5 moves to ensure you're a retirement multi-millionaire

Here's how to get much wealthier than you thought was possible

Dare to dream big! You may be aiming to become a millionaire -- and you may even accomplish that goal. But what if you aimed to become a multi-millionaire instead? For many people, that goal may be out of reach, but for many others among us, it's surprisingly possible.

Here are five steps you might take if you want to work toward that ambitious goal of multi-millionairehood.

No. 1: Plan to become a multimillionaire

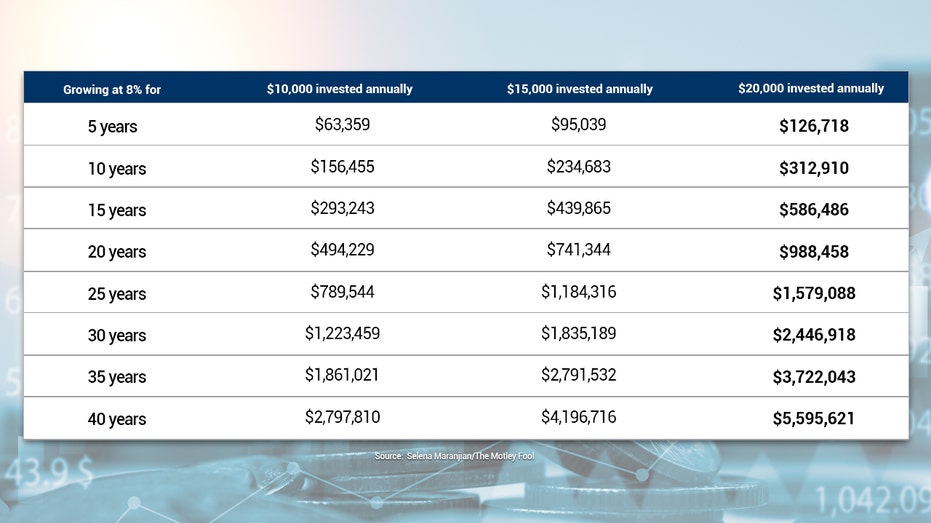

First off, develop a plan. Crunch some numbers. See what's possible. Long-term money is likely to grow most briskly in stocks, which have averaged close to 10% in annual gains over many decades. You'll likely only be investing for a few decades (or less), though, so you may average less -- or more. To be a bit conservative, the table below shows how much you might amass over various periods with an 8% average annual gain.

Clearly, you may be able to amass a lot of money -- if you can invest it and let it grow over many years, and if you can sock away some hefty sums year in and year out.

By the way -- if you're looking at the table above and your own situation and you're concluding that you're never going to achieve multi-millionairehood, you can still do quite well just by achieving say $500,000 or $750,000 or $1.2 million. The tips below can help you make your future more financially secure, no matter whether you become a millionaire or not.

Also, spend a few moments looking at the table and thinking about your kids, if you have any, or any young people you know and care about -- because it's likely to be far easier for them to achieve multi-millionairehood if they begin now. If they're 25, for example, they can likely achieve it by age 60 or earlier, socking away less hefty sums than you'd have to save.

No. 2: Save aggressively

Speaking of hefty sums, that's what you're probably going to have to invest regularly if you want to grow a really big nest egg. An old rule of thumb is saving 10% of your income, but that would be just $7,000 of a $70,000 income, a sum not likely to make you rich anytime soon. That 10% rule is especially insufficient if you're way behind in your saving and investing for retirement, as so many Americans are. More than a third of those 55 and older have saved less than $100,000, and about 60% have saved less than $250,000, according to the 2019 Retirement Confidence Survey.

If your current income won't permit you to save $10,000 or $15,000 or $20,000 a year (or whatever sum is best for you), you'll need to find more money to invest. That can be done in two ways:

- Spend less: Begin your mission to spend less by taking a close look at your spending habits and seeing what you can shave off. Perhaps you don't really need (or use) that gym membership. Maybe you're spending a lot more than you realized on food from restaurants, and you can halve that. Maybe you can try being a vegetarian for a year, skipping buying costly meats. If you get aggressive about it, you might reduce your household's fleet of cars by one, aiming to take public transportation or use your bicycle more. You might skip the landscaping service and take care of your own yard, and you might call around to a handful of insurers to see if you can get a lower rate than what you're currently paying for your various policies. There are many other strategies to spend less, too.

- Earn more: Meanwhile, aim to bring in more money. You might take on a part-time job for a few years. If you earn $15 per hour for 10 hours per week, that's $150 per week, or about $7,800 per year. You might also line up some freelance work to do at home, such as writing, editing, web design, or consulting. Many people are making money on the side by renting out space in their home or their entire homes now and then, via online services such as Airbnb. Depending on your skills and interests, you could also craft items at home to sell, by knitting, woodworking, jewelry making, soap making, and so on.

No. 3: Invest effectively

Socking away meaningful sums regularly is part of the millionaire-making formula, but it's not enough on its own -- you also have to earn a solid rate of return over the years. You can start learning about investing in individual stocks, but being such an investor takes time, skill, and dedication. A much easier alternative that may give you similar or better results is to just park most or all of your long-term money in a low-fee, broad-market index fund, such as one that tracks the S&P 500. It will deliver roughly the same return as the S&P 500 index of 500 of America's biggest companies -- less fees, which should be minimal.

The SPDR S&P 500 ETF is an index fund worth considering, as is the Vanguard Total Stock Market ETF, which will invest you in just about all of the U.S. stock market -- including not only big companies, but also small and medium-sized ones. The Vanguard Total World Stock ETF, meanwhile, aims to track the performance of the stock markets of the world -- including those of the U.S. and countries outside the U.S.

No. 4: Prepare to be patient

Once you're up and running with investing meaningful sums regularly in stocks, you'll simply need to be patient -- which can be easier said than done. We're talking many years here, remember -- so prepare to stick to your plan, through market upturns and downturns. Keep in mind that the market can be volatile, but over the long run, it has always gone up. There may be protracted down periods, though -- which is why any money you'll need within the next five, if not 10, years should not be in stocks.

No. 5: Think about whether you really need to become a multimillionaire Finally, while the steps above might get you to multi-millionairehood if you have the time and funds to work the formula, it's OK if you fall short. Know that many of us don't even need to retire with a million dollars. You'll likely have Social Security income coming to you, as might your spouse, if you're married. It can be worth learning how to increase your Social Security benefits, too, as they can provide a significant chunk of the income you need for retirement, though far from most of it.

Selena Maranjian has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.