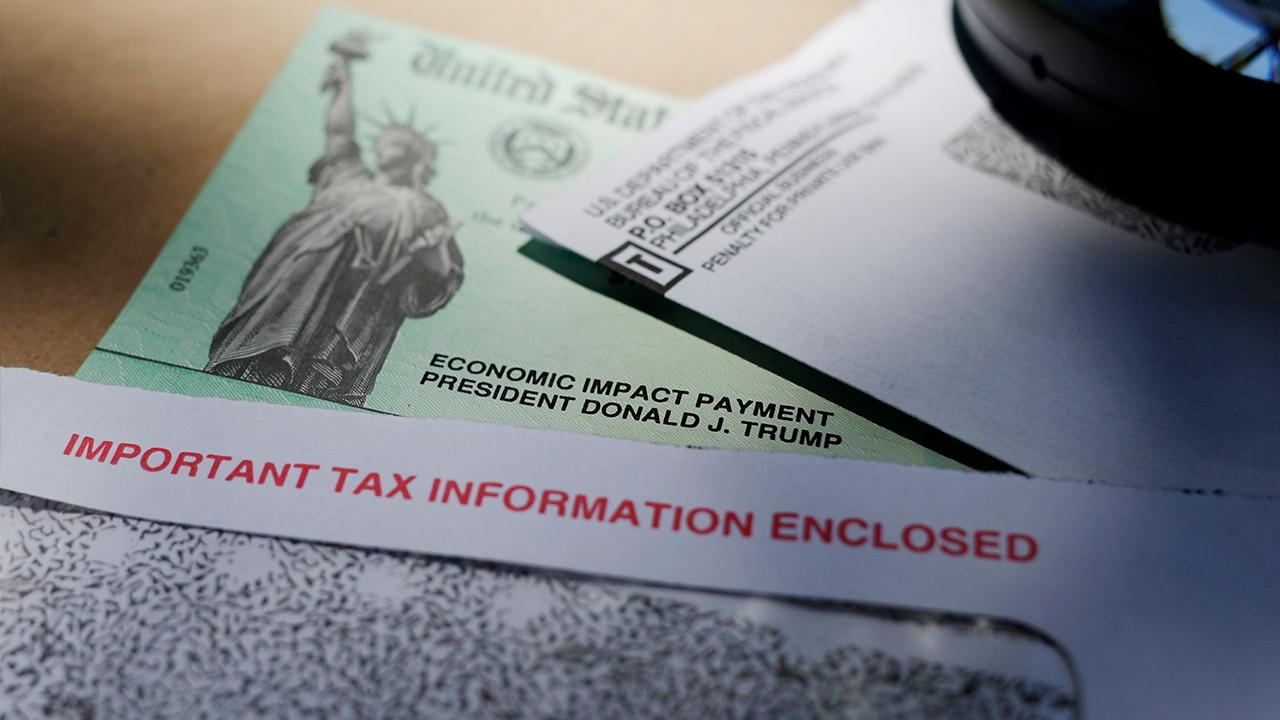

IRS asks inmates to return economic impact payments

The payments, however, were not prohibited under CARES Act

The IRS has administered more than 150 million economic impact payments to American households – but now it is asking for some checks to be sent back.

In an update on its website, the tax agency said inmates are not eligible for the $1,200 checks and it is asking for the payments to be returned.

In situations where a joint payment was made to a couple where one spouse is incarcerated the IRS is asking the half belonging to the incarcerated individual to be returned.

A spokesperson for the IRS did not return FOX Business’ request for comment.

THE IRS SAYS CORONAVIRUS ECONOMIC IMPACT PAYMENTS CAN BE SEIZED FOR THIS REASON

The reason that an inmate may receive an economic impact payment is because the IRS based payments on the most recent tax filings it had on file for individuals from tax years 2018 or 2019.

The guidance has sparked some pushback among lawyers, who question whether the IRS has the authority to take back the payments, which weren’t prohibited under the CARES Act.

TRUMP ADMINISTRATION EXPANDS PPP LOAN ACCESS FOR BORROWERS WITH FELONY CONVICTIONS

Kelly Erb, managing attorney at Erb Law and author of the blog Taxgirl.com, told FOX Business she believes the seizures aren’t legally appropriate because the law doesn’t specifically disallow these individuals from receiving the money.

On her blog, Erb noted there is no guidance as to what people should do if the checks have already been cashed or spent.

CLICK HERE TO READ MORE ON FOX BUSINESS

Recently, the Trump administration eased Paycheck Protection Program limitations on business owners with felony convictions.

Checks sent to inmates can be returned by following instructions provided by the tax agency, which differ slightly based on the method depending on how the money was received (paper check, prepaid debit card, etc.)

As previously reported by FOX Business, the only reason the IRS can garnish a payment is for back-due child support.