Coronavirus made 36% of Americans delay financial milestones

Buying a car or house, going to college, getting married or retiring has taken a backseat during COVID-19

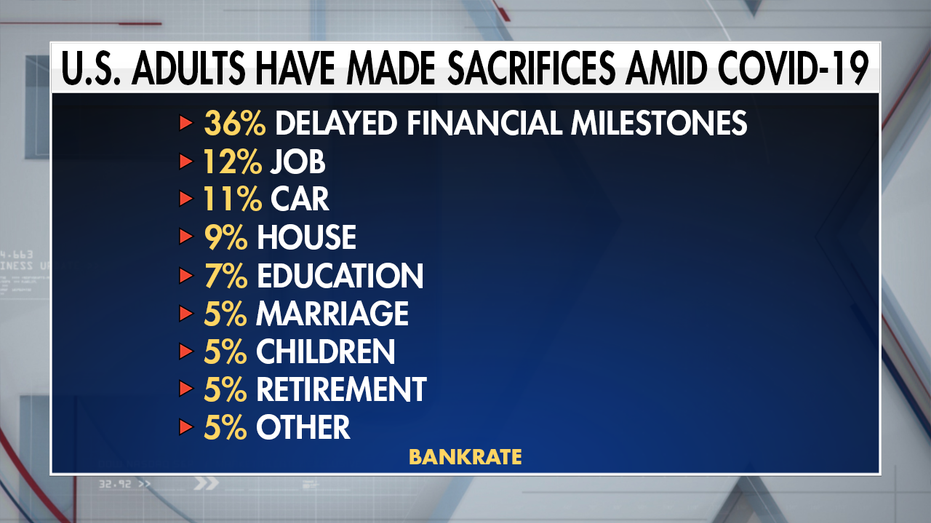

A little more than one in three Americans have delayed at least one major financial milestone due to the coronavirus pandemic, according to a new survey from Bankrate.

These milestones include life events such as finding a new job, buying or leasing a car, buying a home, furthering education, getting married, having children, retiring or similar activities.

HOME OWNERSHIP SHOULD BE A LONG-TERM INVESTMENT: REAL ESTATE EXPERT

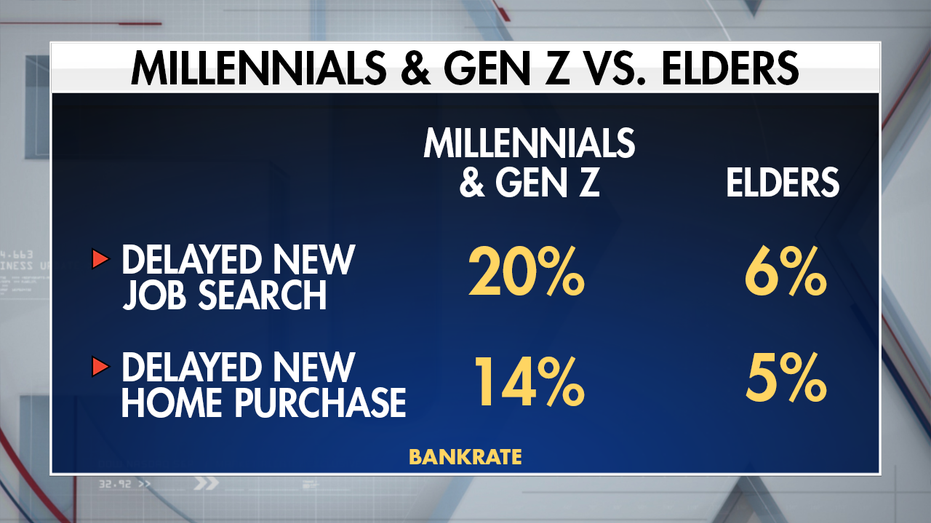

Of those who are making sacrifices to preserve the health of their personal finances, millennials between the ages of 24 and 39 as well as Gen Zers between the ages of 18 and 23 were twice as likely to delay a financial milestone than their older counterparts.

