Pre-coronavirus credit card debt carried over for 110M Americans

Americans were already in the red before the COVID-19 pandemic

Get all the latest news on coronavirus and more delivered daily to your inbox. Sign up here.

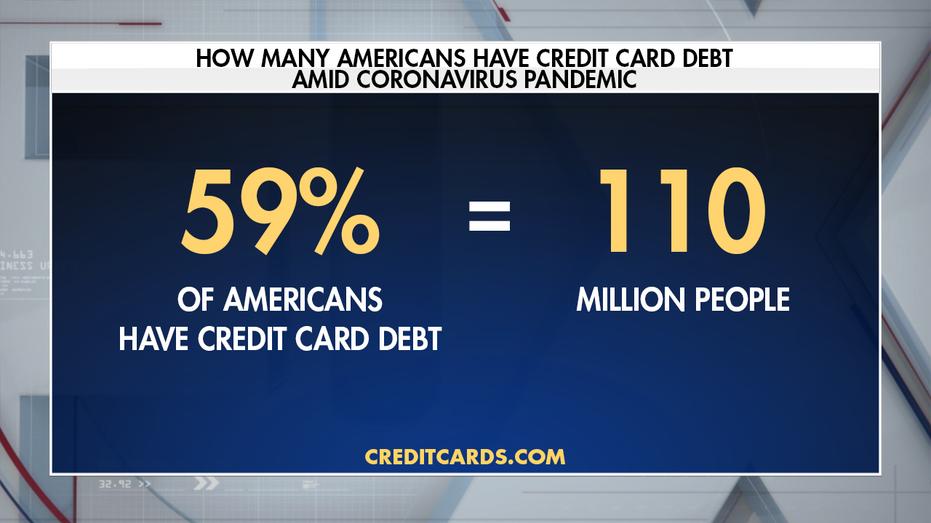

Fifty-nine percent of American credit cardholders entered the coronavirus pandemic with outstanding credit card debt, according to a recent study from CreditCards.com. This percentage is equivalent to around 110 million U.S. adults.

CORONAVIRUS FORCING SOME AMERICANS TO TAKE ON DEBT AS THEY STOCK UP ON SUPPLIES

The study found that of those who had credit card debt, 56 percent (or 61 million) of people were said to be carrying debt for at least one year. At least 27 million of those people have been carrying credit card debt for three years consecutively or more, and at least 17 million of those people have been carrying credit card debt for five years consecutively or more.

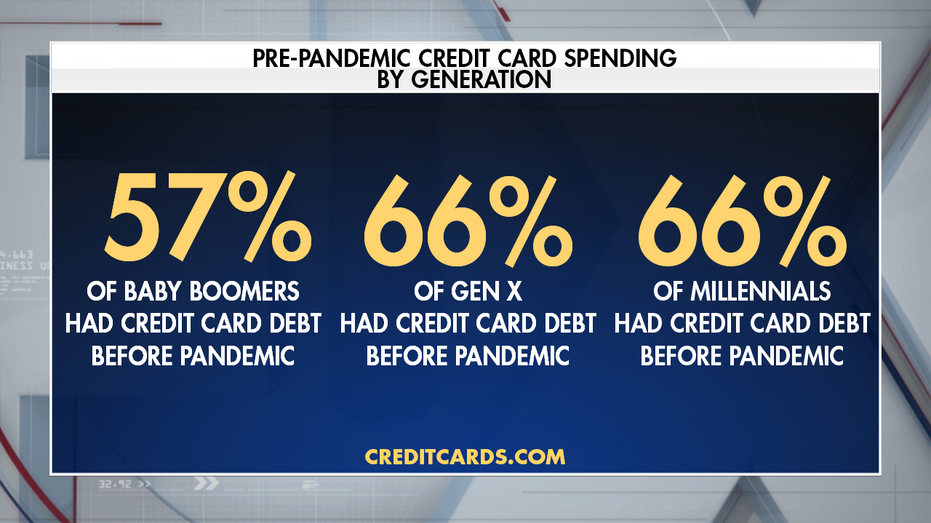

Heading into the pandemic that was officially named as such by the World Health Organization on March 11 – 57 percent of Baby Boomers between the ages of 56 and 74 had outstanding credit card debt while 66 percent of Gen X between the ages of 40 and 55 and Millennials between the ages of 24 and 39 also had credit card debt.

