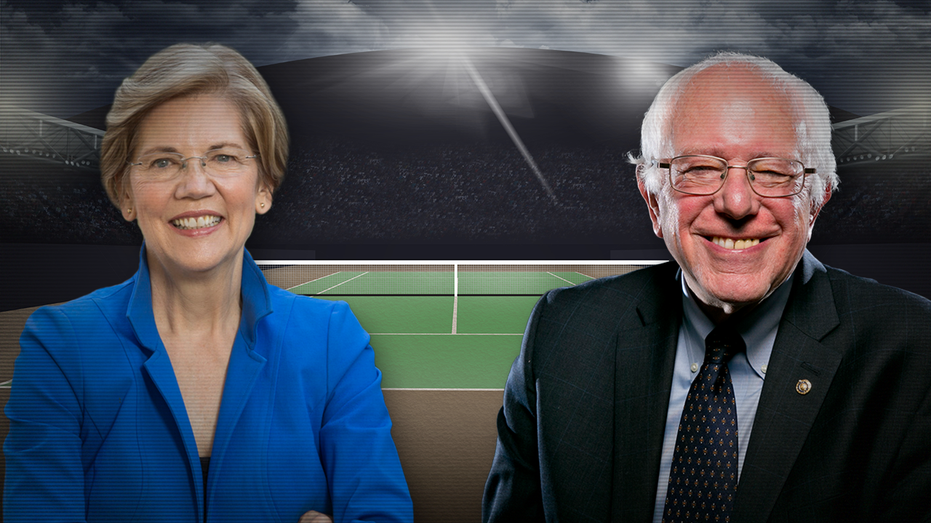

Warren's, Sanders’ wealth taxes could cost American workers $1T, economists say

The taxes would raise trillions of dollars in revenue to expand sweeping new social programs, such as Medicare-for-all and tuition-free public college

A wealth tax endorsed by Democratic presidential candidates Elizabeth Warren and Bernie Sanders could cost American workers more than $1 trillion, according to a report published on Friday.

Although the taxes would raise trillions of dollars in revenue to expand sweeping new social programs, such as Medicare-for-all and eliminating student loan debt, it would come at the expense of innovation and investment, economists Douglas Holtz-Eakin and Gordon Gray argued in the study, which was published by the American Action Forum, a conservative nonprofit based in Washington, D.C.

Under Warren’s plan, which she rolled out in January, there would be a 2 percent tax on individuals with a net worth above $50 million and a 6 percent tax on those worth more than $1 billion. Sanders released a competing wealth tax plan in mid-September, with levies ranging from 1 percent on married couples with a net worth above $32 million to an 8 percent tax on wealth over $10 billion.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Holtz-Eakin and Gray, who both previously served as advisers for multiple Republican politicians, including John McCain, estimated that Warren’s tax on millionaires and billionaires could cost workers $1.2 trillion in lost earnings over the first 10 years, while Sanders’ tax could cost $1.6 trillion over the same time period.

Warren estimates her tax would raise $3.75 trillion over 10 years, while Sanders’ could bring in about $4 trillion. Both candidates have said they intend to use the funds to pay for massive federal programs, like a single-payer health care system, tuition-free public college and universal child care.

“This study indicates that if the federal government needs to raise more revenue, these specific proposals are poorly designed and would have a uniquely negative impact on workers’ real wages – ultimately imposing an effective tax of 63 cents on workers for every dollar the government raises in revenue from the wealthy,” the economists wrote in the report.

WARREN'S WEALTH TAX WOULD STUNT US GROWTH, NOT JUST IRRITATE THE RICH

Taxing the richest Americans could also reduce the country’s GDP, the economists argued: Warren’s tax would ultimately slash growth by 0.6 percent annually over the first six years and, once the economy “fully adjusted to it,” by 1 percent annually. Sanders’ tax, meanwhile, could slash the GDP by 0.8 percent in the first five years and by 1.3 percent in the “long run.”

“In short, the Sanders wealth tax is even worse for workers than anyone else,” they wrote.

There has never been a wealth tax in the U.S. In fact, tax law in the U.S. has become significantly less progressive in recent decades. All three traditional taxes -- the individual income tax, the corporate income tax and the estate tax -- have weakened. For instance, the top marginal federal income tax rate has fallen dramatically, from more than 70 percent between 1936 and 1980 to 39 percent in 2019.

CLICK HERE TO READ MORE ON FOX BUSINESS

“As a result, when combining all taxes at all levels of government, the U.S. tax system now resembles a giant flat tax,” French economist Gabriel Zucman, who helped to advise Warren’s wealth tax policy, wrote recently. “All groups of the population pay rates close to the macroeconomic tax rate of 28 percent, with a mild progressivity up to the top 0.1 percent and a significant drop at the top-end, with effective tax rates of 23 percent for the top 400 Americans.”