Fifty-two percent of respondents from the combined generations reported putting off major plans compared to 26 percent of those who are age 40 or older. Finding new jobs and purchasing a home were two milestones millennials and Gen Z have largely delayed.

5 SMART MONEY MOVES TO MAKE WHILE YOU QUARANTINE DURING CORONAVIRUS

“Among those often adversely affected by the economic downturn are younger Americans, many of whom are just starting out in their careers,” Bankrate Senior Economic Analyst Mark Hamrick offered as an explanation for the generational difference. “As result of these setbacks, they’ll spend years trying to make up lost income and career opportunity.”

Conversely, Baby Boomers who are close to leaving the workforce have delayed their retirement as the pandemic has brought out uncertainty. Seventy-one percent of Baby Boomer respondents told Bankrate they have postponed their retirement by at least six months while 38 percent have postponed their retirement indefinitely.

WORKERS TAP RETIREMENT SAVINGS TO COPE WITH CORONAVIRUS PANDEMIC

“Of those putting off retirement in the wake of the pandemic, nearly 2 in 5 Americans say the delay is indefinite,” Hamrick shared. “This adds further insult to financial injury for those struggling to meet their retirement savings goals, opting to remain employed longer than hoped.”

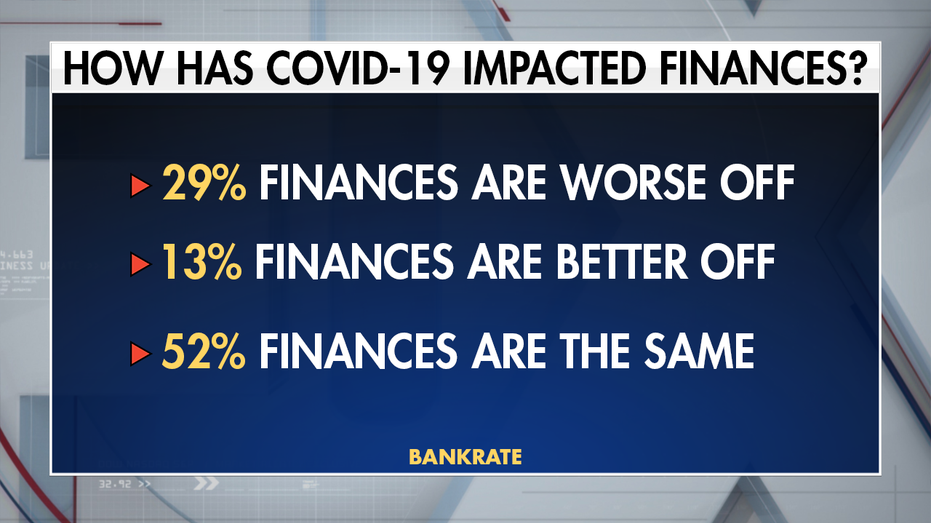

More than one-quarter of U.S. adults said their financial situation has gotten worse amid the coronavirus pandemic while more than one-tenth of U.S. adults said their financial situation has gotten better.

However, more than half of U.S. adults reported that their financial situation has remained the same.

READ MORE ON FOX BUSINESS BY CLICKING HERE

Not so surprisingly, the people who have said that the pandemic has made their finances take a turn for the worse also had to delay major milestones at a higher rate. Fifty-four percent of these individuals reported they had to delay at least one event versus the 26 percent of those whose finances stayed the same.

Cars were the top of the list of the postponed milestones at 20 percent for people who are experiencing financial hardship. Next on the list was finding a new job at 19 percent, buying a new home at 15 percent, furthering education at 10 percent and retiring at 7 percent.

CLICK HERE TO READ MORE ON FOX BUSINESS

“A kind of unseen toll of the downturn is the paused pursuit of dreams including retirement, marriage and major purchases such as homes and vehicles,” said Hamrick. “Beyond the personal toll on individuals, these delays serve to further restrain employment and the broader economy.”