Gold could be a way to avoid a wealth tax, hedge against global recession

World's rich are stockpiling the precious metal; prices could surge past $1,600 an ounce

Investors, rattled by a global growth slowdown, the U.S.-China trade war and vows by several Democratic presidential candidates to tax the rich, are flocking to gold.

Prices of the precious metal, which climbed to a six-year high in September, are up nearly 20 percent for the year, according to a Goldman Sachs analyst note to clients.

“Political risks, in our view, help explain this because if an individual is trying to minimize the risks of sanctions or wealth taxes, then buying physical gold bars and storing them in a vault, where it is more difficult for governments to reach them, makes sense,” the analysts, including Sabine Schels, said in a note Friday.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

By 2020, the firm estimates the price of gold will reach $1,600 per ounce. On Tuesday it was trading near $1,465. In fact, the “wealth effect” of GDP growth in emerging markets could drive the price of gold up 4.6 percent annually in the coming years, Goldman said.

“High political uncertainty due to continued trade tensions and the approaching U.S. elections should also be supportive gold in 2020,” the analysts wrote.

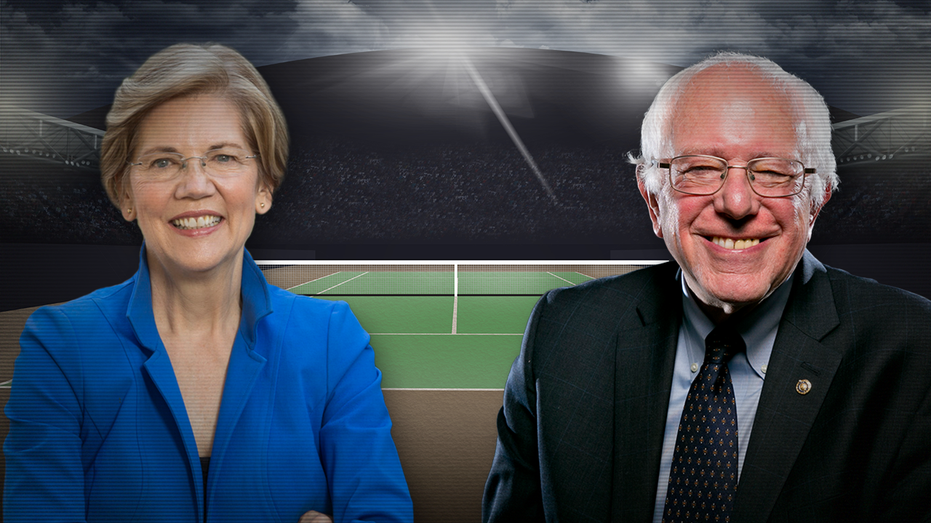

As income inequality comes into focus, two top-tier presidential candidates, Sens. Bernie Sanders and Elizabeth Warren, have vowed to impose a significant tax on extremely rich Americans. Sanders, I-Vt., called for an ambitious levy ranging from 1 percent on married couples worth $32 million to an 8 percent tax on those worth more than $10 billion. Under Warren’s plan, individuals worth $50 million would be hit with a 2 percent tax, and those worth $1 billion would pay a 6 percent levy.

Essentially, growth in gold is surging at least in part because wealthy investors are stockpiling bullion.

IRS RELEASES NEW FORM W-4: WHAT TO KNOW TO AVOID A REFUND SURPRISE IN 2020

The build-up can also reflect ultra-wealthy individuals making hedges against what they perceive to be risky economic and political scenarios “in which they do not want to have any financial entity intermediating their gold positions due to the counterparty credit risk involved.”

“Geopolitical uncertainty is already translating into greater gold demand,” the analysts said.

According to a report released by UBS Wealth in November, more than 3,400 high-net-worth individuals said they think there will be a significant market sell-off before the end of next year. Overall, almost fourth-fifths -- 79 percent -- expect volatility to increase next year, with almost 72 percent characterizing the investment environment as “more challenging” than five years ago.

And in a New Yorker article from 2017, Evan Osnos wrote about some of the wealthiest people in America, like in Silicon Valley, and New York, preparing for the end of the world by hoarding things like motorcycles, guns, generators, solar panels and thousands of rounds of ammunition.

“A lot of my friends do the guns and the motorcycles and the gold coins," the head of an investment firm, who was part of a wealthy survivalist Facebook group that swapped tips on preparing for an apocalypse. "That’s not too rare anymore.”