Coronavirus threatens surging global wealth: Report

US leads with nearly 39% of world's wealthy individuals, but could COVID-19 change global success?

Get all the latest news on coronavirus and more delivered daily to your inbox. Sign up here.

Global wealth has more than doubled over the last decade in the wake of the devastating financial crisis of 2008. But the novel coronavirus has "had a considerable impact on the wealthy" -- largely creating unforeseen challenges and threatening their otherwise solid fortune, according to a recently released report.

“A Decade of Wealth,” a Wealth-X report published Thursday, describes how the U.S. leads the world in its individual wealth, producing almost 39 percent of the world’s wealthy individuals.

HOW THE RICH FIGHT CORONAVIRUS

“The US is by far the world’s largest wealth market and cemented its leading position over the past decade,” the report states, noting that the nation got a “sizeable boost” in its wealthy population in 2019. “The world’s largest economy is backed by the US dollar’s global reserve currency status, underpinned by dominant financial services and technology sectors, and enjoys a business environment largely supportive of private enterprise and competition.”

"A Decade of Wealth," page 2 (Wealth-X)

WEALTHY NEW YORKERS ARE SHOOTING GUNS, RELAXING AT 'SPORTING RETREATS'

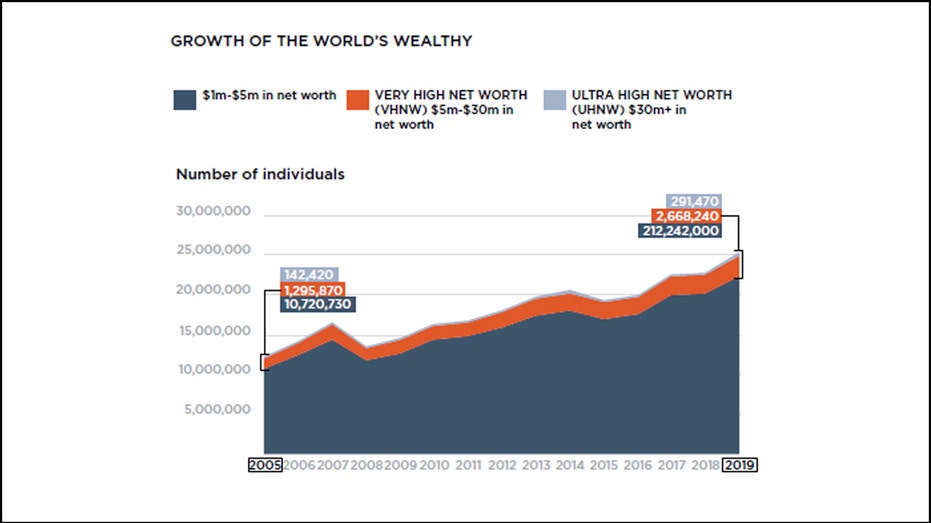

Wealth-X classifies “wealth” using a three-tier system: high-net-worth individuals boast $1 million to $5 million and more than 212.2 million people worldwide fell into this category in 2019. As of that same year, there were more than 2.6 million “Very High Net Worth” individuals, or those who have between $5 million and $30 million. While only 291,470 people are considered “Ultra High Net Worth,” worth $30 million or more.

The U.S. produced an estimated 35.9 percent of the world’s VHNW and UHNW individuals, while China is second with 9.7 percent, according to the report. And New York has replaced Tokyo in leading the list of “Top 10 Cities by Wealthy Population 2019,” with 120,605 VHNW and UHNW individuals. The Japanese city is now second with 81,645.

"A Decade of Wealth," page 2 (Wealth-X)

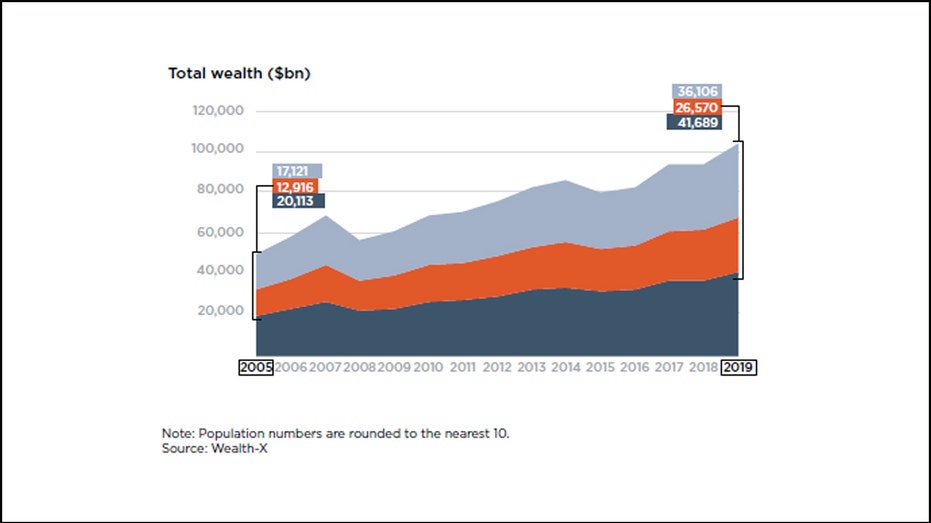

“Over the past decade, the rise in wealth was propelled by strong economic growth in Asia and other emerging economies, continued urbanization, transformative advances in digitalization (led by US tech giants) and, perhaps most of all, a period of unprecedented liquidity from global central banks,” the report states. “Initially an emergency policy response to the 2008-09 global financial crisis that bad damaged wealth portfolios, a constant flow of monetary stimulus supported a record-breaking bull market in global equities between 2010 and 2019.”

But the COVID-19 pandemic has led to “dramatic falls in economic output and volatile shifts in financial markets.”'

CORONAVIRUS PREP FOR THE UBER WEALTHY

“Not only has it brought to an immediate halt the unbroken upward trend in growth over the past decade, it has also threatened a sharp correction in world asset markets and increased the risk of intensifying global rivalries, particularly between the US and China,” the report states.

As a result, the wealthy, many of whom are business owners are likely left questioning “the resilience of their financial holdings and businesses.”

“Stock markets continue to gyrate, while markets in real estate and other luxury goods, such as yachts, are effectively frozen, with prices on the way down,” the report states.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

It leaves some wondering how their businesses will weather the storm, and if they should make more liquid assets available.

“The wealthy will be facing other business challenges, too, such as ensuring staff well-being, deciding when to restart operations (if relevant), as well as preparing their business for when the economy begins to open again,” the report states. “These worries are worsened by the uncertainty of the situation – whether the downturn will last a few months or considerably longer; for how long and how effectively governments and central banks will be able to help; and what form an economic recovery will take once it occurs."

CLICK HERE TO READ MORE ON FOX BUSINESS