Holiday spending for Americans expected to mirror last year

A majority of Americans are choosing to not go into holiday debt for 2019. Here's why.

If your holiday spending isn't going to be exorbitant this year, you're not alone.

A personal finance survey from Bankrate found that nearly three-quarters of U.S. adults have no plans to increase their spending during the season of giving. Moreover, 22 percent plan to spend less than they did in 2018.

MILLENNIALS ARE MOST ACCEPTING OF GOING INTO HOLIDAY DEBT

"It is heartening to see that so many Americans plan to avoid going into debt for holiday purchases, helping to avert a financial hangover in the new year," said Bankrate Senior Economic Analyst Mark Hamrick in the report.

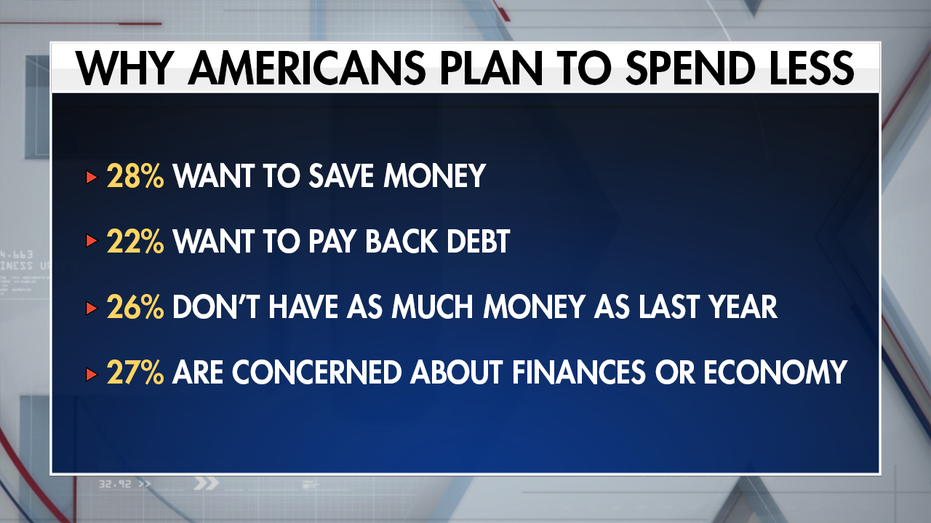

However, Americans have different reasons for why they are not spending more. Over a quarter said they are focused on saving money while over a fifth said they are focused on paying back debt. Twenty-six percent admitted that they don't have as much money as they did the previous year.

Likewise, twenty-seven percent share they are concerned about the state of their finances and the economy. Of those who said they were concerned, 33 percent were millennials between the ages of 23 and 29 – which is higher than older generations.

