Tesla's Elon Musk set to become a bigger cash cow

Elon Musk's net worth of $40 billion is inline to get a nice boost

As the coronavirus ravages the shares of industries such as the airlines and department stores, Tesla's stock has managed to shine.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| TSLA | TESLA INC. | 411.11 | +13.90 | +3.50% |

The stock has advanced 84 percent this year, while the broader S&P 500 has dropped over 11 percent.

TESLA SHARES ZOOM TOWARDS RECORD 10-DAY WINNING STREAK

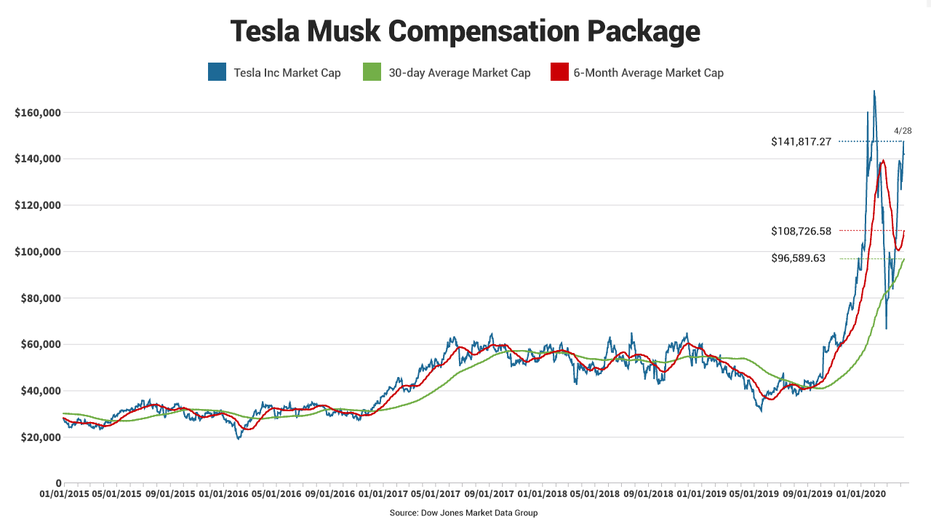

The upward climb has ballooned the electric vehicle maker's market value to a six-month average of $96.59 billion, as tracked by Dow Jones Market Data Group.

If and when that figure nabs $100 billion Musk has an option to buy 1.69 million shares of Tesla stock for $350.02 per share.

Tesla stock closed at $769.12 on Tuesday. If Musk were to sell the 1.69 million at that price, minus what he laid out for the initial purchase, he could net around $700 million.

CITADEL'S KEN GRIFFIN REPORTS TESLA STAKE

But for the options to vest, the market capitalization has to average above $100 billion for the next six months, and it has to be above $100 billion for the next 30 business days, according to the compensation packages contained in company filings with the U.S. Securities and Exchange Commission, as reported by the Associated Press.

With Tesla's earnings on tap Wednesday, CEO Elon Musk, whose net worth is already sitting at $40 billion per Forbes, could see that number, on paper, jump in just a matter of days if the quarter is well received by investors.

As for first-quarter results due after the close of trading, the impact of factory closures due to the pandemic in the U.S. and China could take a toll. Sales are expected to come in around $5.9 billion while a $0.36 per-share loss is expected, as tracked by Refinitiv.

TESLA DOES IT AGAIN, SILENCING CRITICS

The carmaker, which has been known to swing between profits and losses, blew past estimates during the fourth quarter posting revenue of $7.38 billion and net income of $2.14 per share. Cash on hand rose to $6.3 billion.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

"For most of 2019, nearly all orders came from new buyers that did not hold a prior reservation, demonstrating significant reach beyond those who showed early interest. Amazingly, this was accomplished without any spend on advertising" the company stated in its January update.