Biden to unveil tax proposal targeting corporations, wealthy

The different taxes would fund Biden's $3.2 trillion in policy proposals

Democratic presidential candidate Joe Biden reportedly intends to pay for $3.2 trillion in policy proposals with new and higher taxes on wealthy Americans and corporations, including a measure aimed at tax-dodging companies like Amazon and Netflix.

The former vice president’s team expects the so-called minimum book tax, which includes a measure targeting companies that have reported paying no federal income taxes in recent years, to raise $400 billion over a decade, according to Bloomberg News, which obtained a copy of the proposal. It would be coupled with separate tax hikes that Biden has already promised.

Biden’s campaign did not respond to FOX Business' request for comment.

Under Biden’s plan, companies like Amazon, Netflix, General Motors, JetBlue and IBM, which reported net income of more than $100 million in the U.S. but paid zero or negative federal income taxes, would be hit with a 10 percent minimum levy on book income. The minimum tax, which Biden’s campaign expects to impact 300 companies, would give credit for foreign taxes paid.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

In 2018, 60 companies paid no federal income tax on $79 billion in U.S. pretax income, according to a report from the Institute on Taxation and Economic Policy, a nonpartisan think tank. Instead of paying $16.4 billion in taxes at the 21 percent corporate rate, the companies received a corporate tax rebate of $4.3 billion.

Biden also called for doubling Gilti, a minimum tax on foreign profits that was reduced to 21 percent as part of the 2017 Tax Cuts and Jobs Act, which would raise an estimated $340 billion in revenues, according to his campaign.

He also introduced a measure to prevent corporations from shifting overseas and outsourcing, calling for $200 billion in sanctions on countries, including Ireland, the Netherlands, the Cayman Islands and Bermuda, that “facilitate illegal corporate tax avoidance and engage in harmful tax competition.”

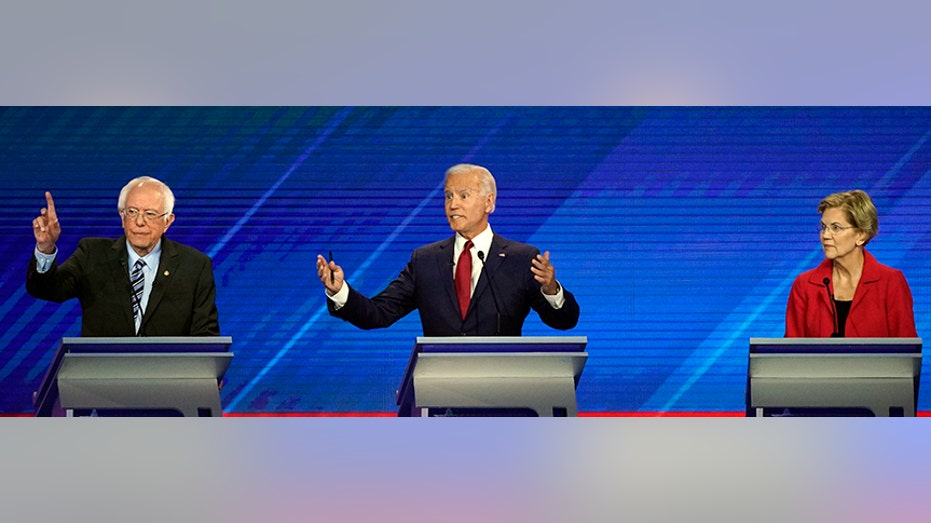

Sen. Elizabeth Warren, D-Mass., right, listens as Sen. Bernie Sanders, I-Vt., left, and former Vice President Joe Biden, right, speak Thursday, Sept. 12, 2019, during a Democratic presidential primary debate hosted by ABC at Texas Southern University

Previously, the Democratic frontrunner said he intends to increase the corporate tax rate, which was slashed to 21 percent from 35 percent as part of Republicans’ tax overhaul, to 28 percent. He also committed to reversing another part of the 2017 tax cuts, lifting the top individual tax rate to 39.6 percent. Those two measures would raise $820 billion in revenues, according to economists cited by Biden’s campaign.

BIDEN SLAMS BUTTIGIEG OVER HEALTH CARE PLAN: 'HE STOLE IT'

Other revenue-raising measures that Biden endorses include ending $40 billion in fossil fuel subsidies and taxing capital gains as ordinary income for taxpayers with more than $1 million in income to raise $800 billion over a decade.

The detailed outline of how Biden intends to pay for all of his spending plans seemed to be a veiled swipe at his progressive rivals, Sens. Bernie Sanders and Elizabeth Warren. Biden has, in particular, pressured Warren to specify how she intends to pay for a number of ambitious and sweeping plans, including Medicare-for-all, universal child care and tuition-free public college.

“The vice president does think it’s very important to be clear with the American people regarding how you’re going to pay for things in order to demonstrate they can actually get it done,” Biden policy director Stef Feldman told Bloomberg.

So far, Biden -- who continues to lead most national and state polls -- has introduced a $1.7 trillion climate and infrastructure plan, a $750 billion health care plan and a $750 billion higher education plan, all totaling $3.2 trillion.

Warren, meanwhile, has introduced a $20.5 trillion health care plan, $3 trillion climate change plan and $1.25 trillion education plan. Sanders has said his health care plan will cost $30 trillion, climate change proposal $16 trillion and education $2.2 trillion.

CLICK HERE TO READ MORE ON FOX BUSINESS