Biden set to unveil slew of tax hikes on wealthy Americans, corporations in budget

Wealth tax, steeper stock buyback levy expected to be included in Biden's budget blueprint

Steve Moore: Blue states with high taxes are being sucked dry as people leave

'Govzilla' author Steve Moore calls out state wealth taxes on 'Kudlow.'

President Biden will make a renewed push to overhaul the nation's tax code and dramatically raise the rates paid by corporations and wealthy Americans.

The president is expected to lay out the tax hikes Thursday as part of his budget blueprint for federal spending in fiscal 2024, which begins in October. The higher taxes would likely be borne by Wall Street and the top sliver of U.S. households.

Biden previewed some proposals during his State of the Union address in February, when he called for steeper taxes on billionaires and floated quadrupling the current 1% levy on corporate stock buybacks.

"I’m a capitalist. But just pay your fair share," he said in the speech. "And I think a lot of you at home agree with me that our present tax system is simply unfair."

BIDEN REIGNITES PUSH FOR NEW MINIMUM TAX ON BILLIONAIRES: WHAT TO KNOW

Chad Wolf: Why haven't we seen immigration plan before State of the Union?

Former Acting DHS Secretary Chad Wolf discusses Biden's handling of the migrant surge and border czar Kamala Harris's role, arguing the administration needs to 'change' its strategy.

The so-called billionaire's tax would impose a 20% rate on both income and unrealized capital gains, including stock and property of U.S. households worth more than $100 million, or about 0.01% of Americans. Households that were already paying 20% will not be required to pay an additional tax.

The rate may ultimately be even higher at 25%, according to a report from Bloomberg News, citing a White House official familiar with the plan.

On top of that, the White House introduced a plan this week to raise payroll taxes from 3.8% to 5% on Americans earning more than $400,000 in a bid to keep Medicare solvent for at least another quarter-century. Another aspect of the plan would apply to business income, in addition to investment, wages and self-employment income, representing a change from the initial surtax levied when applied under the Affordable Care Act.

US NATIONAL DEBT ON PACE TO BE 225% OF GDP BY 2050, PENN WHARTON SAYS

Under Biden's envisioned budget, the nation's deficit would shrink by more than $2 trillion over the next decade. In fiscal year 2022, the federal deficit climbed to nearly $1.4 trillion, according to the Congressional Budget Office, while the national debt ballooned past $31 trillion for the first time. While that marked a decline from the previous year, it was still the fourth-largest annual deficit in American history.

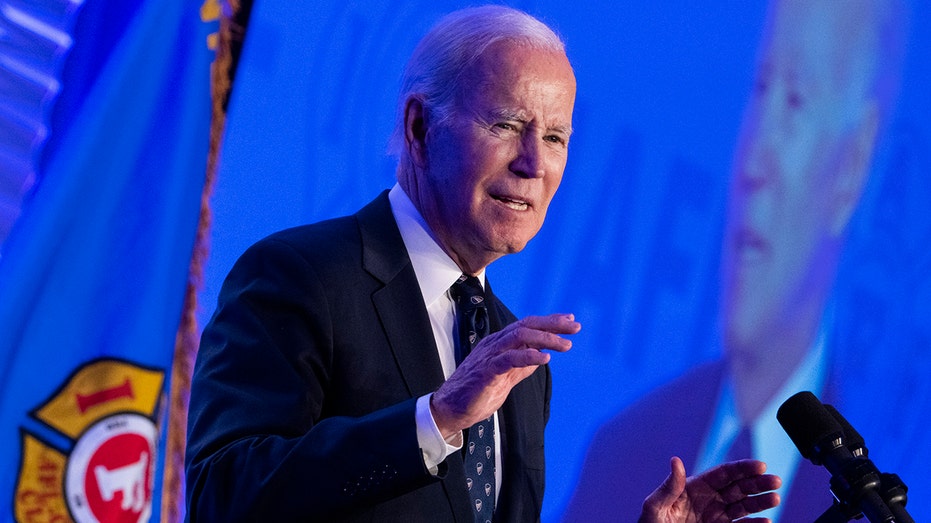

President Biden speaks during the International Association of Fire Fighters' 2023 Legislative Conference at the Hyatt Regency on Capitol Hill Monday, March 6, 2023. (Tom Williams/CQ-Roll Call, Inc via Getty Images / Getty Images)

None of the tax hike proposals are likely to garner much support in the House, now under Republican control following the 2022 midterm elections.

"It probably won’t shock you to hear that the prospects are not great in this Congress," John Gimigliano, principal-in-charge of the federal tax legislative and regulatory services group at KPMG, told FOX Business. "I just think that’s a reality. As long as you have Republicans in control of the House or Senate or White House, they’re probably not going to agree to this."

Republicans have already indicated Biden's budget will be dead on arrival after it is formally introduced Thursday.

"You know the president’s budget is replete with what they would do if they could — thank goodness the House is Republican — massive tax increases, more spending," Senate Minority Leader Mitch McConnell, R-Ky., told reporters Wednesday.

The back-and-forth between parties precedes looming budget negotiations on Capitol Hill over the federal debt limit, which is currently around $31.4 trillion. The U.S. government bumped up against that limit toward the end of January, prompting the Treasury Department to initiate a series of actions that are known as "extraordinary" measures intended to stave off a default.

People walk outside the U.S Capitol in Washington June 9, 2022. (AP Photo/Patrick Semansky, File / AP Newsroom)

The debt ceiling is the legal limit on the total amount of debt the federal government can borrow on behalf of the public, including Social Security and Medicare benefits, military salaries and tax refunds.

CLICK HERE TO READ MORE ON FOX BUSINESS

The prospect of trillions in tax hikes also comes as the U.S. economy faces the increased risk of a recession, threatening to prolong financial pain for many companies and consumers.

"On the impact of tax increases in a recessionary period, we are highly concerned," Chris Netram, the managing vice president of tax and domestic economic policy at the National Association of Manufacturers (NAM), previously told FOX Business.