Wall Street Pioneer: Invest like a man to avoid these expensive money mistakes

Women who don't invest can lose hundreds of thousands over the course of their lives

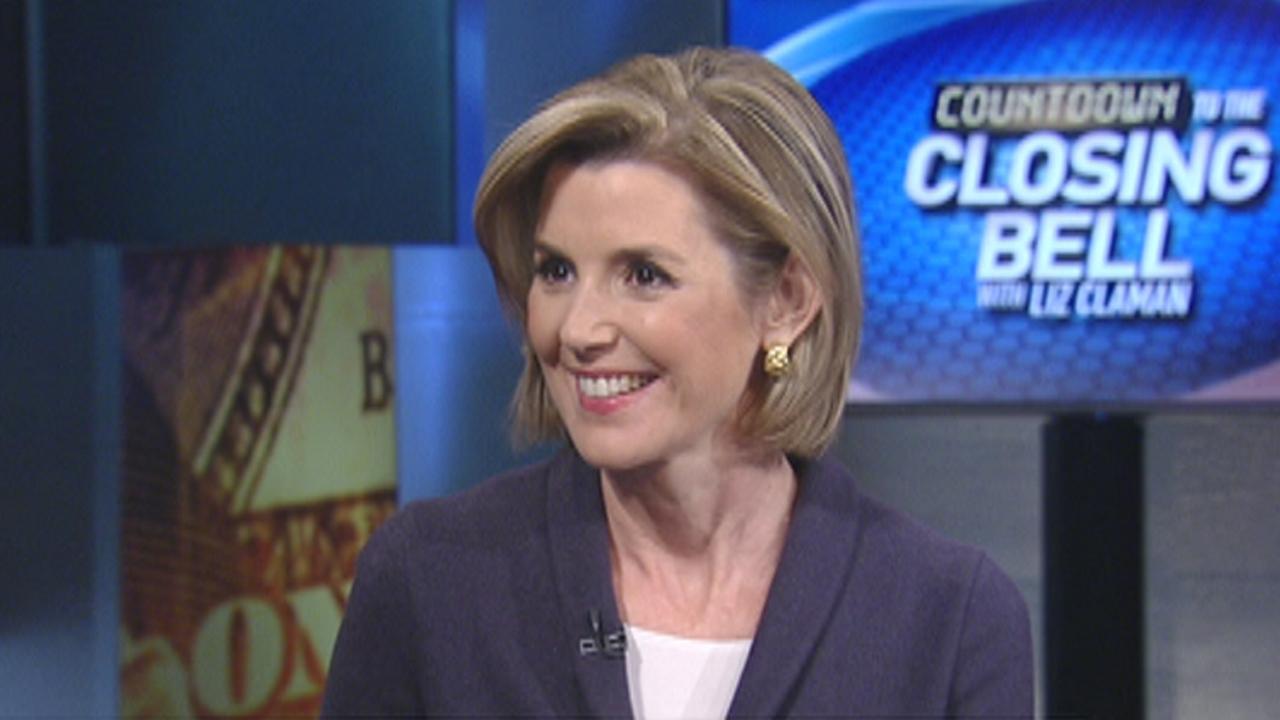

Sallie Krawcheck is bullish about getting women to take the reins on their finances.

The founder of the robo-advising investment platform Ellevest, and one of the most senior women to ever work on Wall Street learned early on that she needed to be in control of her money.

“It started in my 20s with my now ex-husband in charge of my money. He handled the money and I handled the dinner parties with friends,” Krawcheck told FOX Business.

Krawcheck started her career as an equity analyst and worked her way to become the CEO of Citigroup’s wealth management business. She also served as president of Bank of America’s wealth management unit. Fed up with negative stigmas surrounding women and money, she founded Ellevest in 2016 to empower other women to invest in their financial futures – no matter how much they make.

“The biggest money mistake I see is women don’t invest as much as men do.”

“Not investing is so easy to put off because we have been socialized to view it as difficult, full of jargon, challenging and that we’re not good at it," Krawcheck told FOX Business.

Women who don't invest can lose hundreds of thousands and even millions over the course of their lives, Krawcheck says. And those who do invest end up outperforming men when it comes to investment returns. Female investors returned on average 0.81 percent more than men over a three-year period, according to a 2018 study by investment platform Hargreaves Lansdown.

Sallie Krawcheck, founder and CEO of Ellevest, an investment platform for women.

WOMEN CEOS FIND DOUBLE STANDARDS EXTEND BEYOND THE GLASS CEILING: STUDY

Another mistake Krawcheck says some women make when trying to save money is not paying outstanding credit card debt off first. “There are some financial gurus who have given damaging advice to build an emergency fund before paying off credit card debt. If you have $10,000 in credit card debt and a $10,000 emergency fund you should have zero and zero,” she said.

ARE WOMEN BETTER AT INVESTING THAN MEN?

Krawcheck advises women struggling to pay off debt to lean into the 50-20-30 budgeting rule of spending up to 50 percent of after-tax income on financial obligations like rent and other bills, and allocating the remaining 20 percent to savings and debt and 30% to anything else.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Krawcheck says she’s made some of her own biggest money mistakes when she was working on Wall Street during the financial crisis.

“I started a job running Merrill Lynch and Bank of America on a handshake instead of a firm contract. I’ve always been a 'word is my bond' kind of gal.' That’s what Wall Street was. I was told they couldn’t have a firm contract of compensation because we were going through the financial crisis and the regulators wouldn’t allow it and I didn’t make nearly the amount of money I had the handshake on,” she said.

“The next CEO said, ‘this is what we’re paying you.’ I sometimes say because I bought the stock of the company as a show of support and the stock went down – I love to joke that I paid to work at Bank of America.”

A number of investing apps have made saving money simply and accessible. Apps like Acorns let users save up their "spare change" by rounding up purchases to the nearest dollar and automatically investing the extra coins.

CLICK HERE TO READ MORE ON FOX BUSINESS