CORONAVIRUS AND TAXES: FILING DO'S AND DON'TS

The other demographic who is most likely to carry credit card debt at the time of the pandemic are parents with kids under age 18, according to CreditCards.com. Seventy-one percent of parents with young children were said to have debt while 55 percent of non-parents were in the same boat.

Low-income individuals who make less than $40,000 and those who don’t have a college degree were also seen to have credit card debt at this critical time.

“The coronavirus outbreak is unfortunate proof that circumstances can change in an instant,” said CreditCards.com analyst Ted Rossman. “What many believed was manageable credit card debt has suddenly turned into a situation of uncertainty.”

AMID CORONAVIRUS, N.J. PIZZERIA OWNER BORROWS $50K TO PAY STAFF

He added, “Debtors who are facing financial hardships because of the pandemic should talk to their issuer immediately to see what types of relief programs are in place. A zero-percent balance transfer credit card can also help spread payments out without accruing interest.”

Of those who had used credit cards before the pandemic, 35 percent said they did so to cover necessary services such as medical care, car repairs and home maintenance. Another 26 percent said they went into the red for basic day-to-day expenses such as groceries, child care or utilities.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

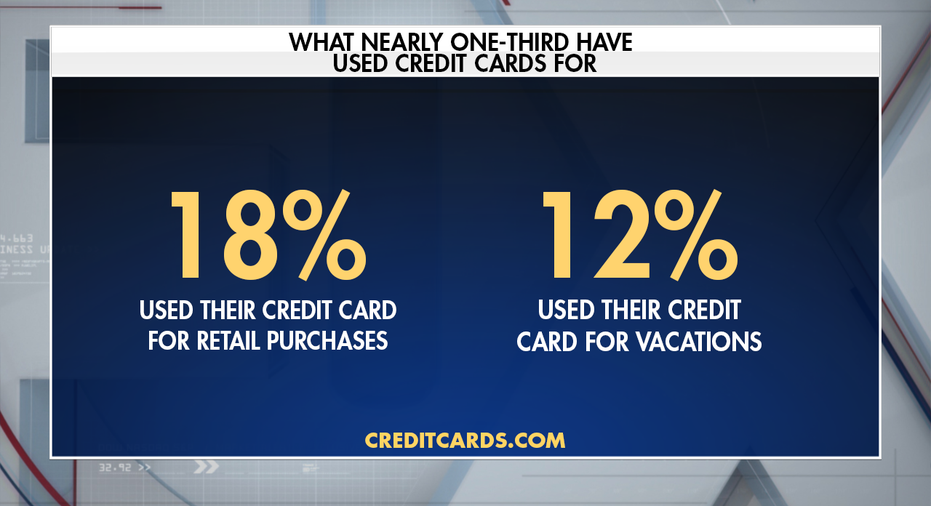

Only 31 percent admitted to using their credit cards for discretionary spending like retail purchases and vacations.

By the time the pandemic ramped up in the U.S., 49 percent of credit card debtors said they were stressed about their debt – 13 percent of which qualified themselves as “very stressed,” according to CreditCards.com.

“Many adults were already teetering on the financial edge, reliant on credit cards to pay for day-to-day bills and emergencies at the start of the COVID-19 outbreak,” Rossman explained. “Credit card rates remain very high, over 17 percent for many cardholders, and Federal Reserve interest rate cuts won’t provide much relief.

CLICK HERE TO READ MORE ON FOX BUSINESS

“Things like payment relief programs, balance transfer cards, and even personal loan debt consolidation are all options right now and should be fully explored to save money and alleviate stress,” he added. “Credit card debtors need to take matters into their own hands.”