Medicare-for-all is unpopular with voters in these key states

Almost two-thirds of voters in key swing states think Medicare-for-all is a bad idea

A majority of voters in states that could determine the outcome of the 2020 presidential election believe Medicare-for-all is a bad idea, according to a new survey.

In key swing states — which include Wisconsin, Pennsylvania, Michigan and Minnesota, among others — 62 percent of voters said a national health plan in which all Americans receive their health coverage through a single-payer system was not a good idea, according to a poll conducted by the Kaiser Family Foundation and Cook Political Report.

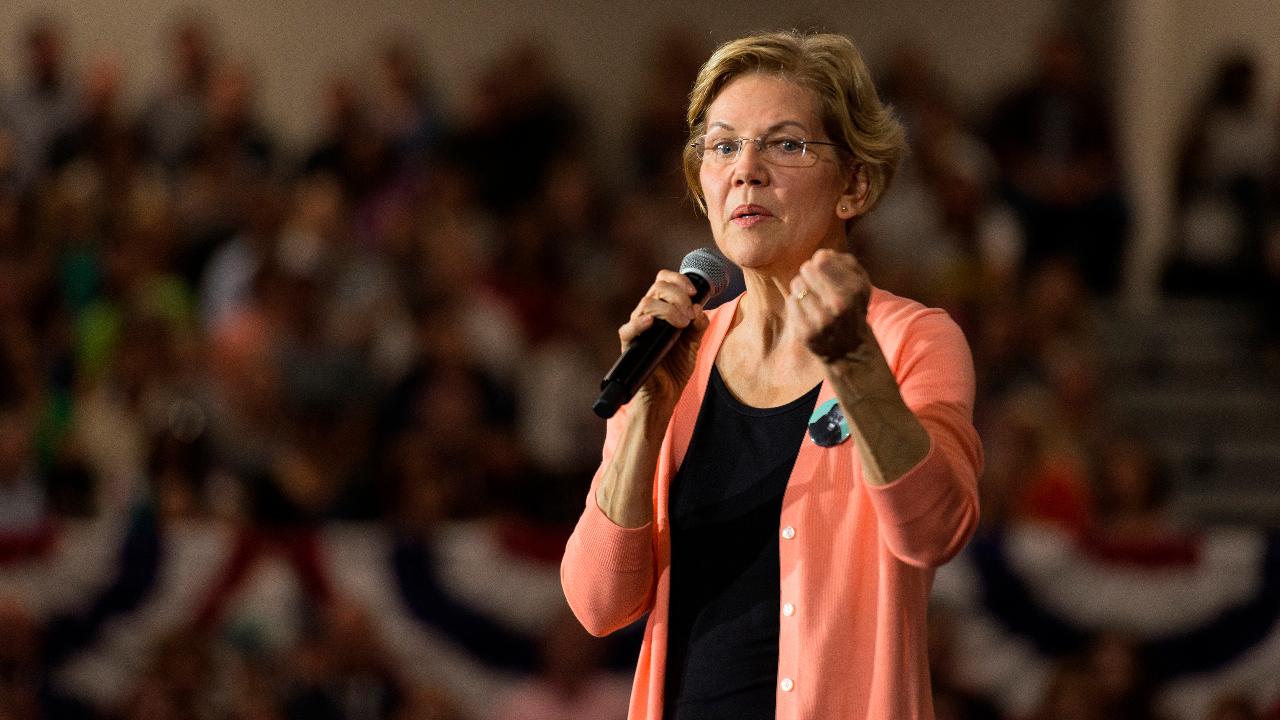

The poll comes amid a fracture between the candidates seeking the Democratic presidential nomination. Progressive Sens. Bernie Sanders and Elizabeth Warren have endorsed Medicare-for-all, proposing sweeping, multi-trillion-dollar plans, while more moderate candidates, including former Vice President Joe Biden and South Bend, Indiana Mayor Pete Buttigieg favor expanding coverage under the Obama-era Affordable Care Act.

ELIZABETH WARREN CAPITALIZES ON BILLIONAIRES' ATTACKS, A TACTIC STRAIGHT FROM FDR'S PLAYBOOK

Nationwide, Medicare-for-all is popular among Democratic voters, according to the study, with 62 percent of respondents saying they believe it’s a “good idea.”

In a piece penned for Axios last week, Kaiser Family Foundation CEO Drew Altman argued that support for Medicare-for-all is “headed in the wrong direction.” In 2000, 40 percent of voters favored a single-payer system. That peaked at 59 percent in March 2018, but slipped back to 51 percent by October of this year.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Sanders, I-Vt., and Warren, D-Mass., have both weathered criticism from Democrats and Republicans about how they’ll pay for the expansive, and expensive, plans.

FILE - In this April 4, 2018, file photo, U.S. Sen. Bernie Sanders, I-Vt., responds to a question during a town hall meeting in Jackson, Miss. (AP Photo/Rogelio V. Solis, File) (AP Photo/Rogelio V. Solis)

Over the summer, Sanders acknowledged that he would raise taxes on the middle-class in order to pay for his single-payer system, but insisted that most Americans would see their overall costs fall because they would no longer be on the hook for deductibles, copays or premiums. A family currently paying $20,000 for private insurance would see that obligation eliminated, he said, though taxes could increase by $10,000.

“Is that a good deal? I think it’s a pretty good deal,” he said at the time.

Warren, meanwhile, went to painstaking lengths to avoid a middle-class tax hike, instead introducing a slew of new taxes including ones on the wealthy and Wall Street.