Millennials are most accepting of going into holiday debt

Millennials are commonly known as the generation that is most willing to take on debt, and the holidays are no exception.

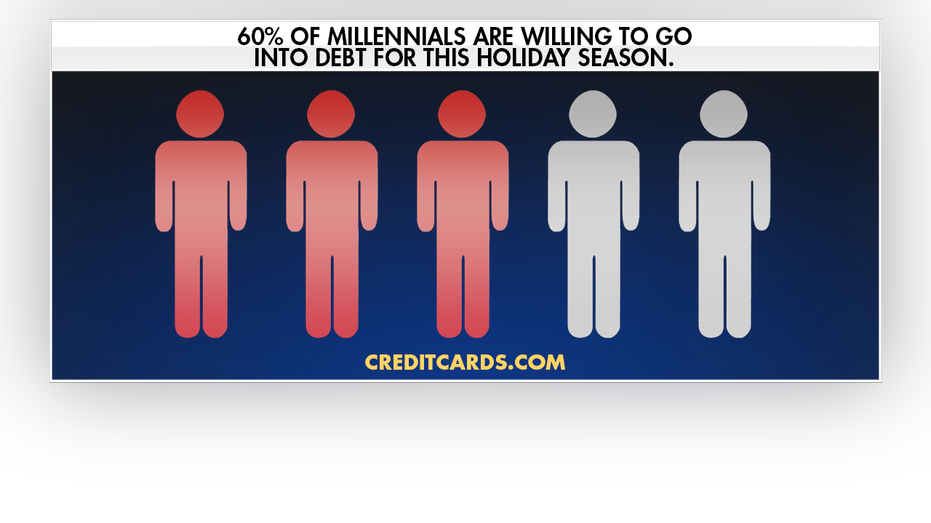

In fact, millennials from ages 23 to 38 are “more tolerant of accruing debt” during the season of giving, according to a study released by CreditCards.com on Monday.

A total sample size of 2,571 adults, which included 2,143 credit cardholders, found that more than half of millennials believe it is acceptable to finance holiday spending. Specifically, 52 percent responded to the survey in agreement that it is alright to go into the red for the season.

IS IT TOO SOON FOR HOLIDAY SHOPPING?

Three in five millennials, however, admitted that they are willing to go into debt for the 2019 holiday season.

These results are a stark contrast to more seasoned credit cardholders. Thirty-eight percent of Gen X respondents from ages 39 to 54 said it was acceptable to pile on debt during the holidays while only 28 percent of baby boomer respondents from ages 55 to 73 agreed.

Despite the responses, 49 percent of Gen X candidates are willing to go into the red for the holidays this year while 34 percent of baby boomer candidates said the same, according to the study.

With all generations combined, 45 percent of credit cardholders are willing to rack up a bill for this holiday season. Thirty-eight percent believe the holidays are a decent excuse for swiping their cards.

THE HOTTEST HOLIDAY TOYS FOR 2019

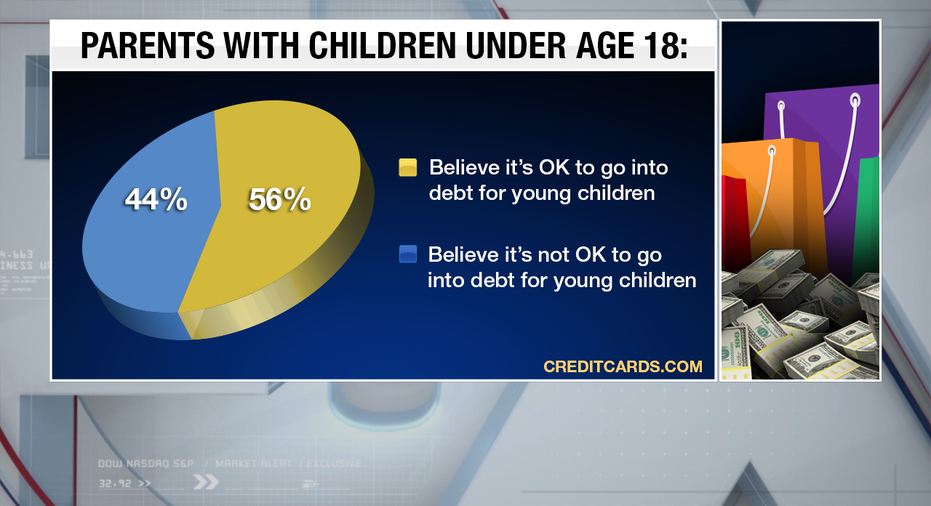

Not so surprisingly, parents are willing to splurge to make their children happy. Thirty-eight percent of cardholders who said they may take on debt this holiday season will do so to bring a smile to their child’s face. Nearly two-thirds of parents with young children are most willing to accumulate debt and more than half believe it is an acceptable thing to do.

Another 38 percent of respondents revealed that O. Henry’s Christmastime feel-good short story, “The Gift of the Magi,” still holds true in 2019 with this group admitting that they’re willing to take on holiday debt to please their spouse or partner.

Interestingly enough, the study also found that half of credit cardholding men in the survey are willing to go into holiday-related debt, which is nine percent higher than what women responded. Forty-three percent of men said they think it is acceptable to spend this way while 34 percent of women expressed the same sentiment.

