Trump's tax cuts reduce US burden to one of lowest in the world

Taxes in France and Denmark are nearly twice what they are in the US

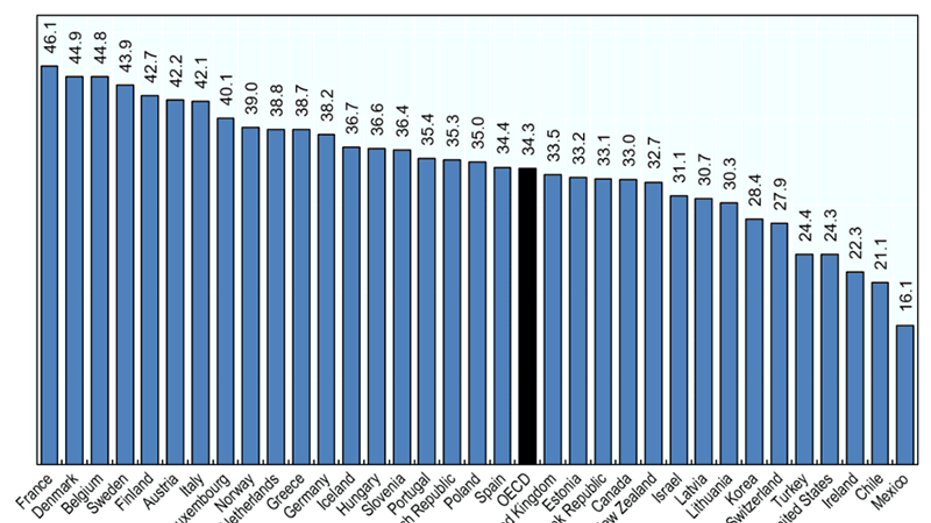

President Trump’s 2017 tax cuts pushed the U.S. tax burden to one of the lowest in the world among major economies, according to a report released Thursday.

In 2018, U.S. tax burdens plummeted as a result of the Republican-passed $1.5 trillion tax cuts, sending U.S. revenue lower than all but three countries in the Organization of Economic Cooperation and Development, the intergovernmental agency said in the report.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Driven by the major tax reforms that Trump signed into law at the end of 2017 — the law slashed the corporate tax rate to 21 percent from 35 percent and temporarily reduced individual taxes — U.S. taxes at all levels of government fell to 24.3 percent of GDP last year, compared to 26.8 percent in 2017, 25.9 percent in 2016 and 23.5 percent in 2010. The 2.5 percentage point drop was the largest among all OECD countries, though 15 other countries experienced a decrease in taxes.

Only Ireland, Chile and Mexico had a lower tax burden than the U.S., which was exactly 10 percentage points lower than the OECD average. A majority of countries recorded a tax burden of somewhere between 30 percent to 40 percent of their total GDP.

Four countries — France, Denmark, Belgium and Sweden — had tax-to-GDP ratios above 43 percent, while four more, Finland, Austria, Italy and Luxembourg, saw their tax burden hovering above 40 percent. Taxes in France, which were the highest among OECD countries at 46.1 percent, and Denmark, at 44.9 percent, are nearly twice what they are in the U.S.

HERE ARE THE 10 RICHEST TOWNS IN AMERICA

Still, a previous OECD report found that the U.S. spends significantly less on public social programs than some European countries, including Finland, France, Austria, Belgium, Denmark and Germany.

Overall, tax revenues were little changed since 2017, the report found, ending a trend of annual increases in the tax-to-GDP ratio that began in the wake of the financial crisis.

The report analyzed federal, state and local taxes, as well as contributions toward Social Security funds.