GENERATIONAL HOLIDAY SPENDING FOR 2019

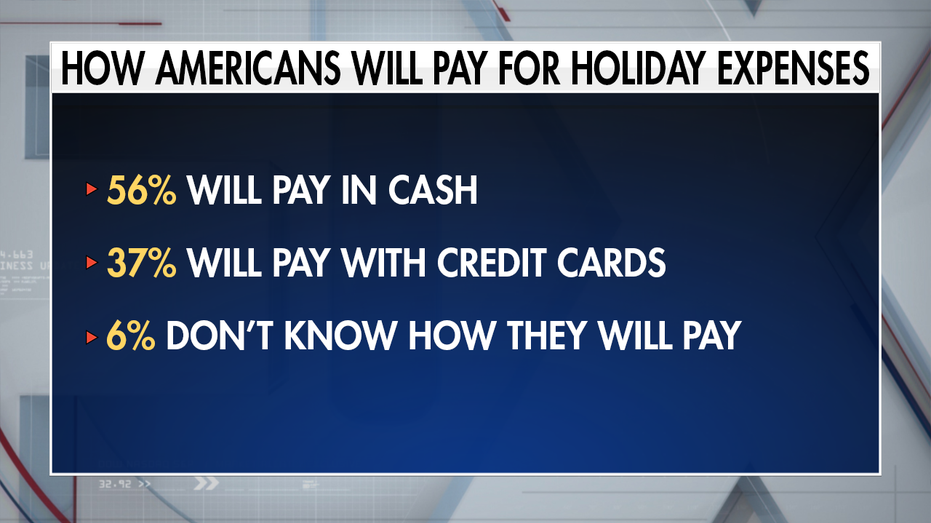

When it comes down to how Americans plan to pay for gifts this year, more than half are in agreement with Hamrick's assertion that shoppers are forgoing debt. In fact, 56 percent said they plan to pay for all their purchases with money they already have.

Thirty-seven percent said they will use a credit card to pay for at least a portion of their holiday expenses.

"For these individuals, we recommend paying the debt or balance off within the billing cycle before costly interest charges hit," Hamrick said.

Six percent admitted that they are unsure of how they will finance their holiday expenses.

IS IT TOO SOON FOR HOLIDAY SHOPPING?

Bankrate found that spending expectations vary by demographic. Low-income households reported more conservative spending habits while households that earn more are not as likely to spend less than they did the previous year.

"While 46 percent of those living in the lowest income households will spend about the same as last year, they are the most conservative group when it comes it holiday spending, with 24 percent of those earning under $30,000/year reporting they will spend less this year than last year versus 18 percent of those earning $80,000/year or more saying the same."

Over a third of the lowest earners cited not having as much money to spend as they did in 2018 while less than an eighth of the highest earners cited the same.

Lower-income households also showed a higher concern over personal finances and the economy – with 31 percent who said this concern is why they plan to spend less. Only 20 percent of higher-income households reported feeling the same way.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

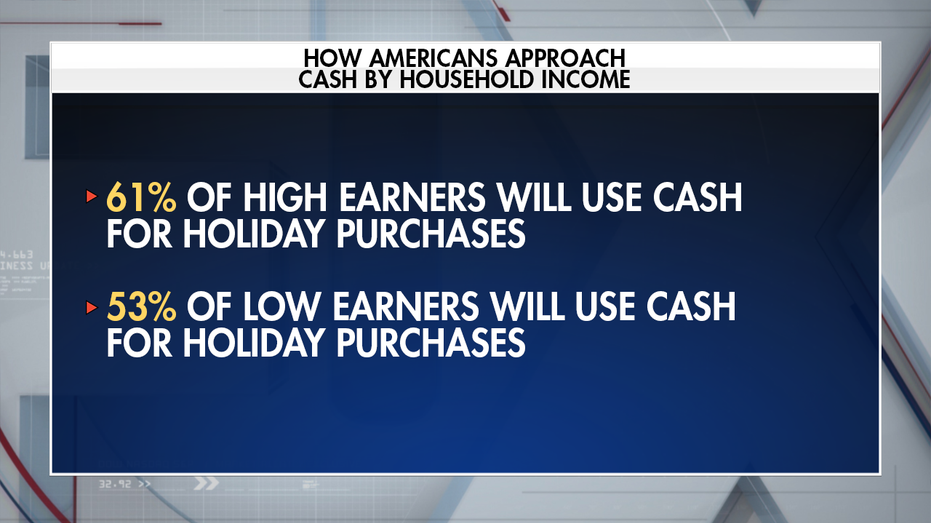

Although low-income households display caution when it comes down to holiday spending, the report found they "are not as prepared to pay for their holiday expenses as the highest earners are."

A little more than three-fifths of high-income households said they will pay for holiday purchases with money they already have while slightly more than half of low-income households said they will do the same.

Additionally, 10 percent of low-income households don’t know how they will pay for their holiday purchases. This number is eight percent higher than what high-income households reported.

CLICK HERE TO READ MORE ON FOX BUSINESS

Out of all the generations, Bankrate found that Baby Boomers are most likely to pay for their holiday expenses entirely with saved cash versus using a credit card because “their financial lives [are] more settled.”