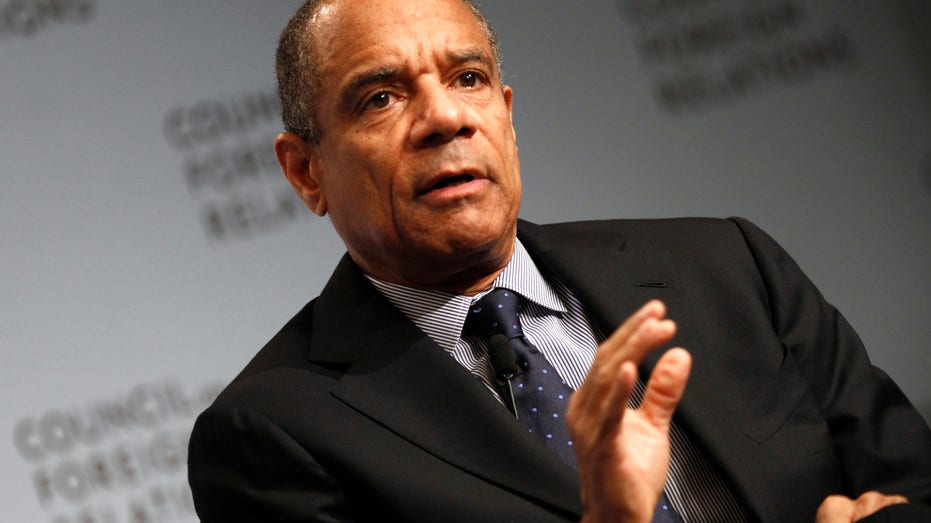

Former American Express co-CEO Kenneth Chenault was nominated to fill the seat vacated by Gates.

Chenault and Berkshire have a history together, as Berkshire has long been AmEx’s largest shareholder.

Kenneth Chenault (REUTERS/Mike Segar)

BERKSHIRE TAPS FORMER AMEX CEO KENNETH CHENAULT FOR BOARD

You can still snag the deals

The big event brings big crowds to Omaha in a normal year. With this year’s meeting being held virtually, the city is missing out on 21.3 million in economic impact, Dow Jones Newswires reported.

Many Berkshire brands offer special promotions for shareholders during the weekend of the event, and they’re still offering the deals even for the remote meeting. Berkshire put up a page on its website with links to all the promotional offers.

Warren Buffett and Charlie Munger are projected on large screens as they preside over a question and answer session during the 2018 shareholders meeting in Omaha, Neb. (AP Photo/Nati Harnik)

BUFFETT’S BERKSHIRE HATHAWAY BUYS KROGER STOCK FOR FIRST TIME

Buffett is preparing for his eventual departure

In his annual letter to shareholders last year, Buffett promised investors that Berkshire is “100 percent prepared” for the departure of its 89-year-old CEO and 96-year-old vice chairman.

“Charlie and I have very pragmatic reasons for wanting to assure Berkshire’s prosperity in the years following our exit: The Mungers have Berkshire holdings that dwarf any of the family’s other investments, and I have a full 99 percent of my net worth lodged in Berkshire stock,” Buffett wrote. “I have never sold any shares and have no plans to do so.”

CLICK HERE TO READ MORE ON FOX BUSINESS