Family, friends and individuals weren’t left out of CreditCard.com’s survey either. Forty-six percent of respondents said they were willing to go into debt to bring joy to a different family member or friend during the holiday. Likewise, 42 percent responded that they do so to make themselves happy.

THIS HOLIDAY SEASON WILL BE THE SHORTEST SINCE 2013

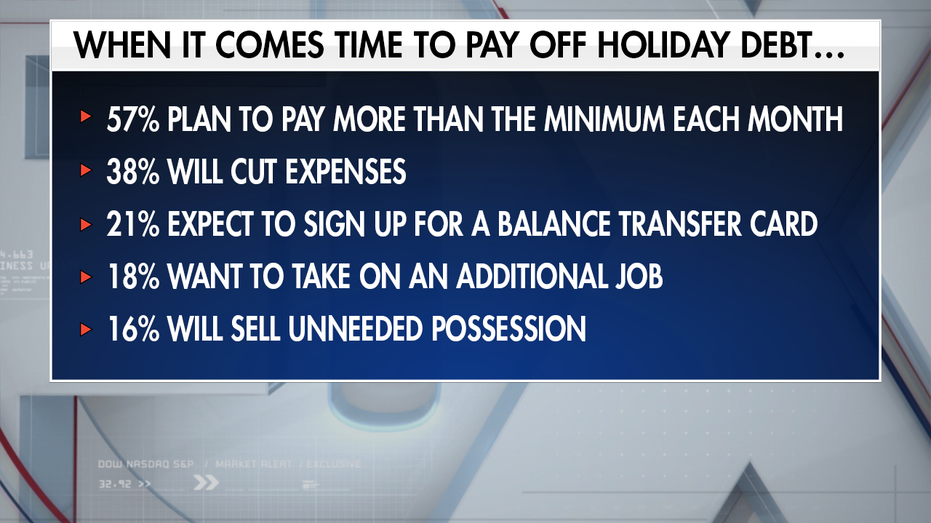

How are people planning to pay off their holiday debt? According to the study, shoppers are trying a mix of strategies that range from making higher payments and cutting expenses to signing up for new credit cards and seeking alternative income.

People who already have credit card debt are more likely to add to their existing balance come holiday time.

The study found that 61 percent of those who have an active balance said they are “willing to add to their deficit” for the upcoming holiday season, which is more double that of the 30 percent of cardholders who do not have debt.

Slightly more than half of credit card debtors responded that they believe the holidays are an adequate reason for taking on more debt while just 26 percent without debt agreed.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

CreditCard.com’s industry analyst Ted Rossman said, “Credit card debt is easy to get into and hard to get out of. Most people in credit card debt have been there for at least a year. You don’t want to be paying off Christmas 2019 in 2020 and beyond.”

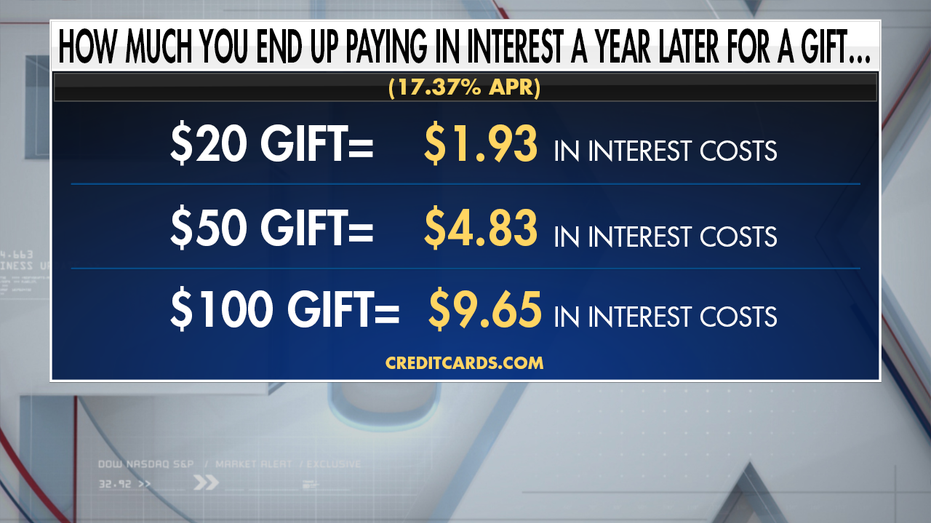

According to an Oct. 30 report from CreditCards.com, the average credit card APR “held steady at 17.37 percent.” Putting off payments for a $20, $50 or $100 gift for 12 months would result in the above interest rates, according to calculations from CreditCards.com’s Payoff Calculator.

However, Rossman believes holiday shoppers can benefit from making purchases outside of the actual holiday season.

“Financing your holiday expenses with a credit card costs about 20 percent extra because credit card rates are so high,” he explained. “Better strategies would be to plan ahead – set aside a dedicated amount each month throughout the year or take on that side hustle or sell those unnecessary purchases ahead of time.”

CLICK HERE TO READ MORE ON FOX BUSINESS

As alternatives, he said shoppers can sign up for a zero percent balance transfer or an intro APR credit card.